Oops!

I wrote about Broadridge (BR) a few times lately. I like the business.

The shares had declined from $171 three weeks ago to $144 at the end of last week. It was closing in on the $125 to $145 a share range where I thought the value was.

I got an alert from Fidelity this morning. Surprise! I bought BR at $142.

I forgot about the limit order I put in early in September. But for that lapse, I would have waited a little longer; bought a little lower. I imagine I’m not the only individual investor who loses track of detail.

Nasdaq, Inc. (NDAQ):

Samuel Brannan became the richest man in California during the gold rush. He didn’t find gold. He sold tools to miners.

There hasn’t been much money made in the stock market lately. But the stock markets themselves are good investments. I bought ICE, the owner of the New York Stock Exchange, on September 23rd.1 What about the Nasdaq?

NDAQ, like ICE, is an oligopolist.

Nasdaq’s position in the market is protected from competition by a strong network effect, high switching costs, and a strong brand.

Network effect: the more companies that trade on the Nasdaq, the more efficient that market becomes. Much of the market’s revenue comes from selling data. The larger the network becomes, the larger the data set that can be monetized.

High switching costs: Very few listed companies switch exchanges. In 2021 the Nasdaq listed 1,000 new companies. 33 of them switched from the New York Stock Exchange.2 33 is roughly 1.1% of the 2,800 companies that list on the NYSE. NDAQ doesn’t disclose its own churn. I presume it is similar.

Strong Brand: Big time CEOs aspire to ring the opening bell on the Nasdaq. They just do.

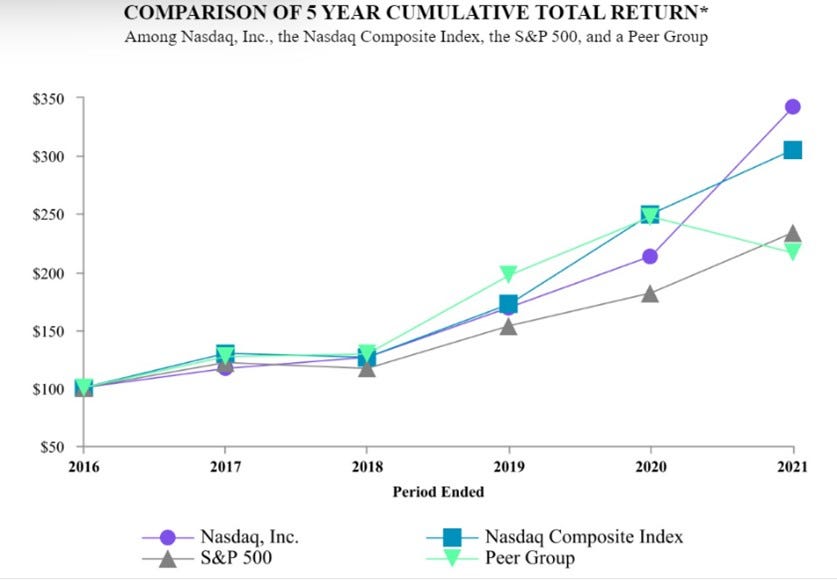

NDAQ has outperformed the S&P 500 (and the NASDAQ Composite) over the last five years.

That was then. This is now.

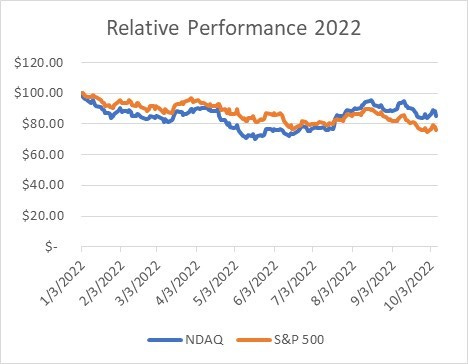

NDAQ has continued to outperform the S&P 500 in the current downdraft. Though that’s small comfort if you had bought it at the beginning of the year, the trend continues.

What’s it Worth?

I wrote about NDAQ’s fundamentals last week3.

At what point does it become a ‘buy’?

Well…. that all depends on earnings of course.4

If the company continues to grow average earnings per share at the rate is has over the previous five years (CAGR 19%) the present value of the stock is $118 and it’s a screaming bargain today at $58.

If the growth in EPS reverts to the long term (2009 – 2022) rate of 12% per year the stock is worth about $66 today.

My guess is the growth rate somewhere in the middle. That puts the present value of the stock around $86 and, with a 40% safety margin, a buy around $52.

