This Weekend: Why I Finally Bought Apple

This week's results: Weekend Newsletter + 10.3% - Stock Market + 3.2%

I bought Apple this week.

Here’s the back story.

A long time ago, not too long after Apple went public, my wife wanted to buy the stock.

She was a graphic artist. She loved her Macintosh personal computer.

Patiently, I explained[1] to her how the personal computer business worked. It was a volume business you see. A business of scale. And no one was doing that better than Gateway Computers. I had to explain this a few times, if I recall, before she realized how right I was.

We (me) invested in Gateway.

Never one to admit a mistake I ignored Apple for a long time.

What’s On Sale?

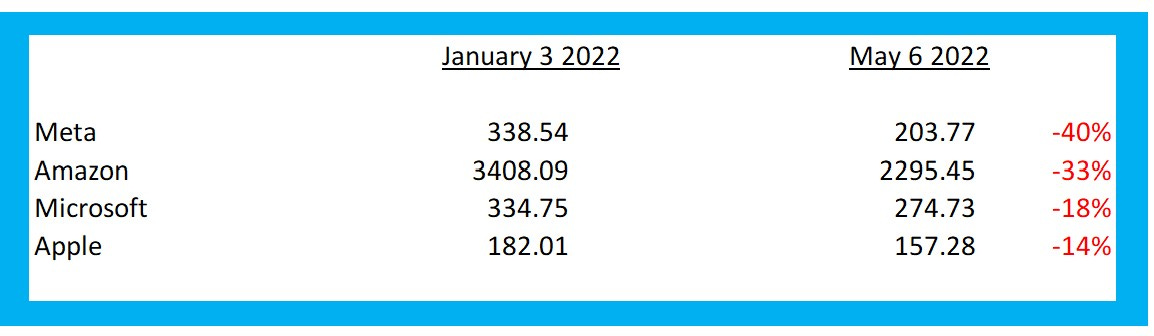

The market has had some days with big drops lately. With prices down, last week seemed to be a good time to look at MAMA.

Meta, Amazon, Microsoft and Apple

All four are down since the beginning of this year.

I don’t like Facebook no matter what Zuckerberg calls it. Meta is out, at least for now.

Amazon is complicated. Amazon Web Services is great. Amazon Streaming? I watch it. I don’t think I pay for it. Amazon.com? I use it all the time but I can’t imagine the margins. Whole Foods? Who knows? And who’s running the place now? Bezos has a new girlfriend and a rocket ship company. But not a cool rocket ship company like the one Elon Musk has. I’m too busy this week to try to untangle it all.

I spent my time this week on Microsoft and Apple.

I like them both.

Microsoft and Apple

Microsoft: Cash. $104b in cash and short term investments vs only $1.7 b in current debt.

Microsoft Cloud; now more than 1/3 of all revenue. Cloud revenue grew 27% in the 9 months ending 3/31/22[3]. Within that, Azure is growing even faster.[4]

Great geographical diversification: about half of revenue comes from outside the United States.

Apple: Well, there’s my iPhone, my iPad, my Apple Watch, countless Apple charges on my credit card for services that my kids bought. But what caught my eye was this in the latest earnings call:[5]

For Mac, revenue of $10.4 billion was a March quarter record despite supply constraints with 15% year-over-year growth, driven by strong demand for our M1-powered MacBook Pro… continued innovation and investment in Apple Silicon has clearly shown in our Mac results as the last seven quarters have been the best seven quarter ever for Mac.

The personal computer business is stale. Apple seems to have seen an opportunity to invest in that side of their business and create something new.[6] Apple Silicon gives Apple a proprietary processor and ends the reliance on Intel’s architecture. They can do a lot with that across all their product lines.

By the Numbers

Both Microsoft and Apple grow revenue well above the historical 3 1/5% average annual rate for companies in the S&P 500.[7] Microsoft’s growth rate in the last five years -13% - is above it’s overall 9% growth rate since 2009. Accelerating revenue growth in a company of that scale is remarkable.

Both Microsoft and Apple are improving their gross margins. Apple gets the nod here with a 10% improvement in the last three years.

Both have strong records of profitability ~ the 5 year average returns on assets and return on equity is a measure of this.

Microsoft is a cash machine. Cash from operations equaled 46% of revenue in 2021. It has been 40% of revenue, or better, since 2017. During that period cash from operations has been growing at an 18% annual rate.

Apple too creates cash. Cash from Operations has grown 13% annually since 2017. And Cash from Operations, as a percentage of revenue, has been in the 22% to 30% range every year during that period.

Apple has spent about $70b a year over the last 3 years buying back its stock. It’s paid out just $14b a year in dividends. Microsoft’s approach is more balanced and better for long term investors. It spent about $21b a year on buy backs and paid out $18b in dividends.

These are both great companies. Microsoft is a business-to-business powerhouse. Apple is the preeminent consumer electronics product company.

Despite the decline in share price since January neither are cheap. They are just a little less expensive than they were at the beginning of the year.

