In times of high inflation, it is good to own real assets. And nothing is more real than a plot of land.

An investor who wants to buy land has a lot of choices. Like, say, Land Securities Group (LAND: LN) which invests in retail, commercial and industrial property in the UK.

Or, closer to home, there’s 112,000 acres of farm land available on the NASDAQ[1]. Gladstone Land Corporation (NASDAQ: LAND) buys farm land and rents it to farmers.

I live in suburban Pennsylvania. The farms here have mostly been sold to developers. The farmers retired wealthy and the developers built houses. The most prominent developer in this neck of the woods is Toll Brothers.

LOCATION, LOCATION, LOCATION

Toll Brothers (TOL) owns or controls approximately 86,000 building lots.[2] They’re all:

“Located in affluent suburban areas near major transit hubs and highways that provide access to employment and urban centers.”[3]

Toll Brothers focuses on up-scale buyers. The average home sold in the most recent quarter sold for more than $1m. Compare that with $300k+ for the nation’s largest homebuilder – D.R. Horton.[4]

Toll is focused on:

“Luxury home buyers... buyers who generally have previously owned a home and who are seeking to buy a larger or more desirable home — the so-called “move-up” market. Our affordable luxury homes are marketed primarily to more affluent first-time buyers…

“We market to the “empty-nester” market, which we believe has strong growth …we were selling from 54 age-restricted active-adult communities, in which at least one home occupant must be at least 55 years of age… with the millennial generation in its prime family formation years, we also continue to focus on this group with our core suburban homes, affordable luxury offerings, urban condominiums and luxury rental apartment products.”

THREE REASONS I LIKE TOLL

A popular way to invest in real estate is through a Real Estate Investment Trust. I’ve looked at a few since the pandemic started. I haven’t found one that struck me as a good, long-term investment.

Still, it helps put Toll Brothers in perspective to compare it to one of the larger REITs – Equity Residential. EQR acquires and manages apartment complexes.

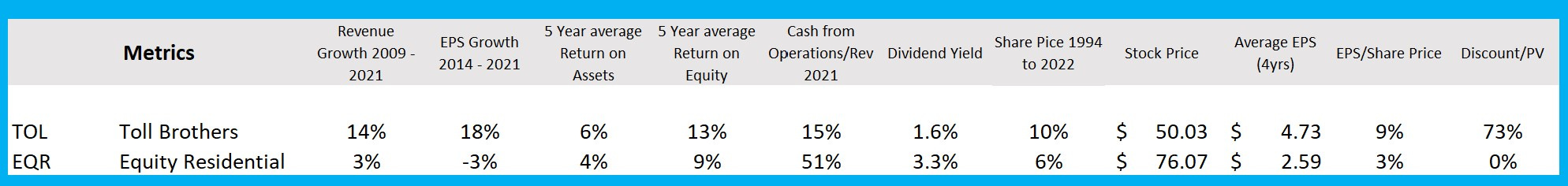

Revenue Growth: To create long term value, a business has to grow revenue. Since 2009 Toll has grown revenue at an annualized rate of 14%. Equity Residential at only 3%. And Equity Residential’s revenue is actually flat over the past five years.

Earnings Growth: Growth in earnings per share tells a similar tale. Over the last seven years, Toll has grown earnings at an 18% annual rate – Equity Residential’s average earnings per share have declined 3% annually in that same time period.

Return on Equity and Assets: Toll Brothers average return on assets and return on equity are 50% and 44% higher than Equity Residential’s.

Equity Residential has a much higher cash flow margin. And it distributes much more cash to its holders - $900m last year compared to Toll’s $76m in dividend payments. But that’s still just a 3.3% dividend yield. I’ll take the lower yielding dividend from Toll Brothers with the prospect for long term capital appreciation.

Since 1994 the share price of TOL has increased at 10% annually - compared with 6% for EQR.

Over my ten-year investment horizon Toll Brother’s combination of growth in revenue, growth in earnings, higher long-term return on equity, all projected forward, should create above market returns. While EQR is priced about where it should be, Toll Brothers is selling at a very steep discount to its current value.

