Zoom! (ZM) Part I - Post Covid

Tips on STIPS? And portfolio results: -1.4%; vs S&P – 8.1%

Zoom: Back to business.

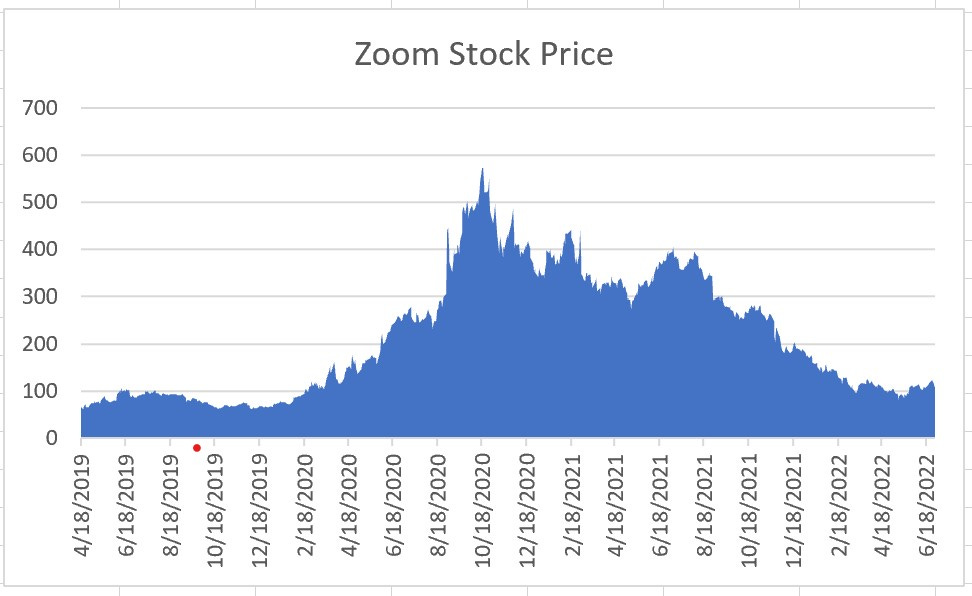

Zoom stock was a fabulous pandemic performer. Covid brought the Zoom brand into our homes with Zoom weddings, Zoom graduations, and Zoom visits with Grandma.

Now, the pandemic is over.

Zoom, pre-pandemic, was a business-to-business provider of communication services. It looks to me like they’ve gotten back to business. On the most recent earnings call, May 23, 2022, Kelly Steckelberg, CFO offered this[1]:

