Tyson (TSN)

Speaking of inflation, and who isn’t, the price of food is rising fast enough to merit a mention from the White House Press Secretary / future MSNBC Financial Correspondent Jen Psaki:

"You could call it 'corporate greed,' sure. You could call it 'jacking up prices during a pandemic,'" White House Press Secretary Jen Psaki said in December. [1]

You could call it, as Milton Friedman did, “too much money chasing after too few goods.”

Both are right. When inflation runs wild some businesses are able to raise prices faster than others. And some can raise prices enough to temporarily add profits.

I looked at two large food producers, Bunge and Tyson, this week. Bunge is a global producer of grains and other foodstuffs. Tyson is one of the largest meat producers.

Bunge operates around the world. Tyson’s operations and sales are mostly in the United States

Both Bunge and Tyson are raising prices.

Jason Lusk, a professor of agricultural economics, spoke about Tyson’s price increases in an interview with CBS news in March[2]:

"Tyson's case is that even while profitability is rising, so are their costs and they're having to pay more for their inputs," Lusk said. "They're paying about 20% higher wages to their workers since the start of the pandemic. And even for inputs such as cattle — cattle prices are up about 15% since the start of the pandemic, so their costs have increased.

In these inflationary times, can Tyson increase prices faster and higher than its costs increase?

Looks like they started last July. I came across this in the transcript from Tyson’s earnings call for the period that ended October 1 2021:

“we have also work to recover inflation through pricing, achieving a 13% price improvement for the fiscal year and a 24% increase for the fourth quarter.”[3]

The company reports that “retail customers typically do not enter into written contracts, and if they do sign contracts, they generally are limited in scope and duration.” Increasing prices is easier if you’re not locked in to long term contracts.

Tyson’s price increases seemed to have come in time. In the quarter which ended January 1, 2022, Tyson reported a 40% increase in operating income.[i] Beef prices were up 37%, chicken prices 20% and pork prices 13%.

I like that Tyson seems positioned to survive the current inflationary storm. I also like that Tyson has performed well over a longer period of time.

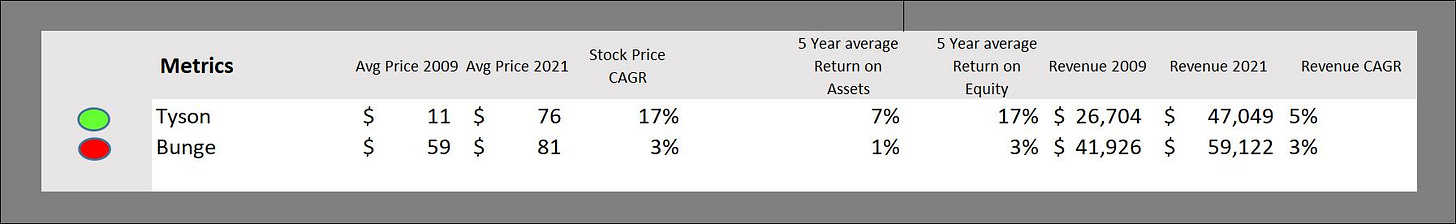

Since 2009 the stock price has increased at an annualized rate of 17%. Revenue in the same period grew at 5% annually. This compares well with the other large food producer, Bunge.

Tyson’s return on equity over a five-year period was 17% on average while return on assets was 7%.

Tyson pays a dividend. The dividend grows at an annualized rate of 15% - roughly in line with earnings growth.

One criticism of Tyson is that they sell commoditized food products. When a product is a commodity – that is, everyone sells the same product – no one can charge much more for that product than anyone else.

The recent inflationary climate gave Tyson a chance to demonstrate its ability to raise prices. This suggests it has some pricing power.

Recent success is in the past. They will need greater price increases in the very near future.

If you’re in the chicken business the price of chickenfeed ain’t chickenfeed.

“In fiscal 2021, corn, soybean meal and other feed ingredients were

major production costs, representing roughly 59% of our cost of growing a live chicken”[4]

Costs, including the costs of soybeans as shown here, have climbed enormously since the Tyson’s last earnings report.[5]

Tyson reports earnings again on May 9th. I hope they continue to outrun the inflationary whirlwind.

Wall Street Journal?