I bought Apple last week. I might buy Microsoft next week. If the prices continue to drop, I’ll buy more.

That doesn’t look like much of a strategy. But that’s all I got this week.

Results: So Far, So Good

10.3% for my newsletter

3.2% for S&P 500

This column started in April of 2020 as a COVID project.

The project tests a theory that, over a ten-year period, a “buy low, sell never” portfolio of stocks bought at a discount to their estimated present value will both make money on an absolute basis and outperform the S&P 500.

The project is set up to mimic the way a lot of individuals invest. I make periodic, roughly equal investments, usually once or twice a month, into stocks that seem undervalued.

I compare the results against a model “Dollar Cost Averaging” style portfolio that consists of shares in the SPDR ETF: SPY that I could have bought had I instead invested an equal amount of money in SPY on the day I bought the stock.

I’m not a professional investor. I buy these stocks with my own money and plan to hold them for ten years.

To keep things honest, I print the portfolio[8] each week.

As of this weekend the portfolio has an annualized rate of return of 10.3% vs a 3.2% return on the fictional portfolio of shares of SPY.

15 of the 28 individual investments have done better than SPY. These by an average of 14%. In 13 instances I’m worse off than I would have been had I simply purchased the ETF; by an average of 9%.

Dividends (through 3/31) juice the return a little bit. They yield, on average, 2.5% vs 1.3% for SPY.

If you like the newsletter please share it. Feel free to comment.

Thanks!

Or email me at: weekendstockpick@gmail.com

Check the Archives for:

Allison Schraeger, Bloomberg February 13, 2022

Alphabet April 17, 2022

Biogen February 6, 2022

Blackrock February 27, 2022

Blackstone February 27, 2022

Bloomberg News February 20, 2022

Boston Beer February 20, 2022

Bunge April 10, 2022

Callidus March 29, 2022

Carbon Black March 29, 2022

Coca Cola January 30, 2022

CuraLeaf April 24, 2022

Draft Kings February 20, 2022

Draft Kings April 3, 2022

Ella Nilsen, CNN March 13, 2022

Elon Musk April 17, 2022

Eric Savitz, Barrons February 13, 2022

Expeditors March 13, 2022

FEDEX March 13, 2022

Fidelity National February 13, 2022

First American February 6, 2022

First American February 13, 2022

Goldman Sachs February 27, 2022

Google April 17, 2022

Granite Real Estate Trust January 18, 2022

Green Thumb April 24, 2022

Henry Grabar, Slate April 17, 2022

IBM January 30, 2022

Inflation January 2, 2022

Inflation January 23, 2022

Inflation January 30, 2022

Intel January 30, 2022

Jen Psaki, MSNBC April 10, 2022

Jen Psaki, MSNBC April 17, 2022

Keith Romer, Bloomberg April 3, 2022

Kinder Morgan January 8, 2022

Nutanix March 29, 2022

Phillips 66 January 2, 2022

Prudential February 6, 2022

Sangfor Technologies March 29, 2022

Silicon Valley Bank March 20, 2022

SUSE March 29, 2022

TerrAscend April 24, 2022

Trulieve February 20, 2022

Trulieve April 24, 2022

Tweedy Brown April 17, 2022

Twitter April 17, 2022

Tyson April 10, 1011

UPS March 13, 2022

Verisk April 17, 2022

Verizon January 23, 2022

Virtuozzo March 29, 2022

VMWARE March 29, 2022

Wall Street Journal April 10, 2022

Wells Fargo March 20, 2022

Western Alliance Bank March 20, 2022

Will Yakowicz, Forbes April 24, 2022

[1] I was, per Merriam Webster, ahead of my time. “mansplaining” was not yet a thing, or at least there was a word for such a thing; https://www.merriam-webster.com/dictionary/mansplain

[2] Sorry; had to really stretch to work in that little play on words

[3] https://www.sec.gov/ix?doc=/Archives/edgar/data/789019/000156459022015675/msft-10q_20220331.htm

[4] https://www.fool.com/earnings/call-transcripts/2022/04/26/microsoft-msft-q3-2022-earnings-call-transcript/

[5] https://seekingalpha.com/article/4504834-apple-inc-aapl-ceo-tim-cook-on-q2-2022-results-earnings-call-transcript

[6] https://9to5mac.com/2021/11/10/comment-1-year-after-the-m1-chip-apple-has-really-changed-the-computer-industry-once-again/

[7] https://www.multpl.com/s-p-500-sales-growth/table/by-year

[8] The chart shows: the individual stocks that I bought (Column A); the dividend yield (Column B); the purchase date (Column C); and price I paid (Column D); the price when the market closed on Friday (Column E) and the paper gain/loss (Column F)[8]. Column G shows the closing price of the SPDR Trust SPY on the Purchase Date and the theoretical gain/loss had I invested in SPY on that date. SPY closed at $412 a share on Friday. SPY closed at 411.34 last Friday.