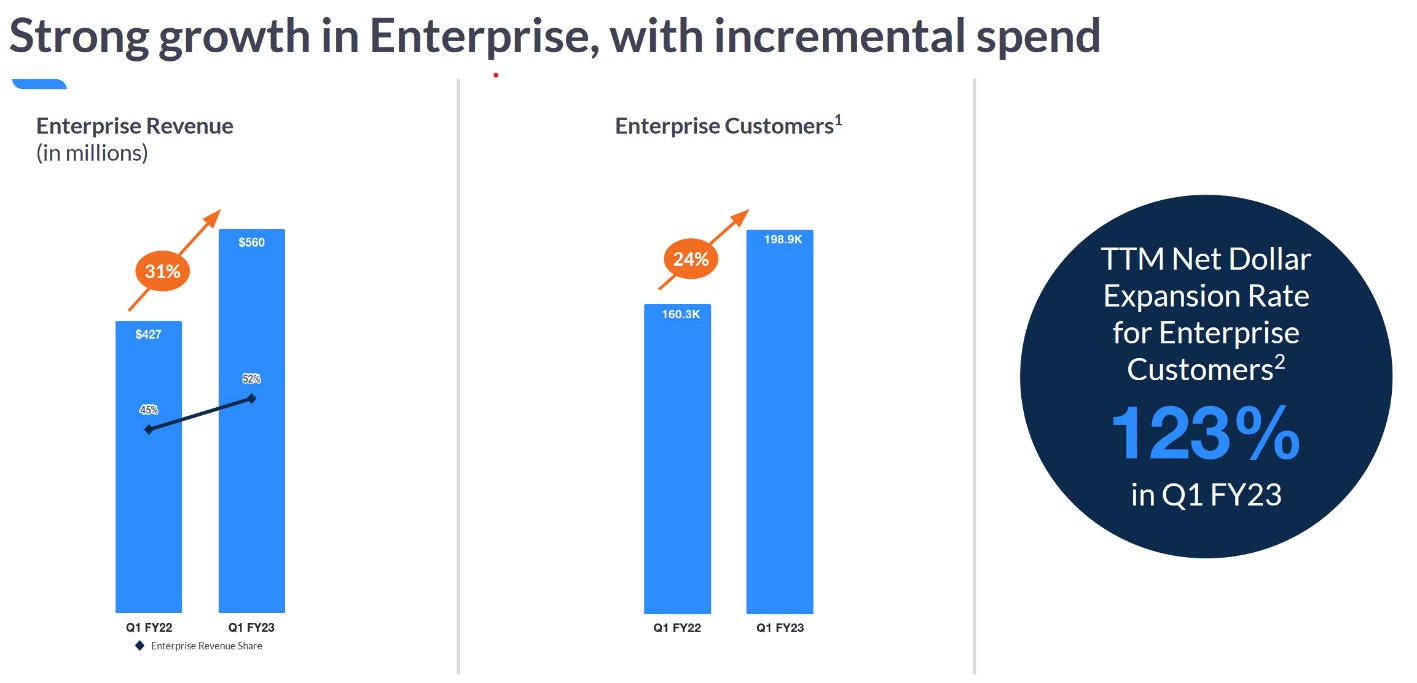

“Revenue from enterprise customers grew 31% year-over-year and represented 52% of total revenue, up from 45% in Q1 of FY ’22. The number of enterprise customers grew 24% year-over-year to approximately 198,900. We expect revenue from enterprise customers to become an increasingly higher percentage of total revenue over time.

And this;

“Our trailing 12-month net dollar expansion rate for enterprise customers in Q1 came in at 123%... as existing enterprise customers continued to expand their investments in the Zoom platform…

And this;

“We saw 46% year-over-year growth in the upmarket as we ended the quarter with 2,916 customers contributing more than $100,000 in trailing 12 months revenue. These customers represented 24% of revenue, up from 19% in Q1 of FY ’22.

Earlier in the year, on the February 28, 2022 earnings call[2] CEO Eric Yuan explained Zoom’s pandemic experience this way:

“Over the past three years, we have had to really think about how to help the world, help the people stay connected.

“Right now, we're seeing the end of the COVID crisis…That's the reason why we adjust our growth strategy… to double down, triple down on our Enterprise customers.

There’s a lot to like here.

