Walk, cautiously, to WalkMe; (Nasdaq: WKME); Part One.

Digital Adoption Platform - B2B Software as a Service - And results through Friday (5 Minute Read)

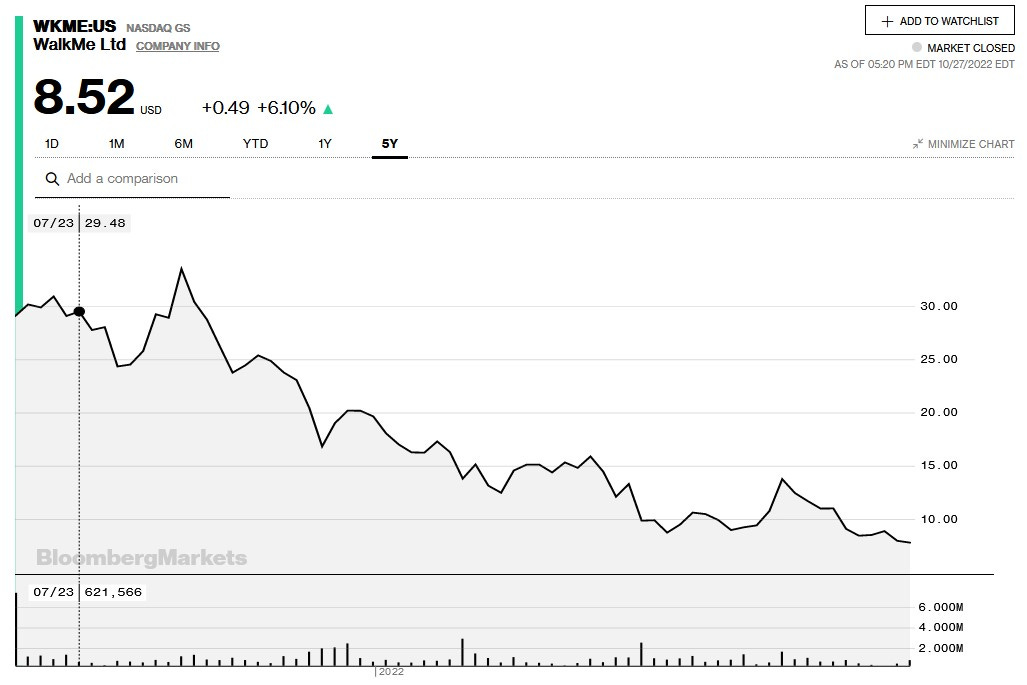

WALKME STOCK PRICE SLIDE – BLOOMBERG.COM

I bought WalkMe on Wednesday for $8.10 a share. Here’s why.

During the next two years, businesses are projected to spend $2.4 trillion on digital transformation. That buys a lot of software.

When a user sits down in front of all this software, they often don’t know how to use it. So, sometimes they don’t use it. Or they are slow to start using it. Or using it slows down productivity during a long learning period.

User Manuals, Help Screens, Live Support and user training solve part of the issue. But they don’t make the problem go away. And they kill productivity.

WalkMe is the company that solves this with Digital Adoption Solutions.

Digital Adoption:

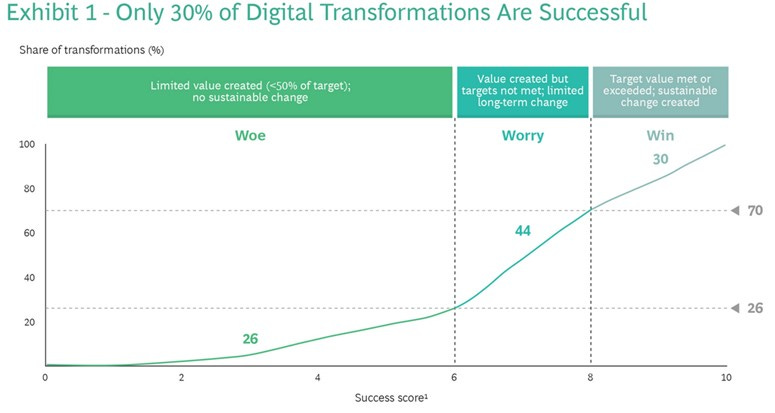

Large enterprises spend hundreds of millions of dollars on software to improve productivity. Often, productivity gains fail to materialize. Boston Consulting Group’s study shows that only 30% of digital transformation efforts are successful.1

There are a lot of reasons digital transformation initiatives fail. One of the simplest reasons is this. Employees use too many different software applications throughout a week or a month or a quarter to become proficient in each of them.

WalkMe’s product sits on top of the enterprise software applications. It provides employees a simple to use interface that ‘walks them through’ the systems in real time. And it ensures the consistency of data as they move from one system to another.

