You’ve heard about Death and Taxes? Vertex, Inc wants to help with the taxes.

VERTEX: NASDAQ: VERX – Indirect Tax Compliance; Software as a Service - (5-minute read)

There are more than 19,000 jurisdictions, many of them overlapping, that require businesses to collect and remit some form of indirect tax: sales, use or value add tax. The amount of indirect taxes paid exceeds the spend on income taxes. The taxing rules change often and penalties for non-compliance can be severe.

How do large, multinational businesses correctly compute and charge taxes across millions and millions of daily on-line and bricks and mortar transactions?

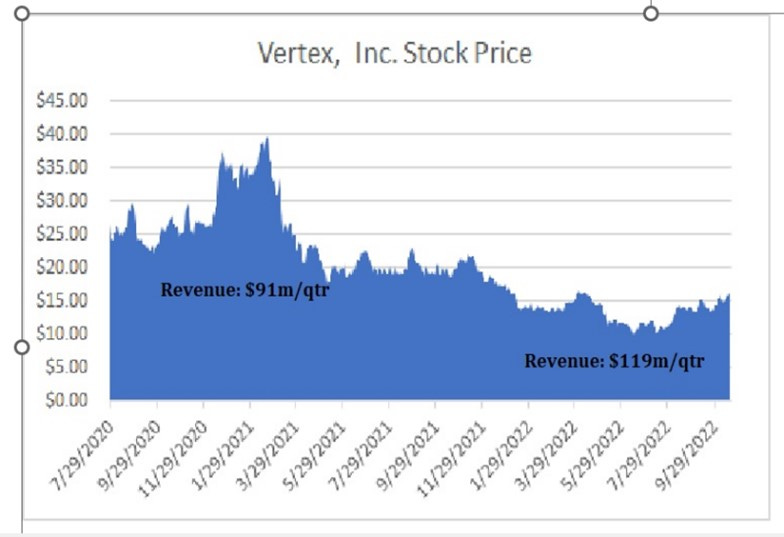

Some use solutions built internally and maintained by the company’s tax department. Many are migrating the task to cloud based solutions. Three companies provide these solutions to large enterprises: Thomson Reuters ONESOURCE, Sovos and Vertex. These three companies build the software to calculate the taxes at the transaction level. They also maintain vast repositories of tax regulation data. The data drives the software to produce instant and accurate computations of sales taxes. And they help large enterprise clients in the accurate and timely filing of sales tax returns and remittances.

Sales tax compliance is a big business opportunity. And it is in the early stages of moving to the cloud.

Problem Solved

Read this customer success story from Sovos. It describes the catalysts that force customers to make a buying decision, the problem the software vendors solve and the untapped opportunity in the sales tax market:1 It’s a good story.

“Sun Chemical is the world’s largest producer of printing inks and pigments… with… $3.5 billion in annual sales… in 56 countries. Sun Chemical… has hundreds of multinational suppliers and partners from around the world.

“Its e-invoicing process must be seamless across… SAP configuration, middleware performance, connections to the local authority’s compliance server, and printing…

Of necessity, Sun had built in house solutions deployed regionally around the world to solve for sales tax problems. But, as often happens, there was a catalyst that forced Sun to go out to market for a cloud-based solution. In this case, the catalyst to buy a cloud solution was a new set of regulations in Latin America:

“Because of new e-invoicing mandates in Latin America, Sun Chemical faced the challenge of conducting constant legislation reviews…. The language barrier also posed a challenge. With technical requirements being communicated in local languages, fluency to understand the mandates and to convert changes into the home-grown system was required…this caused lag time and confusion, contributing to reduced efficiencies.

What happened when Sun went shopping is interesting. And it illustrates how each of the three sales tax software providers gets increased wallet share from clients after they make the initial sale.

Sun Chemical initially elected to implement different solutions in each country. In Argentina, it selected … Sovos…in Chili it selected two separate local providers…and in Mexico, it implemented an internal solution.

Eventually, Sun moved its Brazilian, Chilean and Mexico business to Sovos as well. Sovos landed and expanded.

Sovos is a portfolio company of Hg and TA Associates, both large private equity firms. ONESOURCE is a small division of the large multinational Thomson Reuters OneSource.

There is one pure play public company in the space: Vertex, Inc. (NASDAQ: VERX).