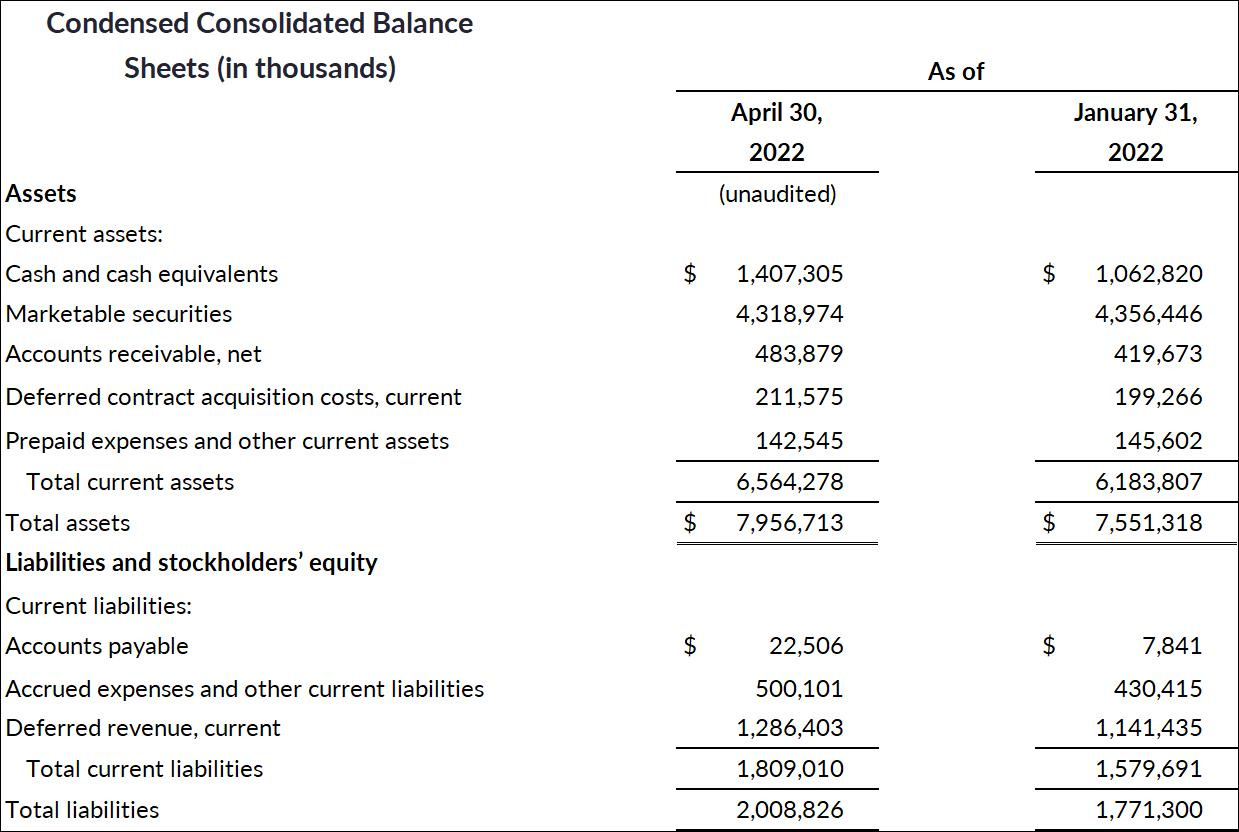

I - Strong Balance Sheet[3]

The company has no debt. The $33b market cap company has more than $5b in cash and marketable securities. That’s a good position to be in post pandemic and pre-recession.