WalkMe unlocks the productivity gains that the enterprise thought they were getting when they bought Salesforce and Microsoft and Anaplan and ServiceNow and Oracle and DocuSign and; Well, you get the picture.

Here’s how Dan Adika, WalkMe’s CEO describes the problem that WalkMe solves:

“Companies are deploying a lot of software. Just in sales, they're using 8 to 12 different applications, not mentioning HR, benefits, payroll and so on.

“Reality is that employees are not using one vendor. They're not using one application. They're using multiple, we're talking about 20, 30 and, in some cases, much, much more. Think about organizations, big organizations that making acquisitions. They have 4 or 5 different CRMs from different vendors. It can be Oracle, Salesforce, Microsoft, you name it.

“At the end of the day, the employee needs to be productive. They need to complete a process. And this is exactly where we fit. We're sitting on every employee front end -- or on the application or on the desktop, and we're helping them execute business processes being more efficient, data validation, ensuring that they're doing their job correctly… at the end of the day, we are the last mile to the employees…

Customer Perspective

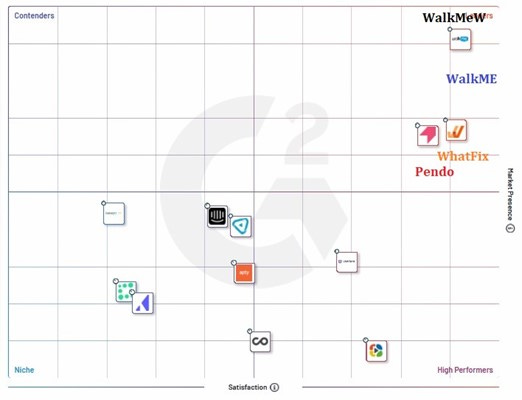

There are three leaders in the Enterprise Digital Adoption Space: WalkMe, Pendo and Whatfix.

Among the three, WalkMe is the only publicly traded company.

WalkMe's go to market messaging uses themes of customer successes and strong ROI. For example,3:

“Thermo Fisher saw 20% reduction in Salesforce®-related support tickets and a 2000% improvement in data accuracy

“Linked In reduced live training costs by 43% after installing WalkMe. Christus Health enjoyed $1 million/month in improved payment outcomes, and 200–300 fewer support calls/month when they layered WalkMe across 20+ applications used in the healthcare system.

That’s powerful messaging.

Employee and Organizational Perspective

80% of employees who reviewed WalkMe would recommend it to a friend. Among software engineers who reviewed the company on Glassdoor that number is 93%. Sales people are not as positive. There are common complaints among the sellers: culture, commission plan and the lack of strong customer service function.

Salespeople complain a lot. That’s expected. But there’s also a cautionary note among the generally positive employee feedback. There are reviews that hint of a toxic culture, including sexual harassment, in units of the company. If true, there is a leadership issue that the CEO needs to address. Companies like WalkMe can be crippled if they tolerate toxic behavior.

There was organizational news on September 12th. WalkMe announced that the CFO, Andrew Casey is stepping down4:

“After nearly three years of financial leadership, Casey is leaving to pursue another opportunity. He will remain with WalkMe on an advisory basis through WalkMe’s third quarter earnings announcement to support an orderly transition.

“WalkMe has launched a formal search to hire Casey’s permanent replacement who, along with the company’s recent executive leadership team additions, will lead WalkMe’s expansion efforts to capitalize on digital adoption’s $34B total addressable market. In the meantime, Hagit Ynon, WalkMe’s EVP of Finance & Operations, will serve as interim CFO

The announcement was a surprise. Not surprising is a law firm recruiting plaintiffs for a class action because “Following this news, the Company's stock price dropped.”5

Metrics

In the quarter ending June 30th WalkMe reported6 year over year growth in recurring revenue of 29%. The company expects full year revenue of $249m – roughly 30% higher than last year. WalkMe is not profitable. This year the company expects to lose $68m (excluding the cost of stock-based compensation and amortization of intangible assets)7.

The burn rate is increasing. Free cash flow in Q2 of 22 was -$12m. That’s $5m worse than the $7m the company burned in Q2 of 21.

There was $318m in cash on the balance sheet, and no debt, on June 30th of this year. CEO Dan Adika said this on the Q2 earnings call:

“We now expect to achieve positive free cash flow during 20238.

That’s key. If the company burns between $12m and $20m per quarter between now and the end of 2023 they’d use $120m of their available $317m.

That gives them sufficient runway to first reach positive free cash flow; then positive non-GAAP earnings; and, eventually, GAAP earnings. All the while they can grow revenue 25% to 30% year over year.

Summary

- The software delivers much needed improvements to productivity and a rapid way to realize the ROI from previous investments in software. That’s appealing.

- The customer experience is good.

- The employee perspective is fair to good.

- WalkMe is a leader in the large, new digital adoption space where greenfield opportunities abound.

