Inflation is just a 6.3 Trillion Dollar Bout of Indigestion

And, Alteryx (NYSE: AYX) Analytics as a Service (3 Minute Read)

““Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” – Milton Friedman

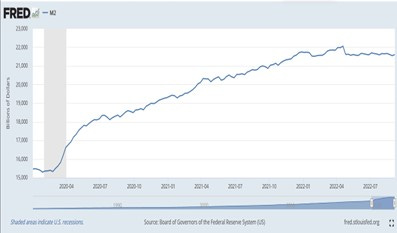

When we’re trying to guess where inflation is headed (and we are all just guessing) the money supply is worth as much attention as the more widely reported upon CPI1. Here’s the Federal Reserve’s chart of the supply of money:

Here’s what I think Money Supply is telling us about inflation.

M22 was 15,294b in January 2020. It peaked around 21,600b in April of this year. That is a $6.3 trillion dollar (41%) increase in the supply of money over a roughly two-year period.

Real GDP during that same period increased 5.2%.

Using Milton Friedman’s logic, this increase in the supply of money will, as it passes through the economy, cause inflation of 35.8%. That is the 41% increase in the supply of money minus the 5.2% increase in the economy’s output.

My hypothesis is that the U.S. housing market has proven Friedman’s theory to be the correct explanation for the current bout of inflation.

Here’s why I think housing prices are the right gauge of inflation today.

Housing prices are transparent and they reset quickly. Millions of individual owners price houses to sell at the highest price that buyers will pay. If buyers are feeling flush, and willing to pay more, ‘bidding wars’ begin and houses sell above the asking price. Prices quickly find their level.

This was going on, until recently, in the housing market.

Friedman’s money supply theory predicted that a 41% increase in supply of money with only a 5.2% increase in output will result in 35.8% inflation.

That’s almost exactly what we got in the residential property market. The median sale price of a home increased from $322,600 in Q2 of 2020 to $440,300 in Q2 of 2022.3 = 36%.

Looking ahead, economists at Redfin (who study housing prices for a living) expect prices to increase 0% to 4% next year. That is about what Friedman’s theory would predict if a) money supply stays flattish, and; b) GDP increases 0% to 4%.

Real Estate Prices vs the CPI

In contrast to real and timely measurements of home sale prices, the Consumer Price Index is a calculated value based on measurements and assumptions of prices for a fictional ‘basket’ of goods and services thought to be widely consumed by typical households. The prices of items in the basket may reprice quickly (the price of gas) or slowly (the cost of insurance.) They are subject to changes in supply and demand, political intervention, subsidies, regulation and supply chain disruptions.

Here’s my hypothesis. The great increase in money supply between 2020 and 2022 permanently decreased the purchasing power of the dollar by about 36%

All of that hit to purchasing power has worked its way through the housing market.

13% of the hit has been measured, so far, in the fictional CPI. Assuming the money supply stays flat, inflation will continue at high rates until the remaining 23% works through the real economy.

The good news? Money supply has been flat since March of this year. The bad news? Central bankers can create a recession. That will reduce the output side of the equation and prolong the period of time it takes for the economy to digest the increase in money supply.

Alteryx (NYSE: AYX) Analytics as a Service

Alteryx is a 5.1b market cap software as a service business. It sells, on a subscription basis, software used to analyze large data sets. Over the course of a year revenue has increased by 50% while the price of the stock has declined 37%.

That caught my eye.

At year end, the balance sheet looked healthy and the company was creating cash

Then, in Q1 of 2022, the Company paid $400m in cash to acquire Trifacta, a provider of design tools.

Alteryx now markets the combined solution as the Alteryx Designer Cloud powered by Trifacta.

Comparing the six month period ending June 30th of 2022 (after the combination with Trifacta) with the same period in 2021 (before the acquisition) we see4:

- 42% increase in revenue post acquisition with:

- 127% increase in Cost of Goods Sold

- 72% increase in Operating Expense

- Losses from operations increasing from $63m to $195m.

- Cash provided from operations dropping from +15m to -55m

Combining software as a service businesses is notoriously difficult. It almost always takes longer and costs more than planned.

Alteryx reports on November 1st. I’ll steer clear of the stock pending some positive progress report from management

https://www.investopedia.com/terms/m/m2.asp

https://fred.stlouisfed.org/series/MSPUS

https://fred.stlouisfed.org/series/WM2NS

https://www.sec.gov/ix?doc=/Archives/edgar/data/1689923/000168992322000023/ayx-20211231.htm