A Riddle: How is the Stock Market like the California Gold Rush?

And, the waiting list; earnings calls and results through friday

I bought Intercontinental Exchange, Inc. (ICE) for $92.10 two weeks ago.

ICE owns, among other assets, the New York Stock Exchange.

That got me thinking.

On January 24, 1848, gold was discovered in California. During the next seven years hundreds of thousands of people (mostly men) rushed into California to try to get rich. Some did. Most didn’t. Some ended up dirt poor. A Wikipedia editor wrote this about the economics of the gold rush:

Some gold-seekers made a significant amount of money. On average, half the gold-seekers made a modest profit, after taking all expenses into account; … In California most late arrivals made little or wound-up losing money.

Recent scholarship confirms that merchants made far more money than miners during the Gold Rush. The wealthiest man in California during the early years of the rush was Samuel Brannan a tireless self-promoter, shopkeeper and newspaper publisher. Brannan opened the first supply stores in Sacramento, Coloma, and other spots in the goldfields. Just as the rush began he purchased all the prospecting supplies available in San Francisco and re-sold them at a substantial profit1.

The men who got in early made bank. People who came later broke even or slightly better. And the people who got in late made themselves poor. So far, that sounds like the stock market.

The smartest fellow sold the tools the gold miners needed. He became the wealthiest man in California.2

If the stock market is like a gold rush, should I own the companies that sell the tools that make the markets work?

Selling Tools

If you want to sell stock to the public you need a place to do that. U.S. companies tend to stake out a spot on the New York Stock Exchange or the Nasdaq.

If the company’s IPO does well, or it disappoints, the exchange gets paid its fee.

Once a company is listed the exchange has a strong hold on that company’s trading. If anyone buys or sells, if they make money or lose money, the stock exchange gets paid.

Stock traders buy a lot of information. The exchanges sell the information the traders buy and the analytic tools they use. The traders can win or lose. The exchanges make money either way.

Recurring Revenue

The New York Stock Exchange and the NASDAQ have one big advantage over Samuel Brannan.

Mr. Brannan could sell a pan, pick or shovel only once3. He used what we’d now call a transactional revenue model.

In contrast, the exchanges sell the right to list on their exchange one year at a time. They get paid every year. They sell data and analytic software on a subscription basis. With this recurring revenue model they sell the same thing over and over again.

ICE, the owner of the New York Stock Exchange, has moved almost half its revenue to the recurring model.4

We have increased our portion of recurring revenues from 34% in 2014 to 49% in 2021…

Over 70% of S&P 500 companies <are> listed on the NYSE… the global leader in ETF listings with 75%... of ETF assets under management…listing fees are largely recurring in nature. …We are a leading provider of … pricing services on… three million fixed income securities…fixed Income Data and Analytics revenues are… recurring in nature…. Our proprietary… mortgage origination platform, … acts as a system of record for the mortgage origination…. These revenues are based on recurring Software as a Service… fees… We also provide a Data as a Service… for lenders to access their own data5... Revenues related to our data products are… recurring in nature.

The owners of the Nasdaq like recurring revenue, too6. They brag on it in the annual report.

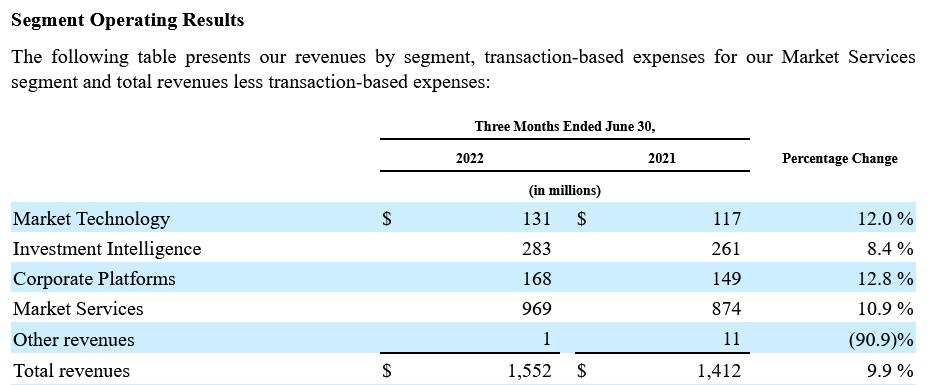

The quarterly report for the period ending June 30th shows that overall revenue grew by 9.9% year over year. Not shabby.

Some back of the envelope math (shown below) leads me to this nugget of wisdom: NASDAQ, unlike ICE, is not growing recurring revenue faster than overall revenue. Their revenue mix is not improving7.

Alas, for CME Group, which operates the Chicago Mercantile Exchange, the move to recurring revenue isn’t panning out.

Like the (still fortunate) Mr. Brannan, CME makes its money one transaction at a time:

“Our revenue is substantially derived from fees for transactions executed and cleared in our markets”8.

The Numbers

Samuel Brannan got rich by first creating a monopoly on mining equipment and then selling that equipment to miners.

The exchanges are a form of oligopoly9. The barriers to entry are high and high switching costs for customers limit competition. If the exchanges are similar to Samuel Brannan’s mining supply shops they should enjoy pricing power and that pricing power should manifest itself in higher-than-average revenue growth and profits.

Revenue growth:

Do the exchanges grow revenue faster than the S&P 500? Yes, they do.

Look at the average revenue over rolling 5-year periods beginning in 2016 and ending in 2021.