Revenue: $425m

# of employees 1,300

Market Cap: $2.4b

Stock Symbol: VERX

All time high: $39.71 (2/21)

All time low: $9.97 (6/22)

Category: Technology/Software/Technology Enabled Services

Vertex, Inc.

Vertex, Inc., headquartered in King of Prussia, PA., was founded forty years ago. Today it has 4,000 customers including (parts of) 59% of the Fortune 500. 95% of its 1,300 employees are in the US. From there they serve clients who operate in 130 different countries.

The CEO, David DeStefano, is a 23-year veteran of the company. He served as CFO before taking over in 2016. The company went public in July of 2020 through an IPO in which it raised $400m at a price of $19 a share.

Luisa Beltran wrote about the IPO in Barron’s. Here’s a link to the story.

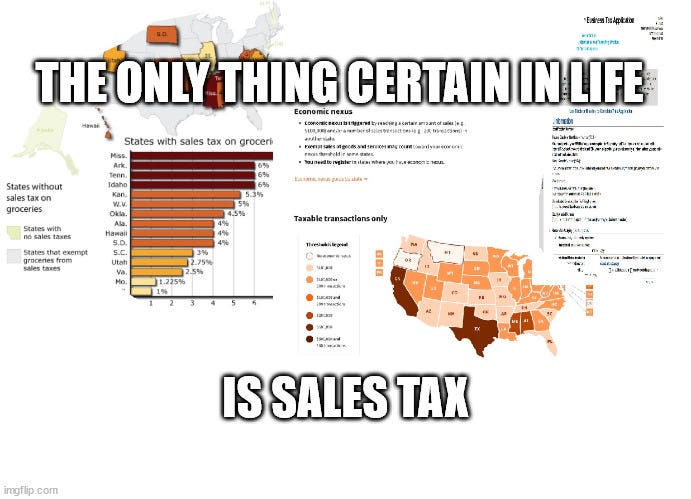

The stock popped in the months following the IPO. It trades between $15 and $16 a share now. The $2.4b market cap is about 5.1X annual revenue of $425m.

Customer Perspective

Vertex shares their own customer success stories from Walmart, Siemens and Patagonia with the link here:

IDC Marketscape shows Vertex as one of the leaders in the sales tax compliance space. Only 3 of those (Sovos, OneSource and Vertex) have a significant presence in the large enterprise sales tax compliance space. The others are focused on less complex small and mid-market businesses.

Vertex, Sovos and ONESOURCE all receive similar G2 client ratings – four out of five stars.2

Client reviews of the Vertex software are positive. Complaints revolve around poor customer service and cost. Reviewers found competitor Sovos to have better customer support and more comprehensive product updates and roadmap.

Vertex retains 96% of its customers year over year. That’s a good gross retention rate. The net dollar retention rate (a metric similar to “same store sales” in the retail trade) is healthy at 110%. The company’s Land and Expand strategy works.

Employee Perspective is Mixed.

Glassdoor Reviews by the Company’s technology team imply that the “tech stack is out of date”. Not unexpected in a 40-year-old company. But Vertex doesn’t have a lot of free cash flow to invest in modernization. The company operates a mix of cloud and on-premise technology. The tech stack could be a problem that weighs on future growth.

Reviews by sales executives frequently cite slow decision making as a negative. Enterprise software sales require flexibility. Slow decision making can kill complex software deals.

Market Opportunity

Vertex estimates that the total addressable market is $22b. $10.6b is comprised of 66,000 large enterprises: Vertex’s target market. 90% of these potential clients have not yet migrated from ERP and in-house solutions to a global SaaS provider.3

As the only public company focused on selling must-have software solutions in a greenfield market where migration to the cloud is still in early stages Vertex is in the right spot, at the right time, with the right product.

What’s Not to Like?

In my opinion:

