Five 9 (FIVN) Part II; Time to Buy? And Alteryx (AYX)

Category: Software as a Service (5 ½ minute read)

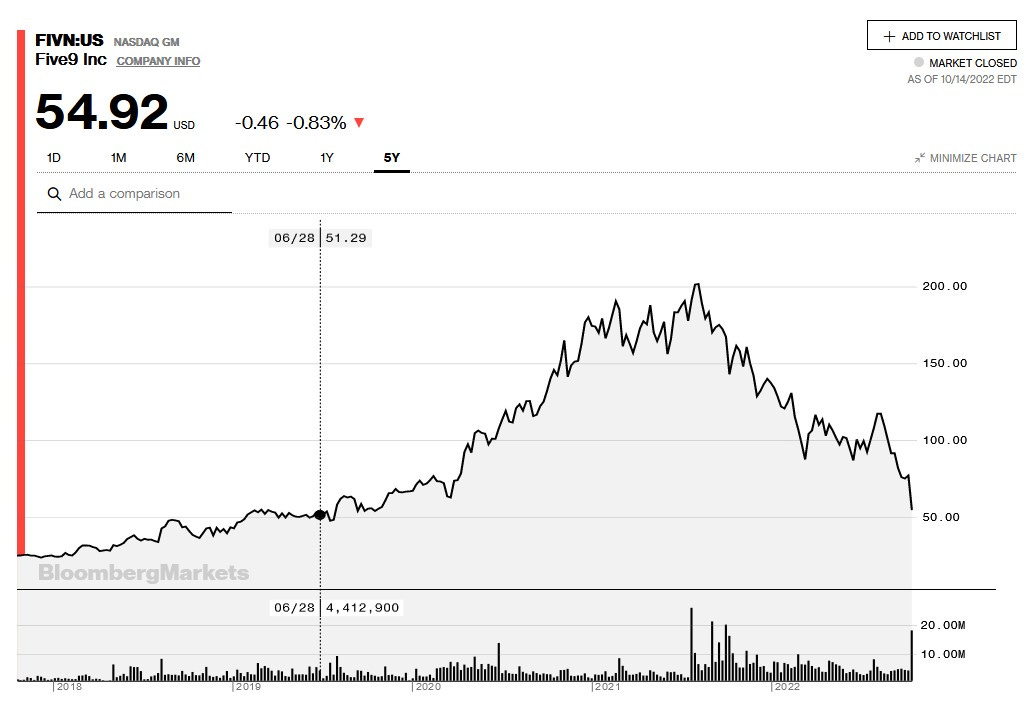

It’s 2019 all over again for the owners of Five9, a Software as a Service provider of Call Center Management solutions.

All year, share prices were fluttering down alongside the rest of the market.

Last week the company announced that CEO Roland Trollope was stepping down and the price dropped like a stone in a well.

Has the sudden drop in price created a buying opportunity? Let’s look at Five9.

Five 9’s Customer Perspective:

The company sells cloud-based call center software to enterprise customers in the US and Canada.

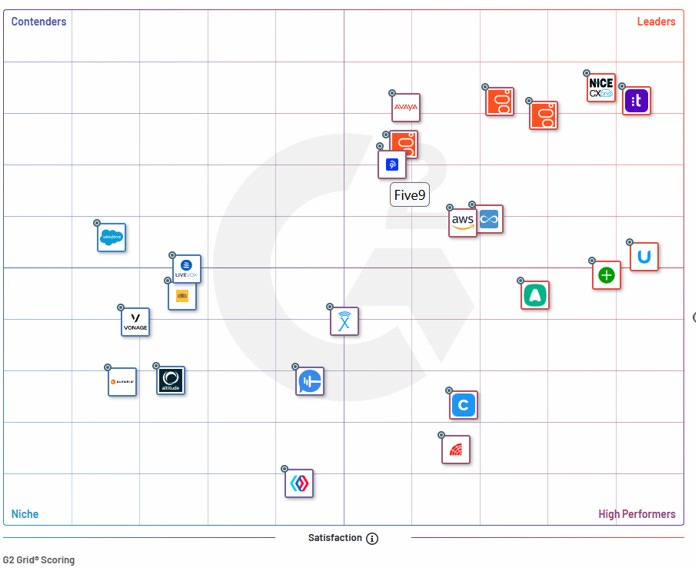

Gartner lists three companies as leaders in this space: Talkdesk1, Genesys2 and NICE3.