The Pew Research Center reports that a third of large U.S. newspapers laid off staff in 2020.[6] Newspaper employment dropped 57% between 2008 and 2020.[7]

Reductions hit mid-career newsroom workers the hardest.[8]

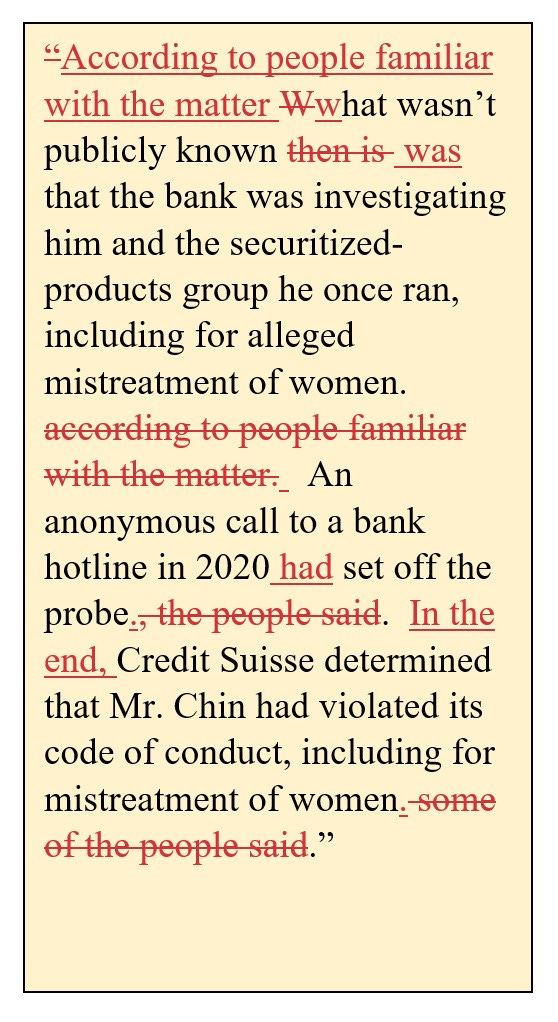

My guess is a lot of the missing are editors.

This is from the front page of the Business and Finance Section of Wednesday’s Wall Street Journal:

“What wasn’t publicly known then is that the bank was investigating him and the securitized-products group he once ran, including for alleged mistreatment of women, according to people familiar with the matter.

“An anonymous call to a bank hotline in 2020 set off the probe, the people said. Credit Suisse determined that Mr. Chin had violated its code of conduct, including for mistreatment of women some of the people said.”[9]

Some of those same people said the Wall Street Journal needs to hire more editors.