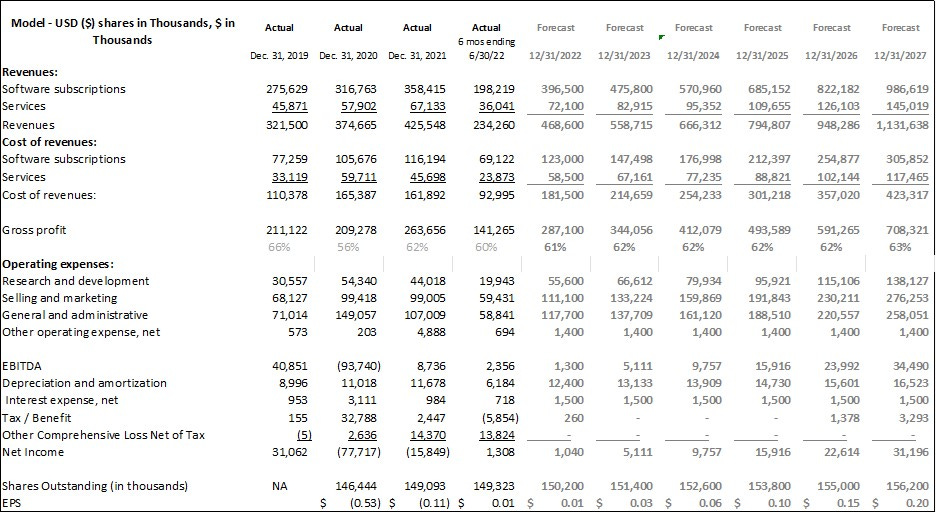

1) Earnings: This is a forty-year-old business. My back of the envelope modeling, (based on just a few years of public company data), doesn’t show a clear trend towards meaningful earnings per share.

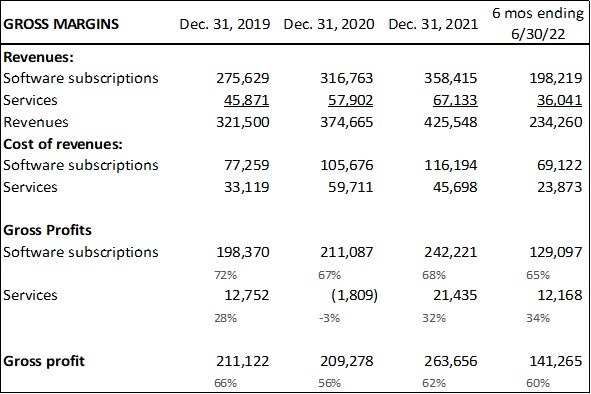

2) Gross Margins: Low gross margins limit growth.

Vertex has low margins (between 34% and -3%) on the services component of its business. Understandable.

Troubling are the low gross margins on the software side of the business (between 72% and 65%).

Vertex has a mix of cloud and on-premise software subscription revenue. According to DeStefano:4

“<There is> a notable segment of our installed base where customers have indicated they are not yet ready to migrate to the cloud. We are able to continue supporting their needs today without disruption to their business.

Providing SaaS service on premise is inherently more expensive than doing so in the cloud. Supplying support, upgrades and patches to single tenant software sitting inside a client’s firewall is just harder than doing it across a multi-tenant solution sitting in the cloud. If that’s what Vertex is doing (and it’s not clear from the filings) that is a significant drag on growth.

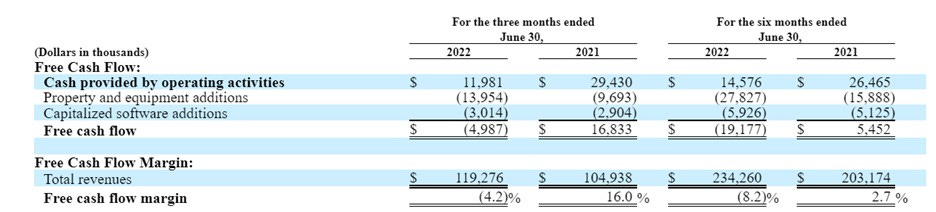

3) Free Cash Flow Fast growing SaaS businesses can generate significant free cash flow without producing GAAP earnings. They bill customers and get paid upfront. Then they recognize the revenue from that sale ratably over the subscription period. The collection of cash outstrips the recognition of revenue. That’s GAAP accounting.

Unlike fast growing SaaS businesses, Vertex does not generate much free cash flow:

4) Acquisition Strategy: The company has done several acquisitions. They’ve spent more than half of the $400m they raised in the IPO. But it’s not clear what the value add is. In at least one case they seem to have overpaid. In May of 2021 the Company paid approximately $200m for an Irish VAT tax software firm, Taxamo. Owler.com reports that at the time of acquisition Taxamo had between $5m and $20m in revenue.

The Currency News reported the sale of Taxamo as a windfall for the sellers:5:

What did Vertex get? Hard to say. Subscription revenue was $80 million in the three months ending Sept 30th 2020 (before Taxamo). That was a 11% increase over the same period in the prior year.

