I could not find bliss in the stock market this week.

But who cares? For those who celebrate[1] this was 4/20 week.

Dudes, this is my weekend to slouch on the couch with a giant bag of Spicy Sweet Chili Doritos, my sister in-law’s neighbor’s Netflix password, a little OG Kush Hybrid Strain[2] and scribble my thoughts about the future of the cannabis business in the United States. Here it goes.

There’s No Blockbuster Yet

The legal cannabis market in the United States is growing rapidly. States are licensing sales of both “medical marijuana” and recreational marijuana.

Most of the trade is still done by unlicensed vendors (once shamed as “drug dealers” and “pushers” now: ‘they/them’.)

Still, as Will Yakowicz writes in Forbes, legal sales in 2020 were $17.5b – a 46% increase from the previous year.[3]

“Legalization isn’t like turning on a switch…It’s ongoing and people become more comfortable with it as the market matures.

The bulk of the cannabis industry is still in the black market. Illicit cannabis sales are estimated to be more than $100 billion each year. The legal industry is catching up, albeit slowly. By 2026… the legal U.S. cannabis market will reach $41 billion in annual sales, roughly the size of the craft beer industry.[4]

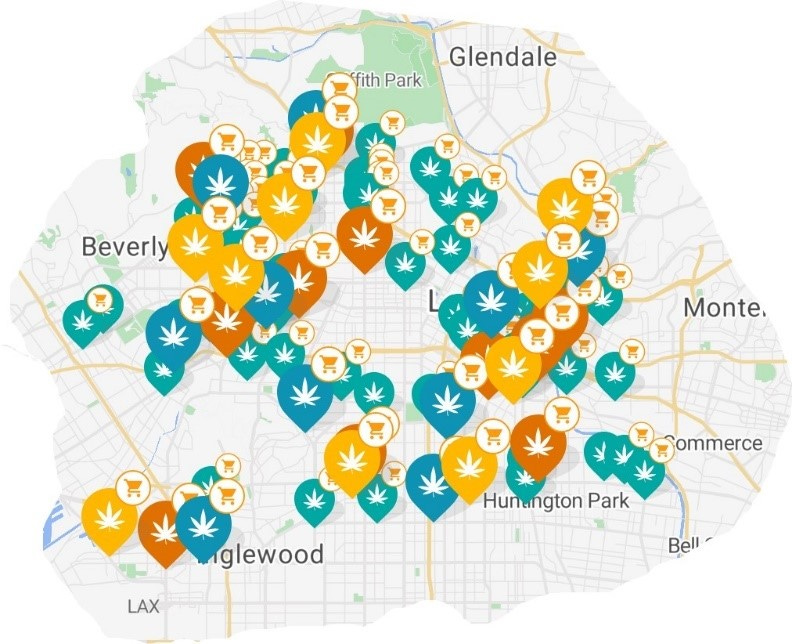

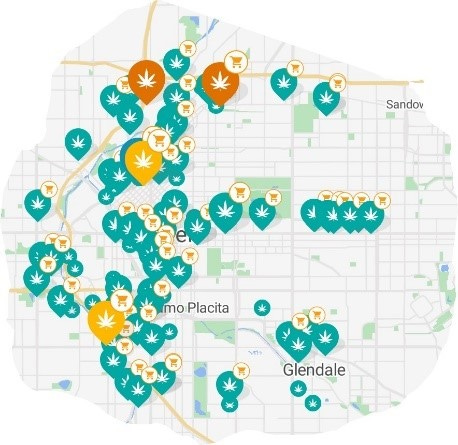

Among other things, it's a retail business. As the Weedmaps[5] show, in areas like Denver or Los Angeles, where the trade is long established, you can find a pot store on almost every corner.

This reminds me of the early days of the video tape rental business. There was a store on every other street. Before Blockbuster.

Now, as there was then, there will be a great consolidation.

Or maybe I should say that a lot of these businesses will get “rolled up”.

It Ain’t Easy Being Green

Rapid market growth provides any business with a lot of room for error. Cannabis companies will need all of that.

The U.S. cannabis business is uniquely difficult. There are reasons for that.

The interstate transportation of cannabis is still illegal in the United States.

Because they can’t move product between states, the larger companies operate retail, wholesale, farming and manufacturing businesses in each state in which they operate.

That’s hard in any industry.

There are additional challenges unique to cannabis. Green Thumb’s annual report[6] lists some:

“Limitations on ownership of cannabis licenses.

OK, that’s easy to understand. Licensing is a barrier to entry for new players and an incentive for large companies to acquire small firms who hold licenses.

“We may become subject to Food and Drug Administration…It is possible that the FDA would seek to regulate cannabis under the Food, Drug and Cosmetics Act of 1938. Clinical trials may be needed to verify the efficacy and safety of cannabis.

I had never thought of that one. But given the government’s penchant for regulation – it’s not impossible.

“Cannabis businesses are subject to applicable anti-money laundering laws and regulations and have restricted access to banking and other financial services.

I knew about this one. But I didn’t connect the dots. That also means:

“Dividend distributions…. may be viewed as proceeds from a crime…this may restrict our ability to declare or pay dividends or effect other distributions.”

Even the businesses that succeed tremendously on the state level may never pay a dividend?

“We operate in a highly regulated sector and may not always succeed in complying fully with applicable regulatory requirements in all jurisdictions

Regulations are state specific. This will favor companies (like Trulieve) that achieve scale in a single, large state before scaling operations in other states. Conversely, it will be difficult and expensive for smaller multi-state operators to comply. Another thing to tip the scale in favor of the large consolidators.

“We will not be able to register any federal trademarks for our cannabis products”

The investments made in branding on the retail side of the business have no trademark protection. That could be rough.