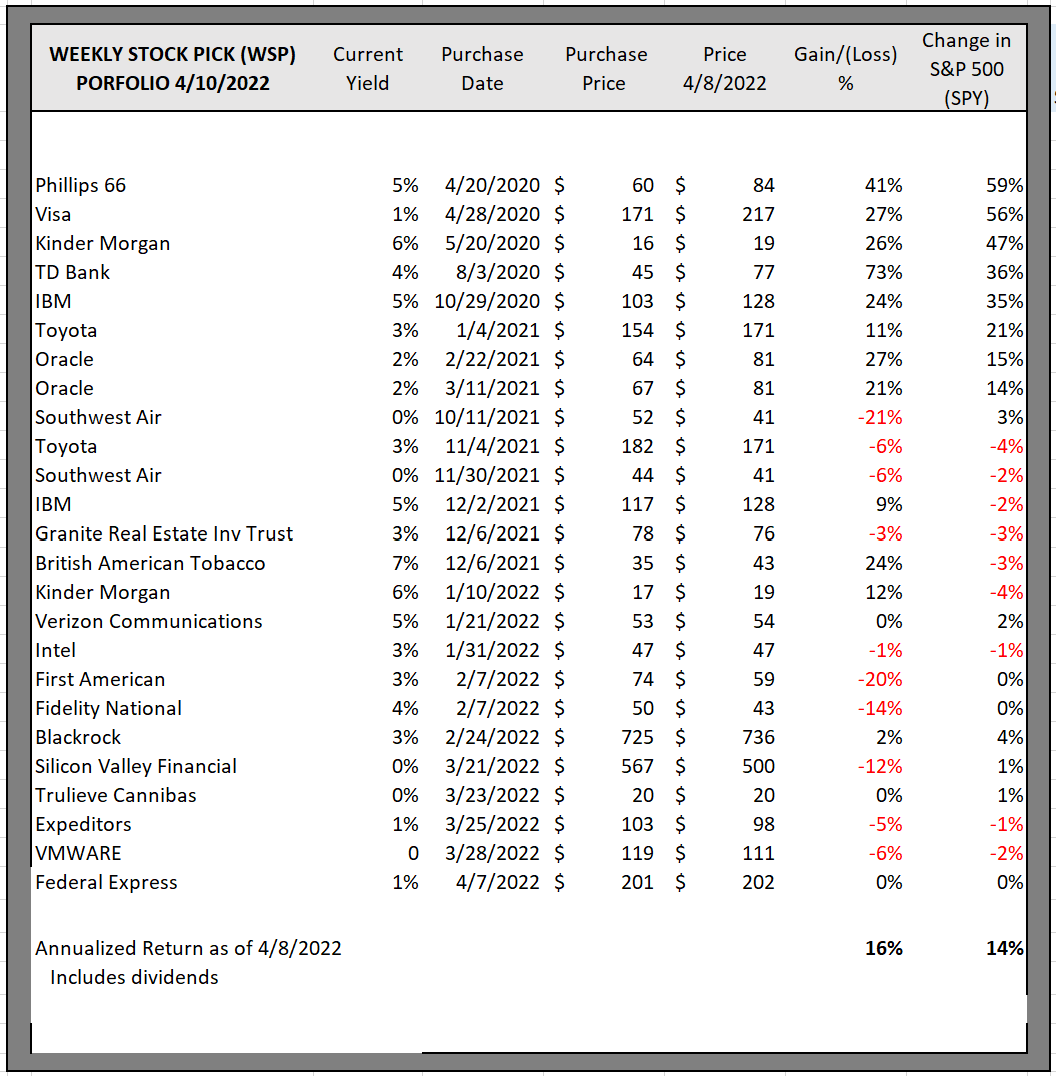

Weekly Stock Pick Portfolio as of 3/25/2022

The Weekly Stock Pick newsletter is a personal project.

The project tests a theory that, over the ten-year period that began in April of 2020, a “buy low, sell never” portfolio of individual stocks bought at a steep discount to their estimated present value will outperform the S&P 500 ETF SPY.

I wrote about FEDEX on March 13th. The stock jumped up before I had a chance to buy it. This past week it dropped back to $200 and I added it to the portfolio.

If you like the newsletter please share it with someone who might enjoy it. Reading it costs nothing - except your time.

Thanks!

Mentions Newsletter Date

Allison Schraeger, Bloomberg February 13, 2022

Biogen February 6, 2022

Blackrock February 27, 2022

Blackstone February 27, 2022

Bloomberg News February 20, 2022

Boston Beer February 20, 2022

Bunge April 10, 2022

Callidus March 29, 2022

Carbon Black March 29, 2022

Coca Cola January 30, 2022

Draft Kings February 20, 2022

Draft Kings April 3, 2022

Ella Nilsen, CNN March 13, 2022

Eric Savitz, Barrons February 13, 2022

Expeditors March 13, 2022

FEDEX March 13, 2022

Fidelity National February 13, 2022

First American February 6, 2022

First American Fina February 13, 2022

Goldman Sachs February 27, 2022

Granite Real Estate Trust January 18, 2022

IBM January 30, 2022

Inflation January 2, 2022

Inflation January 23, 2022

Inflation January 30, 2022

Intel January 30, 2022

Jen Psaki, MSNBC April 10, 2022

Keith Romer, Bloomberg April 3, 2022

Kinder Morgan January 8, 2022

Nutanix March 29, 2022

Phillips 66 January 2, 2022

Prudential February 6, 2022

Sangfor Technologies March 29, 2022

Silicon Valley Bank March 20, 2022

SUSE March 29, 2022

Trulieve February 20, 2022

Tyson April 10, 1011

UPS March 13, 2022

Verizon January 23, 2022

Virtuozzo March 29, 2022

VMWARE March 29, 2022

Wall Street Journal April 10, 2022

Wells Fargo March 20, 2022

Western Alliance Bank March 20, 2022

[1] https://www.cbsnews.com/news/meat-prices-pandemic-inflation-corporate-greed/

[2] Ibid

[3] https://www.fool.com/earnings/call-transcripts/2021/11/15/tyson-foods-inc-tsn-q4-2021-earnings-call-transcri/

[4] https://s22.q4cdn.com/104708849/files/doc_financials/2021/q4/TSN-2021-10K-DRAFT-11.12.21.pdf

[5] https://www.nasdaq.com/market-activity/commodities/zs

[6] https://www.pewresearch.org/fact-tank/2021/05/21/a-third-of-large-u-s-newspapers-experienced-layoffs-in-2020-more-than-in-2019/

[7] https://www.pewresearch.org/fact-tank/2021/07/13/u-s-newsroom-employment-has-fallen-26-since-2008/

[8] https://www.pewresearch.org/fact-tank/2020/04/07/decade-long-decline-in-newsroom-employment-hit-midcareer-workers-the-hardest/

[9] The Wall Street Journal, Wednesday April 6, 2022, B1 “Credit Suisse Probed Executive Misconduct”

[i] https://s22.q4cdn.com/104708849/files/doc_financials/2022/q1/Tyson-Foods-FINAL-1Q22-Investor-Presentation.pdf