Subscription revenue was $92 million in the three months ending Sept 30th, 2021 (including Taxamo). That’s a 15% increase year over year after Taxamo. A pick up of 4 points, or about $4m a quarter, after spending $200m on the acquisition.

Everyone makes mistakes in M&A (I’ve made quite a few.) It is important to make only small mistakes.

5) Vertex has a dual class structure. When the Company went public it created two classes of common shares. The Public owns the Class A. The founder’s heirs own the Class B. Although the heirs are not active in the business, they have 10X the voting rights of public shareholders. As the prospectus explained:

“The rights of the holders of Class A common stock and Class B common stock will be identical, except with respect to voting, conversion and transfer rights. Each share of Class A common stock will be entitled to one vote per share. Each share of Class B common stock will be entitled to ten votes per share… Outstanding shares of Class B common stock will represent approximately 98% of the voting power… with members of our founder's family… holding approximately 98% of the voting power…

Summary

Tax compliance software is an exciting space. Customers need to solve for complexity at a large scale. The operational need to find a good solution for this complexity is reinforced by the steel boot of regulatory compliance. The three companies in the space (Vertex, Sovos and ONESOURCE) are selling must have software that will be resistant to pricing pressure even in a downturn. The software provides a great ROI to the buyer. And the market is still in the early stages of migration to the cloud.

But (there’s always a ‘but’) Vertex does not seem like the company to bet on.

The next earnings call is at 8:30 am on Wednesday, November 9th. To listen: via telephone dial in at 1-844-825-9789 (USA) or 1-412-317-5180 (International).

My Results

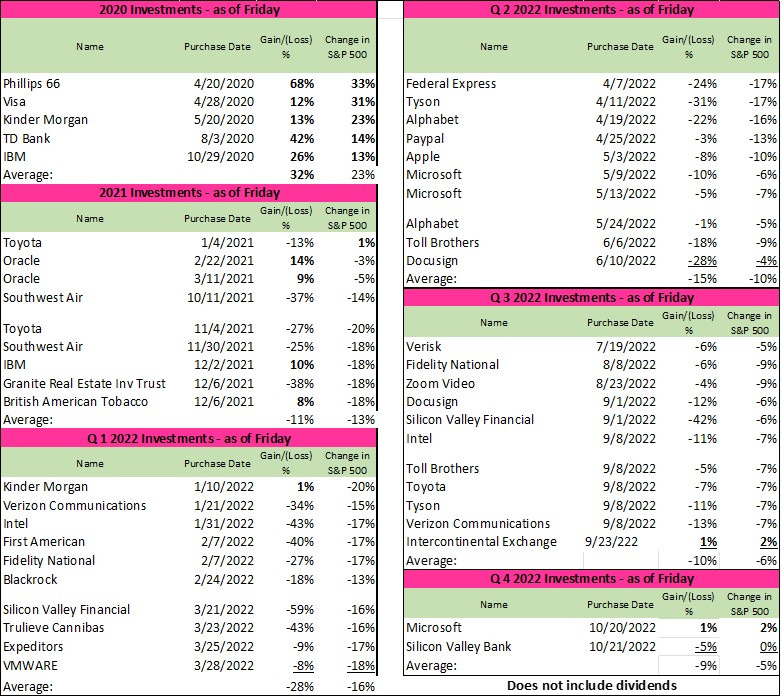

This newsletter is meant to test a theory that, over a ten-year period of time, a diversified portfolio of US equities purchased at a discount to their present value will outperform the S&P 500. I started purchasing stocks for this portfolio in April of 2020. My intended holding period is ten years. I purchase shares in the companies with my own money. I’m an individual investor – not an advisor or analyst.

To keep things honest, I publish the portfolio results from time to time. Results so far are mixed: A mix of bad and worse.

If you know anyone who would find this interesting, please support my writing by sharing the newsletter. Thanks

Frank!

https://sovos.com/case-study/vat/sun-chemical

https://www.g2.com/compare/sovos-vs-thomson-reuters-onesource-vs-vertex-inc-vertex

https://ir.vertexinc.com/static-files/33ba232e-12c2-4fa9-8baa-b85fc0604ab8

https://seekingalpha.com/article/4533777-vertex-inc-verx-ceo-david-destefano-on-q2-2022-results-earnings-call-transcript

https://thecurrency.news/articles/47257/co-kerry-tax-software-firm-deal-makes-millionaires-from-killorglin-to-warsaw/