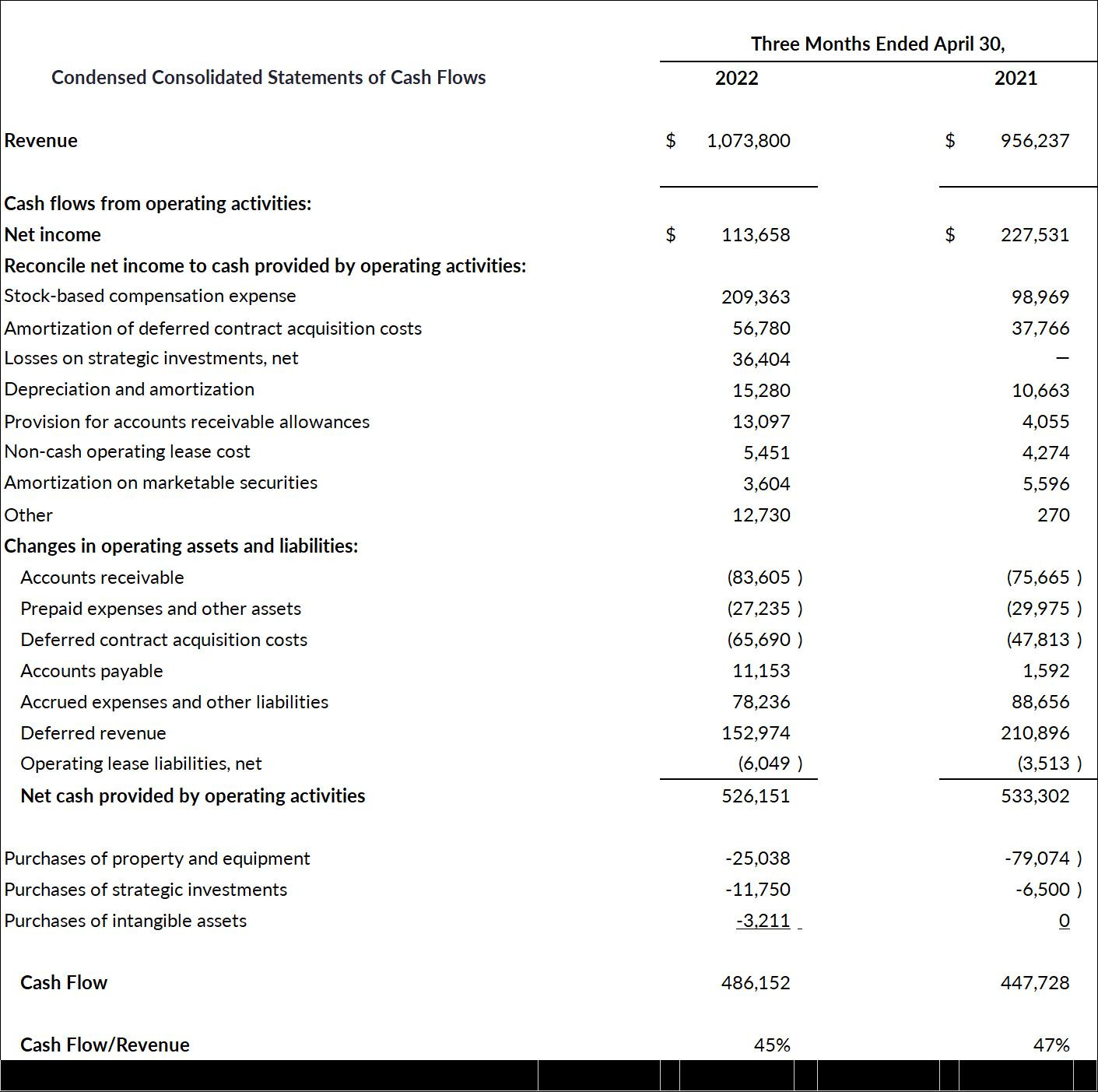

II - Strong Cash Flow

Zoom is profitable. It’s creating a lot of cash with cash flow margins around 45% of revenue. Zoom doesn’t pay a dividend but it is buying back up to $1b in stock.

III - Everyday Low-Price Strategy

Strong cash flow allows Zoom to pursue a Walmart like ‘every day low price strategy.’ This is from the Q4 earnings call:

“Peter Levine -- Evercore ISI -- Analyst

“Thanks for taking my question. So maybe just to piggyback off the Contact Center discussion. I think it's been reported that you're selling seats at $70 per month per agent.

“So that's obviously a huge discount from the industry average, call it, $200.

“Kelly Steckelberg -- Chief Financial Officer

“Peter, I would say that Zoom has always been disruptive in pricing, and Contact Center is absolutely no different. If you look across the market in how we price Meetings, how we price in Phone when we introduced it, we're approximately half the price of any of our competitors' list price.

“Eric Yuan -- Founder and Chief Executive Officer

“Yes, Peter, Kelly is right. Our growth strategy is always better product, better price and also much better service.

In the long run, the competitor with the lowest total cost generally wins. Zoom is planning to win.

So, what’s not to like?

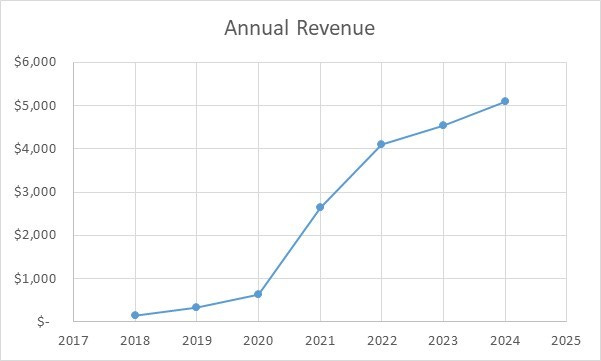

Growth has slowed.

The hockey stick growth from 2020 to 2022 has flattened. Revenue growth recently is in the 12% annual range.

Within that though, there’s some good news.

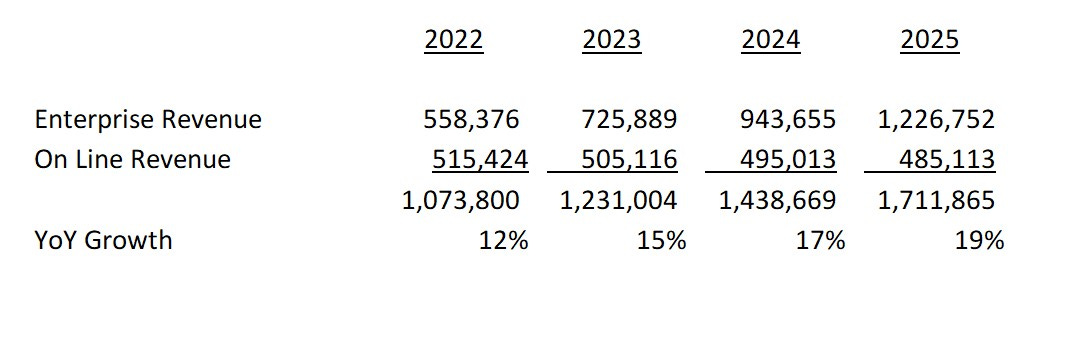

The overhang from the consumer and small business segments, which are not growing well, depresses overall revenue growth. But revenue from enterprises, which is about half of all revenue now, is growing at 31% year over year.[4]

The net dollar expansion of 23% from enterprise customers both fuels enterprise growth and proves that the ‘land and expand’ strategy is working.