Average revenue grew at 4.1% for the S&P. ICE, NDAQ, and CME group all grew revenue at a much higher rate; more than 7%

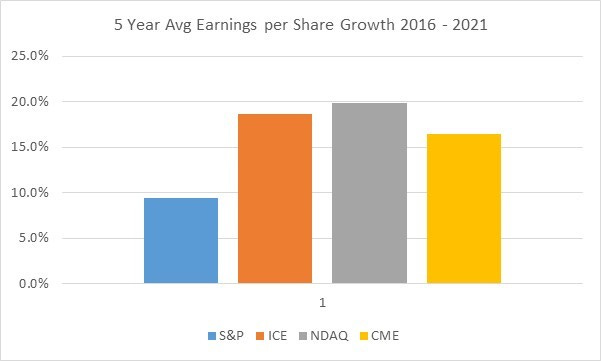

EPS Growth:

Firms with pricing power can more easily raise prices to protect profits.

During that same 2016 to 2021 period, all three exchanges grew average earnings per share faster than the S&P 500. 5-year average earnings per share grew at 9.4% for the S&P. The exchanges grew at 16.4% (CME); 18.6% (ICE) and 19.9% (NDAQ).

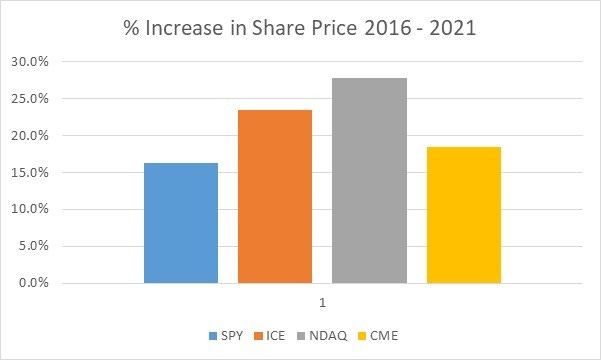

Stock Price Growth

Given the limited competition, pricing power and somewhat captive customers, do the exchanges outperform the stock market in the actual stock market?

At least during the boom years they did. Between the end of 2016 and December 31, 2021 shares of SPY (an ETF proxy for the S&P 500) enjoyed an average annual gain of 16.3%. ICE, NDAQ and CME all outperformed that with 23.5%, 27.8% and 18.4% growth respectively.

Buy Now?

No rush.

ICE has been trading around its historical PE ratio. I bought that.

Both NDAQ and CME are still trading above their historical PE ratios as measured over a 12-year period ending December 31, 2021.

I like NDAQ and CME. But they still look expensive to me. I’ll dig deeper and sift through more data if the price to earnings ratio reverts closer to the norm.

Watching and Waiting.

Broadridge (BR) I wrote about this one a few times in the last weeks. This is another business that serves investors; selling tools to miners if you will.

The shares have declined from $171 three weeks ago to $144.32 at the end of the day on Friday. It is now close to the $145 - $125 range where I think it’s a good value.

CSX (CSX) was at $34 a share in February of 2022. I like the profile of the business and what appear to be strong operating cash flows. It closed at $26.64 on Friday. I think it’s a good value around $21 a share. I’ll wait on that as well.

Earnings Calls.

Blackrock reports earnings on Thursday, October 13th.

I’m down about 24% since I bought Blackrock (BLK)

When I bought the stock in February of 2022 I expected full year earnings of $35.86 this year and $41.12 in 2023.

Expectations are for $8.41 a share for this quarter.10 Zack’s now estimates full year 2022 earnings at $33.92 and $37.89 for 2023.

Results

I’m underwater on just about everything I’ve bought since the end of 2020. Overall this portfolio is underperforming the S&P 500 by 1%.

My holding period is ten years. The portfolio dividend yield is 3%. I don’t enjoy seeing this sea of red every Sunday morning but I’ll persevere.

Thanks,

- Frank

https://en.wikipedia.org/wiki/California_Gold_Rush

The Wikipedia article is a fun read. As far back as 1848, California had a confiscatory tax system. Wild fires were a serious problem in the tent cities and shanty towns. Samuel Brannan, the richest merchant in California, had the same bad luck in marriage as do some of today’s richest men in California. After he became wealthy (and bought a newspaper), his wife divorced him. She ended up with half his assets. The more things change, the more they stay the same.

Collecting rents on tools would have been difficult for Mr. Brannan who was often paid by his customers in gold dust.

https://www.sec.gov/ix?doc=/Archives/edgar/data/1571949/000157194922000006/ice-20211231.htm

I love that one. They take the customers data and sell it back to the customer, over and over again.

https://www.sec.gov/ix?doc=/Archives/edgar/data/1120193/000112019322000017/ndaq-20220630.htm

Which makes me wonder about the $2.75b acquisition of Verafin in November of 2020. If NASDAQ have been able to grow that business at an outsized rate we’d see a positive shift in the revenue mix, no? https://www.barrons.com/news/nasdaq-buys-canadian-fraud-detection-company-for-2-75-bn-01605801306?mod=article_inline

https://www.sec.gov/ix?doc=/Archives/edgar/data/1156375/000115637522000076/cme-20211231.htm

https://www.investopedia.com/ask/answers/121514/what-are-some-current-examples-oligopolies.asp#:~:text=An%20oligopoly%20refers%20to%20a,others%20or%20steal%20market%20share.

https://www.nasdaq.com/market-activity/earnings