Five9, Amazon Connect4 and ContentGuru5 are behind these leaders.

I like to use Net Promoter Score6 as a simple way to one company’s customer loyalty against another. And High Net Promoter Scores are highly correlated to high rates of growth.

Five9’s Net Promoter Scores are very good but not great: Five9 has a Net Promoter Score of 347. This is better than competitors Genesys (12) and NICE (13) but behind Talkdesk (50) and tied with Contentguru (34)

G2 Reviews, another source of customer feedback, places Five9 high (but not tops) in both Customer Satisfaction and Market Presence.

Did you notice how many players G2 shows in the enterprise call center management space. Hold that in your head. We’ll come back to it later.

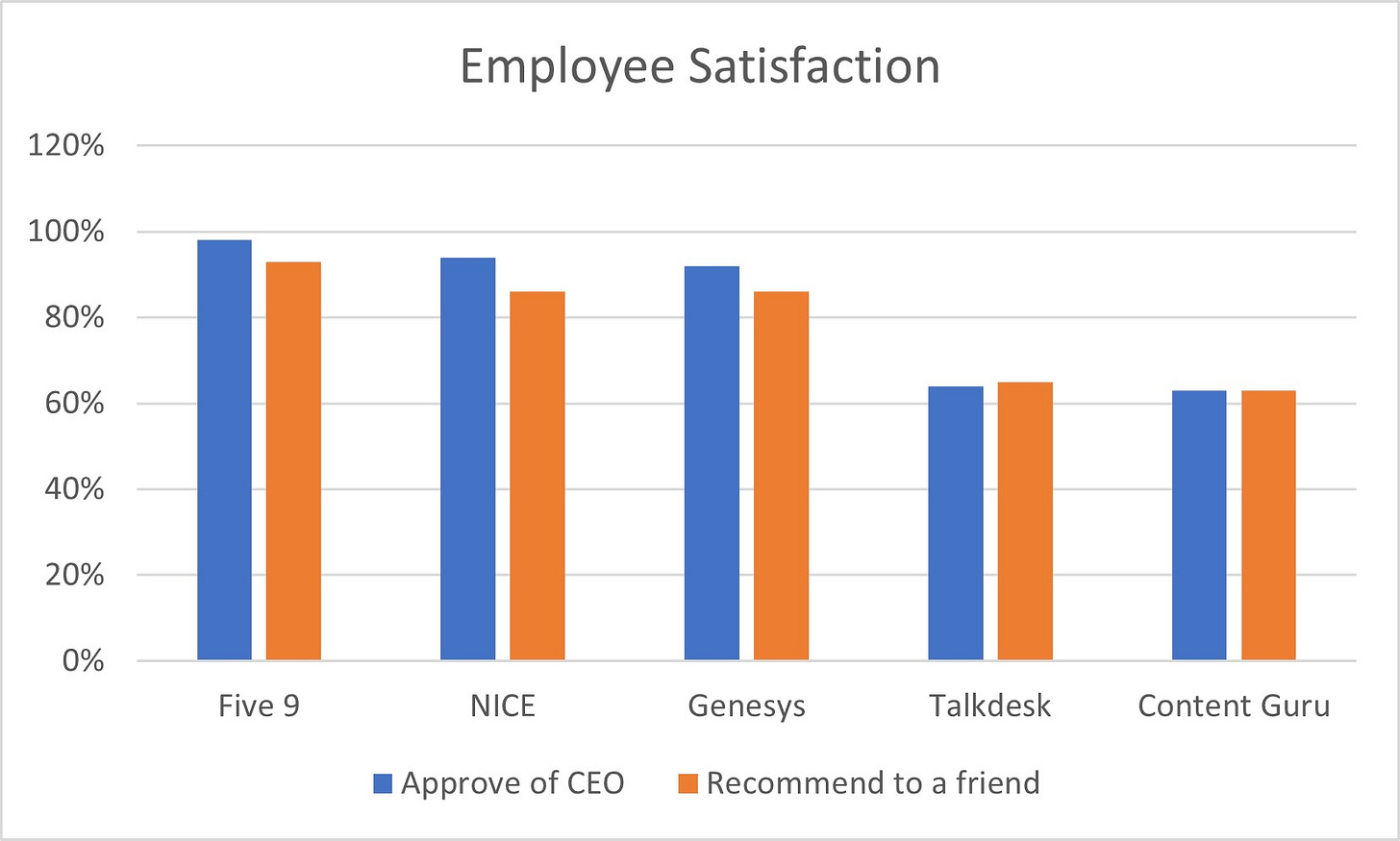

Employee Perspective:

Happy employees make for happy customers. Five9 employees are pretty happy8.