If the company can continue to grow enterprise revenue around 30% annually, and keep the on-line revenue flattish, we should see revenue growth in the high teens, low 20s by 2025

Stock Based Compensation: There were 278m shares outstanding on January 31, 2020. Two years later there are 299m shares. This 7 ½ % dilution over two years is entirely the result of the issuance of stock options, restricted stock units and shares purchased through an employee stock purchase plan.[5]

China Syndrome: The company has an unusually low cost of research and development. Much of this cost advantage comes from the location of R&D facilities in China.

These offshore development teams may have an outsized role in Zoom. Software developer reviews like this, on Glassdoor[6], are not uncommon:

“US engineers are treated as second class citizens. It is difficult to get anything done without China engineers and they are not usually motivated to collaborate with US engineers…

The war in Ukraine taught everyone in the software industry that offshore development teams can be rendered completely ineffective, overnight, by geopolitical events. The concentration of R&D in China is a risk.

China also presents an existential reputational risk to Zoom. In a 2020 incident the Department of Justice charged a criminal complaint against a China based Zoom executive for sharing user information and terminating video calls at the Chinese government’s request.[7]

“Prosecutors said the China-based executive, Xinjiang Jin, worked as Zoom’s primary liaison with Chinese law enforcement and intelligence services, sharing user information and terminating video calls at the Chinese government’s request.

“Jin monitored Zoom’s video system for discussions of political and religious topics deemed unacceptable by China’s ruling Communist Party, the complaint states, and he gave government officials the names, email addresses and other sensitive information of users, even those outside China.

Building secure software in China is a near impossibility. The same enterprise clients whom Zoom is now building the go forward business upon will have small tolerance for security breaches.

Summing it all up?

I like Zoom. I’m in no hurry to buy it. I’ll dig in a little more and write Zoom Part II next Sunday.

Any tips on STIPS? Or where to Stash Cash?

Andrew Bary wrote an excellent article on income investing in this week’s Barron’s

This caught my eye:

“TIPS, or Treasury Inflation-Protected Securities, are an even better investment than regular Treasuries due to their current yields of about 8%. The $31 billion iShares TIPS Bond exchange-traded fund (TIP) offers exposure to a range of the securities.[8]

I’m about ¾ in cash now. A month or so ago I was looking for a place to stash cash and generate income. I saw the headline yield on STIP, the iShares 0-5 Year TIPS Bond ETF. I thought, “What could go wrong?”

In May I bought STIP at $103.54 a share. In June, I collected the dividend ($1.11 a share - cool!). Today the shares trade for $101.80.

So, by my math, I’m now at $101.80/share + $1.11 cash = $102.91. A loss of $1.38; (or $1.38/$103.54) or -1.3% of my $103.54 purchase price. Not adjusted for inflation.

Results: Bleh!