Comparing a large REIT like EQR to the luxury home builder TOL is like comparing an elephant to an apple. One doesn’t tell you much about the other. I’ll keep looking at REITs. But I’ll pick Toll Brothers today.

PORTFOLIO RESULTS

Portfolio: + 13.3%

S&P 500: - 2.1%

The Weekend Stock Pick project tests a theory that, over ten years’ time, a “buy low, sell never” portfolio of stocks bought at a discount to their estimated present value will both make money on an absolute basis and outperform the S&P 500.

I’m 110 weeks in to this ten-year project.

The portfolio continues to outperform the S&P 500. And it’s making money[5].

I’m not a professional investor or financial advisor. In my day job I run a software business. I buy the stocks I write about in the portfolio with my own money. I buy (roughly) equal dollar amounts of each position.

I don’t find a stock to buy every week. I’ve made 32 purchases in the portfolio over roughly two years. I intend to stop investing in this portfolio when it has 100 individual stocks. No one stock should be more than 1% to 2% of the portfolio.

This is what the portfolio looked like when the market closed on Friday.

Thanks for reading. If you like this please share. Subscriptions are free.[6]

Or email me at: weekendstockpick@gmail.com

Check the Archives for:

Allison Schraeger, Bloomberg February 13, 2022

Alphabet April 17, 2022

Billpay.com May 15, 2022

Biogen February 6, 2022

Blackrock February 27, 2022

Blackstone February 27, 2022

Bloomberg News February 20, 2022

Boston Beer February 20, 2022

Bunge April 10, 2022

Callidus March 29, 2022

Carbon Black March 29, 2022

Coca Cola January 30, 2022

CuraLeaf April 24, 2022

DocuSign May 15, 2022

Draft Kings February 20, 2022

Draft Kings April 3, 2022

Ella Nilsen, CNN March 13, 2022

Elon Musk April 17, 2022

Eric Savitz, Barrons February 13, 2022

Expeditors March 13, 2022

FEDEX March 13, 2022

Fidelity National February 13, 2022

First American February 6, 2022

First American February 13, 2022

Goldman Sachs February 27, 2022

Google April 17, 2022

Granite Real Estate Trust January 18, 2022

Green Thumb April 24, 2022

Henry Grabar, Slate April 17, 2022

IBM January 30, 2022

Inflation January 2, 2022

Inflation January 23, 2022

Inflation January 30, 2022

Intel January 30, 2022

Jen Psaki, MSNBC April 10, 2022

Jen Psaki, MSNBC April 17, 2022

Keith Romer, Bloomberg April 3, 2022

Kinder Morgan January 8, 2022

Nutanix March 29, 2022

Phillips 66 January 2, 2022

Prudential February 6, 2022

Sangfor Technologies March 29, 2022

Silicon Valley Bank March 20, 2022

SUSE March 29, 2022

TerrAscend April 24, 2022

Trulieve February 20, 2022

Trulieve April 24, 2022

Tweedy Brown April 17, 2022

Twitter April 17, 2022

Tyson April 10, 1011

UPS March 13, 2022

Verisk April 17, 2022

Verizon January 23, 2022

Virtuozzo March 29, 2022

VMWARE March 29, 2022

Wall Street Journal April 10, 2022

Wells Fargo March 20, 2022

Western Alliance Bank March 20, 2022

Will Yakowicz, Forbes April 24, 2022

[1] https://www.sec.gov/ix?doc=/Archives/edgar/data/1495240/000149524022000004/land-20211231.htm

[2] DR Horton, the largest homebuilder, owns or controls more than 500,000 lots

[3] https://www.sec.gov/ix?doc=/Archives/edgar/data/794170/000079417021000079/tol-20211031.htm

[4] https://seekingalpha.com/article/4503573-d-r-horton-inc-dhi-ceo-david-auld-on-q2-2022-results-earnings-call-transcript

[5] For convenience, I update the dividends collected once a quarter. So, these results reflect only dividends collected through 3/31/22. The portfolio’s dividend yield is a percent or two higher than the yield on the S&P 500 – so there’s that too.

[6] Btw, Frank Lee Wright is a Pen Name