- The company is not overvalued.

- WalkMe seems to have enough of a cash runway to fund the burn until it reaches GAAP profitability.

I liked the story and I bought the stock. I’ll write Part Two of my WalkMe story, and I might buy more shares, after I see the balance sheet and the burn rate in the 3rd quarter report on November 15th.

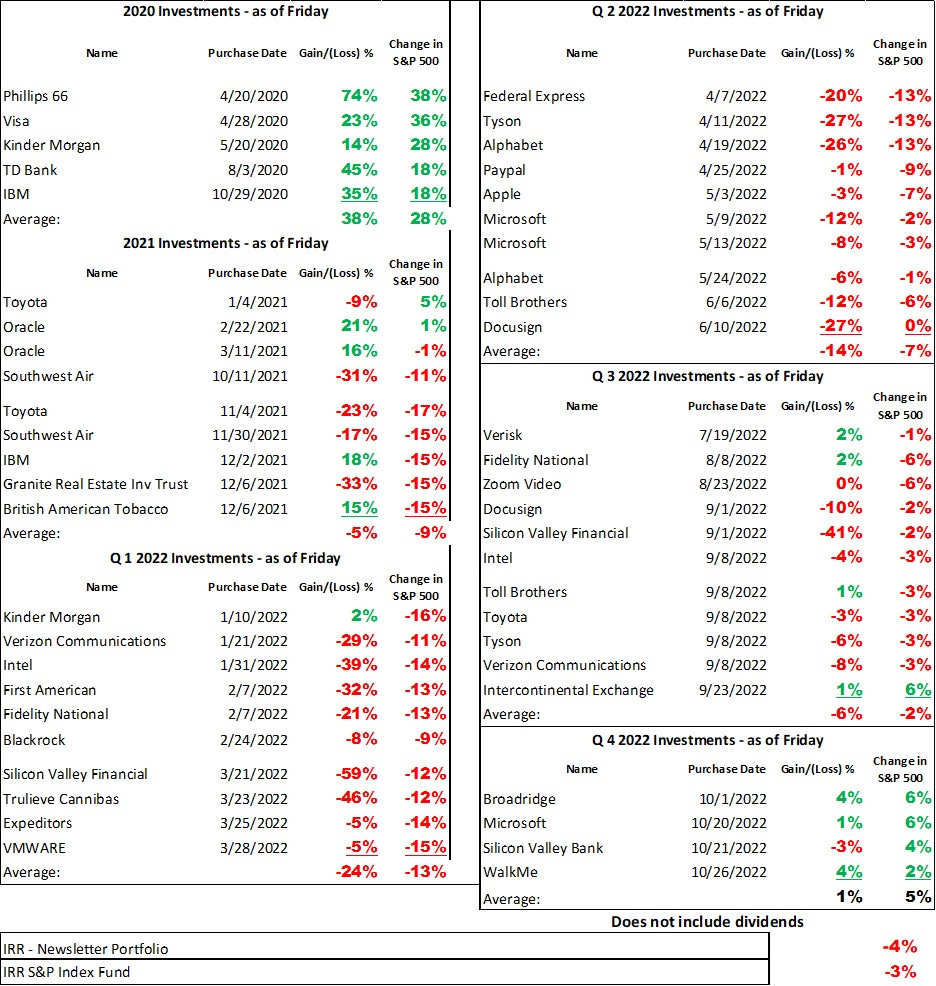

Investment Results through 10/28/22

There are a lot of folks who write investment advice columns. I don’t give advice. I write about interesting companies. When I like something I’m writing about I buy it. When I buy something, I plan to hold it for ten years.

In my day job I run a business. I’m not an advisor or analyst. I buy shares in the companies I write about with my own money.

To keep things honest, I publish the portfolio results. Results from investment that I made in 2020 and 2021 are ahead of the returns on the S&P 500 from the same period. 2022 results? Well, I’m hoping they get better with age 😊.

THANKS FOR READING

https://www.bcg.com/publications/2020/increasing-odds-of-success-in-digital-transformation

G2 Reviews. www.g2.com

https://www.walkme.com/customer-stories/linkedin/

https://www.sec.gov/Archives/edgar/data/1847584/000117891322003397/exhibit_99-1.htm

https://www.newsfilecorp.com/release/138105/SHAREHOLDER-ALERT-Investigation-of-WalkMe-WKME-Announced-by-Holzer-Holzer-LLC

By the way, WalkMe is an Israeli company and does not file standard 10k and Qs. There’s less detail than you want in the quarterly and annual reporting.

https://ir.walkme.com/news-releases/news-release-details/walkme-ltd-announces-second-quarter-2022-financial-results

https://seekingalpha.com/article/4533153-walkme-ltd-wkme-ceo-dan-adika-on-q2-2022-results-earnings-call-transcript