93% would recommend working at Five9 to a friend. 98% approve of the CEO.

Five9 is better than its competitors. Importantly for a SaaS business, the reviews from sales people and software engineers are strongly positive.

SaaS Metrics

Average Contract Size

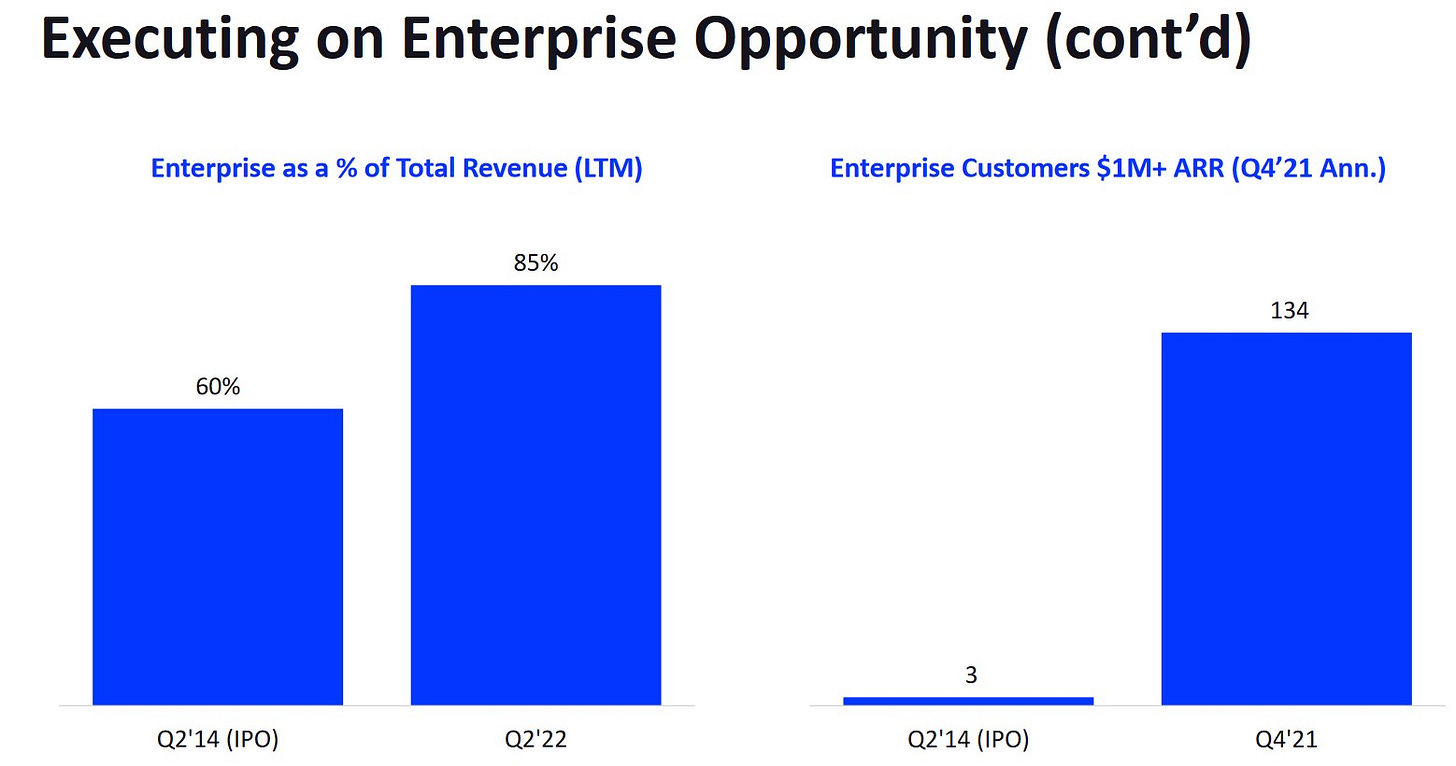

Five9 staked its claim to the large enterprise market in 2014 before it had many large enterprise customers. A recent investor presentation shows the progress the company has made in increasing the value of the average customer.