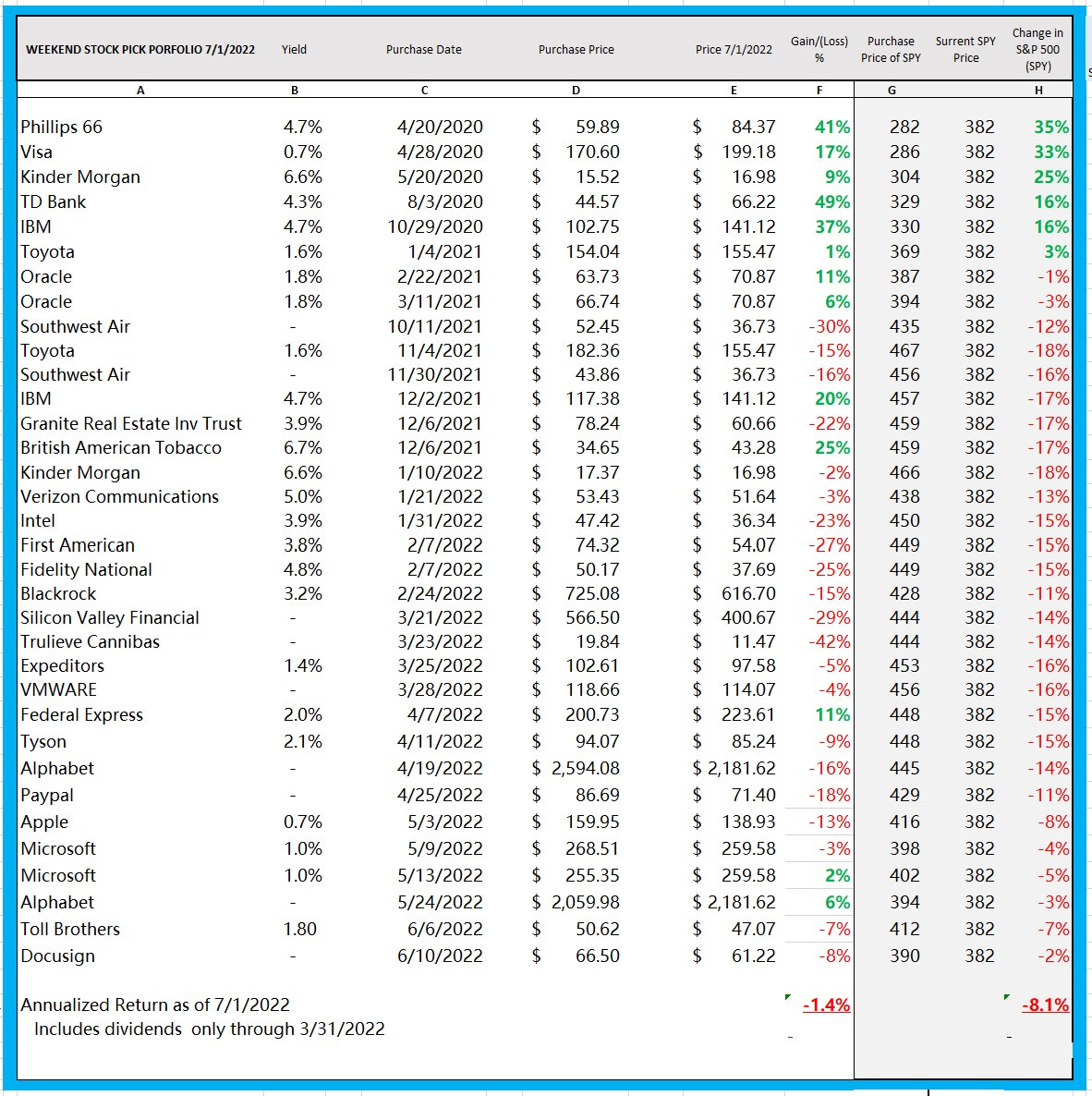

Portfolio: - 1.4 %

S&P 500: - 8.1 %

This is the 26th month of a 120-month project.

The project tests a theory that, over ten years’ time, a “buy low, sell never” portfolio of stocks bought at a discount to their estimated present value will both make money on an absolute basis and outperform the S&P 500. 26 months in the portfolio has lost less than the S&P 500. But that’s a cold comfort when it’s not making money at all.

This is the portfolio when the market closed on Friday.

Thanks for reading. If you like this please share. Subscriptions are free.

Or email me at: weekendstockpick@gmail.com

[1] https://news.alphastreet.com/zoom-video-communications-inc-zm-q1-2023-earnings-call-transcript/

[2] https://www.nasdaq.com/articles/zoom-video-communications-zm-q4-2022-earnings-call-transcript

[3] https://investors.zoom.us/news-releases/news-release-details/zoom-video-communications-reports-financial-results-first

[4] https://investors.zoom.us/static-files/85900e23-f539-452e-9021-77f8dc78c0c8

[5] https://investors.zoom.us/static-files/9a9d91bf-5c62-45fd-9573-fb03159c8a93 Page 65

[6] https://www.glassdoor.com/Reviews/Zoom-Video-Communications-Software-Engineer-Reviews-EI_IE924644.0,25_KO26,43.htm?filter.jobTitleFTS=Software+Engineer&filter.iso3Language=eng&filter.employmentStatus=REGULAR&filter.employmentStatus=PART_TIME

[7] https://www.washingtonpost.com/technology/2020/12/18/zoom-helped-china-surveillance/

[8] https://www.barrons.com/articles/best-income-investments-bonds-yields-51656713799?mod=past_editions