Vanadium?

Speaking of gold rushes5... A reader asked me what I thought about Vanadium. Truth is, I last thought about it, and then only briefly, when I learned the periodic table in high school.

It turns out Vanadium is now a thing.

Vanadium6 is a chemical element with the symbol V and atomic number 23…. Vanadium occurs naturally in about 65 minerals and in fossil fuel deposits. It is produced in China and Russia from steel smelter slag. Other countries produce it either from magnetite directly, flue dust of heavy oil, or as a byproduct of uranium mining. It is mainly used to produce specialty steel alloys such as high-speed tool steels, and some aluminum alloys…The vanadium redox battery for energy storage may be an important application in the future….

It's the connection to energy storage that seems to have brought this rare earth metal to the surface.

“The growing interest in vanadium redox batteries, could further drive the demand for the metal as well as increase its price…The vanadium redox flow battery is a rechargeable battery that utilizes vanadium ions to store chemical potential energy. Unlike other battery types, the vanadium redox battery provides almost unlimited energy capacity.

The largest Vanadium processing capabilities in the Unites States belong to Energy Fuels, Inc. (NYSE: UUUU).

Primarily a uranium miner, Energy Fuels produces Vanadium as a by-product of its mining and milling operations. Energy Fuels operates:

White Mesa Mill, a fully licensed uranium and vanadium processing facility… the only fully operational and licensed conventional uranium mill in the U.S. The Mill is licensed to process an average of 2,000 tons of ore per day and to extract over 8.0 million pounds of U3O8 per year. In addition to the conventional circuit, the Mill has a separate vanadium by-product recovery circuit.

As a result of strengthening Vanadium markets, the Company sold 5,000 pounds of FeV in 2021 at a weighted average price of $14.74 per pound. The Company expects to continue to sell vanadium from its inventory into rising markets if they continue,7.

Wikipedia says Vanadium is an odorless mineral. Still, something smells fishy at Energy. Energy’s 2021 Annual Report8 mentions Vanadium 187 times. It also says that, in total, Energy sold 5,000 lbs. of Vanadium (at $14.74 a pound). That’s $73,000 of total $3m in 2021 revenue coming from Vanadium sales.

Syrah Resources has a Vanadium project in development. It posted $29m in revenue last year. Gross profits were (- $32). Next Source Material has two Vanadium projects in development. However,

“The Company has not previously operated any mines and has not completed the construction of any mines. No commercial revenue has been generated from any mineral resources.9

It occurs to me that Vanadium mining might be early in what Gartner Research calls the “Hype Cycle.”

An Australian company, Neometals looks more interesting. The company recycles lithium-ion batteries and recovers Vanadium. It owns 50% of a German recycling operator Primobius.

Neometals has cash and no debt. Management appears to be seasoned.

Growing demand for all the rare earth minerals10 is being created by the transition to renewable energy. Neometals seems worth spending more time on.

Watching and Waiting.

CSX (CSX) was at $34 a share in February of 2022. I like the profile of the business and what appear to be strong operating cash flows. It closed at $26 on Friday. I think it’s a good value around $21 a share. CSX reports earnings on Thursday, October 20th.

Earnings Calls.

The next few weeks should be interesting. Companies in my portfolio that are reporting earnings are:

Blackrock, on Thursday, October 13th. I bought the stock in February of 2022 expecting full year 2022 earnings of $35.86 and $41.12 in 2023. Analysts estimate full year 2022 earnings now $33.92 and $37.89 for 2023. I’m down about 24% since I bought Blackrock.

IBM reports on Wednesday, October 19th. Kinder Morgan also reports on the 19th. Silicon Valley Bank on the 20th and Verizon, Friday October 21st

THANKS,

It’s down about 2.5% since then.

NDAQ reports earnings on Wednesday, October 19th.

SEGUE ALERT! Segue: an immediate transition from one part to another…. (From the Italian for “it follows”). A Segway, on the other hand, is a personal transport device. I suppose one could Segway or segue from one’s home to the bus stop. And end up in the same place. Grammatically, I mean.

https://en.wikipedia.org/wiki/Vanadium

https://www.sec.gov/ix?doc=/Archives/edgar/data/1385849/000138584922000024/efr-20211231.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1385849/000138584922000024/efr-20211231.htm

https://www.nextsourcematerials.com/static/media/uploads/nextsource_consolidated_2022_fy_financials_(final).pdf

And for copper