Sales Efficiency

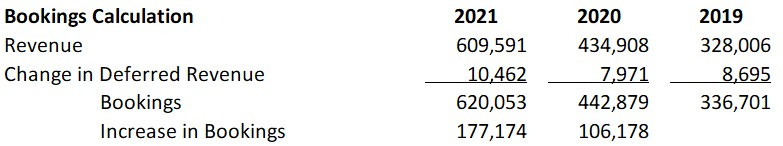

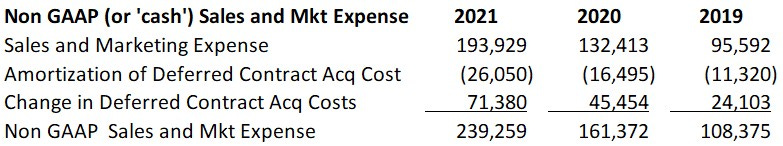

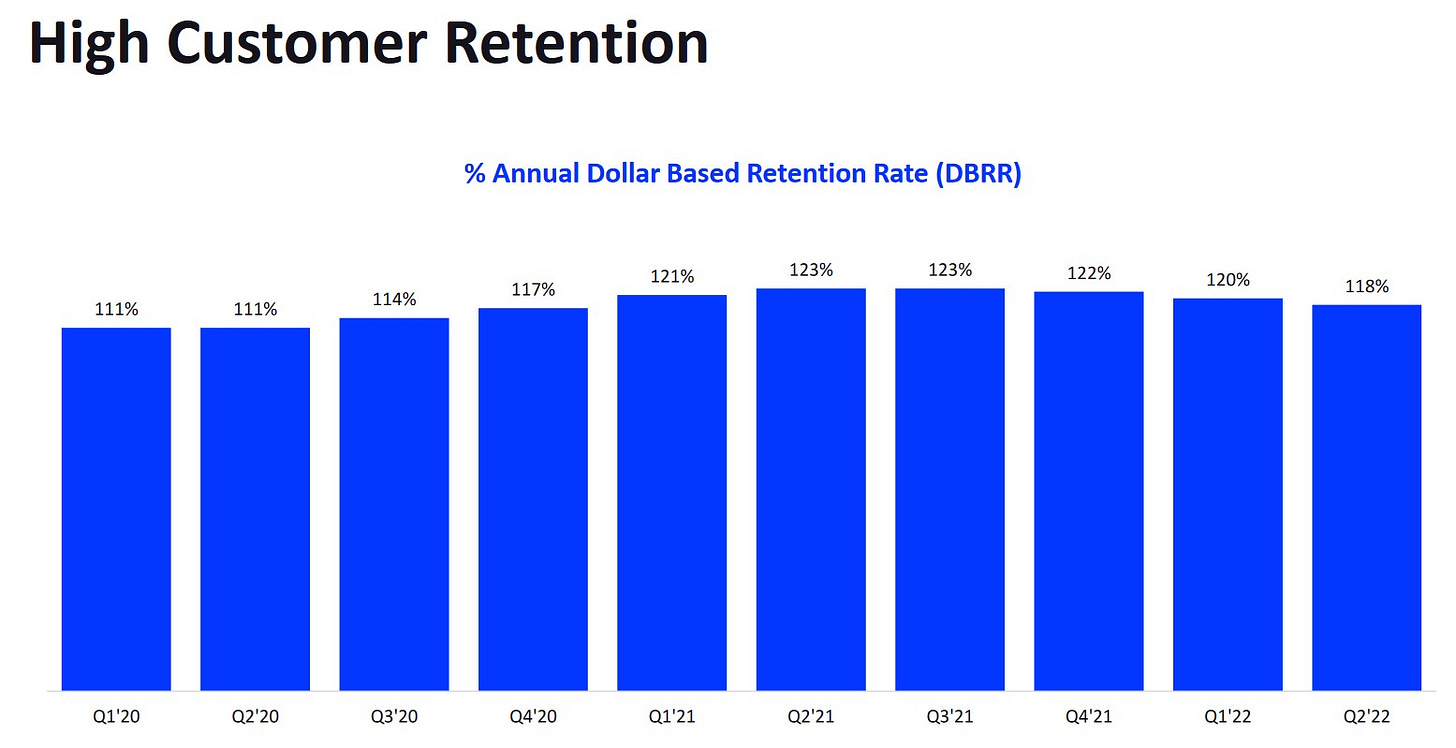

Sales efficiency is a measurement of how many dollars a company spends to get a dollar’s worth of new customers. The numerator in this equation is sales and marketing expense and the denominator is the increase in bookings.

In a SaaS business, where some revenue recognition is always deferred, the increase in bookings has to be calculated from the sum of GAAP (recognized) revenue and the change in deferred (unrecognized) revenue.

SaaS businesses now apply ASC 6069 to defer some sales expense and amortize it over the expected life of the customer. That makes calculation of sales and marketing expenses a little bit like the calculation of bookings.

The ideal efficiency number is “1”. If a SaaS business spends $1 to acquire $1 in new revenue it will recover all of its customer acquisition costs within the same year that it makes the spend. That creates a sort of perpetual growth machine.

FIVN isn’t ideal. It’s sales efficiency in 2021 was .7 and that’s less than 1

There’s no clear trend that shows sales efficiency improving. It’s not terribly inefficient. It’s just not ideal.

Net Dollar Retention

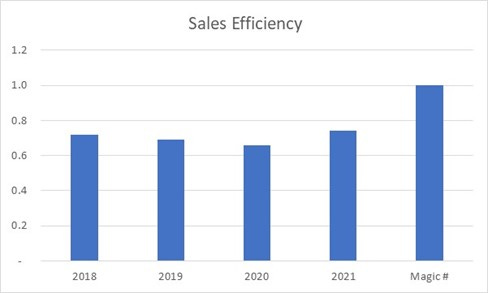

In their latest investor presentation management posts a high dollar based net retention metric10:

CUSTOMER RETENTION

This tells us that the customers who were billed a dollar in Q2 of 21 were billed $1.18 in Q2 of 22. That’s a good indicator of the company’s ability to upsell existing clients and gain more wallet share with customers.

It doesn’t tell us how long the company keeps its customers.

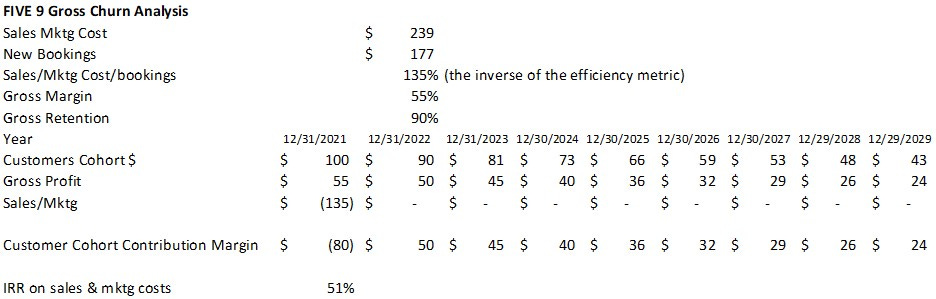

Churn and Return on Investment in Sales and Marketing

Which brings us to churn. Since it takes FIVN 17 months to recover the cost of signing a new customer it matters a lot how long they will keep that customer.

Five9 doesn’t disclose churn. But (I’m guessing here) if net retention is 118% gross retention is likely well north of 90%.

Assuming that’s correct we can live with an 17-month recovery of the cost of customer acquisition – because with 90% gross retention the typical customer will stay for many, many years. Here’s how the math works over a nine-year period.

This shows that Sales and marketing spend in 2021 was 239m. New bookings were 177m. Gross margins were 55% and (I’m still guessing) gross retention was 90%. The internal rate of return on investment in a dollar spent on sales and marketing at FIVN is 55%

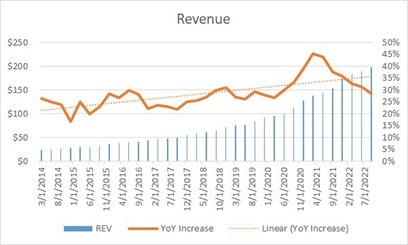

That’s a great rate of return on investments in growth. And Five9 is creating great growth

I wrote more detail about that growth last Tuesday. You can read it here:

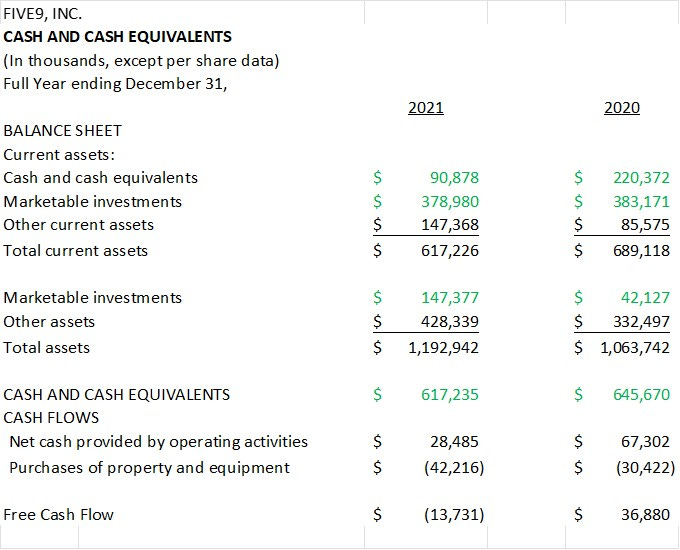

The company has $736m in debt in the form of a low interest, interest only, convertible balloon note that comes due in June 2025. On 12/31/21 it had $617m in cash and cash equivalents.

The question for today is this.

Can Five9 finance its growth and pay down debt without raising additional capital?

Liquidity

For the twelve months ending 12/31/21 we see that the company burned $13.7m in cash.

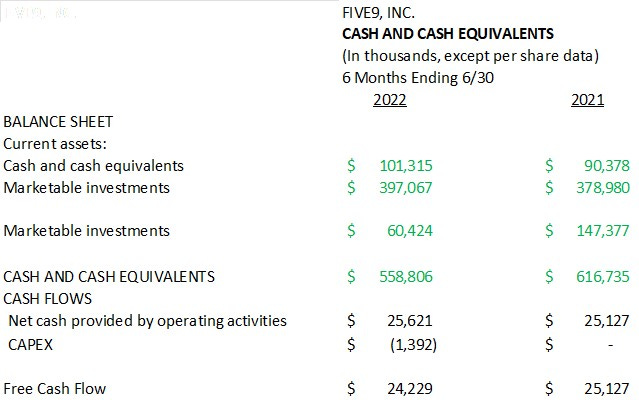

In the 6 months ending 6/30/21 cash was + $24m.

What Does This Mean?

Five9 is a fast-growing software business. Five9 has an attractive product in a large but very crowded space. The company is executing well on its Go-to-Market strategy. It creates small amounts of cash and less than zero GAAP earnings.

The company has more than enough liquidity to continue to invest in growth – right up until June 1st of 2025. Then the $736m note comes due.

I like the business. Buying shares of Five9 now is a bet that, in the next 31 months, the company will grow revenue, and contain expenses, in a manner that lets it restructure or extend the loan. Or that the company will be acquired. Odds are that one or the other will happen.

FIVN reports earnings on November 7th when the market closes. I’m going to wait until then to decide.

Alteryx (AYX)

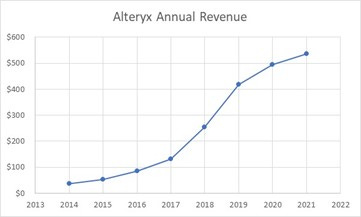

Alteryx is another SaaS business where revenue and share price are moving in opposite directions.

And stock price:

Is this one worth buying? Maybe. But I have a game to watch now, so this will have to wait until next week.

News and Earnings Calls.

I own both Google and Intel. So I liked this news: “Google announced it is expanding its AI cloud offerings using chips produced by Intel"11:

NDAQ (fin tech), October 19th; IBM (tech) reports on Wednesday, October 19th. Verizon (telcom), Friday October 21st. Intel (tech) October 27; Alteryx (SaaS) on November 1st; ICE (fin tech) on Nov 3, Five9 (SaaS) on November 7th.

THANKS for reading,

https://www.talkdesk.com/

https://www.genesys.com/company

https://www.nice.com/

https://aws.amazon.com/connect/

https://www.contentguru.com/en-us/

https://hbr.org/2003/12/the-one-number-you-need-to-grow

https://www.comparably.com/brands/five9-inc

https://www.glassdoor.com/Reviews/Five9-Reviews-E433188.htm

If you want to get down in the weeds on ASC 606 a simple explanation is here: https://www.performio.co/insight/revenue-recognition-asc-606-explained

https://investors.five9.com/static-files/85ae6af5-4d6e-44fc-825f-43e80e07add7

https://www.bloomberg.com/news/articles/2022-10-11/google-goog-expands-cloud-to-more-regions-adds-new-ai-capabilities