“Cannabis businesses are subject to unfavorable tax treatment.

Not sure what that means. But the feds got Al Capone on taxes.

“We face exposure to fraudulent or illegal activity…we face exposure to the risk that employees… may engage in … illegal activities”

Like, you know, selling marijuana.

Investors don’t get extra points for degree of difficulty – even with booming revenue keep in mind that these are hard businesses to operate.

Short Tokes Takes

The public cannabis companies with U.S operations mostly trade over the counter in the U.S with listings in Canada. The ones that have grown large are using their access to cash (from private placements), credit and their equity to be active acquirers. Here’s a quick look at three of the bigger ones.

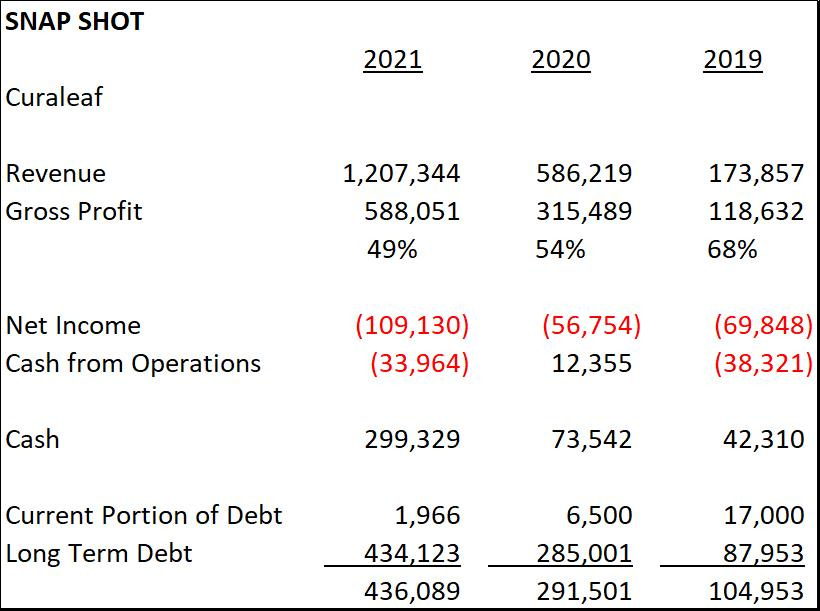

Curaleaf (CURLF)

Curaleaf is interesting, to me at least, as an example of the important advantage large companies have over small companies when borrowing money.

One of the largest operators, and one of the fastest growing, Curaleaf secured $425m in debt financing in December of 2021.

The five-year note was priced at 8%[7].

MJBizDaily has an interesting description of the role debt is playing in the consolidation of the cannabis industry.[8]

Larger companies, like Curaleaf and Trulieve, are able to borrow at something like market rates. Smaller companies are paying much more - as much as 20% - and have access to less debt.

Access to this debt gives big companies like Curaleaf more cash they can use to acquire small companies.

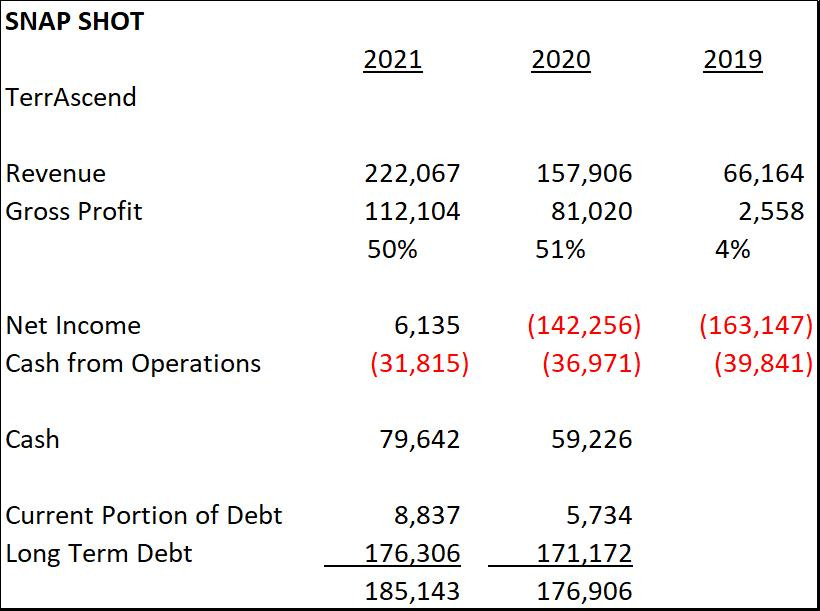

TerrAscend (TRSSF)

TerrAscend used a combination of cash, stock, notes and earn outs to acquire a large position in the U.S. market: Grander Assets; Apothecarium; Illera; State Flower; HMS; Keystone Canna Remedies; and most recently Gage.

They bought Gage from an entity controlled by TerrAscend’s Chairman, Jason Wild.[9]

“On March 10, 2022, the Company closed its… acquisition of Gage… Gage shareholders received 51,349,978 Common Shares and an additional 25,811,460 of Common Shares are reserved for issuance in… exchange of former Gage convertible securities…Total consideration was approximately $386 million

“Jason Wild and his respective affiliates received 10,467,229 of the Company’s common shares in exchange for their Gage subordinate voting shares… and 7,129,517 of the Company’s warrants in exchange for their Gage warrants

Likely this is all on the up and up. But one thing to keep in mind when looking at these immature companies is that corporate governance is still, well, a little bit hazy.

TerrAscend revenue is growing quickly, as it does in any M&A fueled company. But low margins, no cash flow, and a leveraged balance sheet means it’s time to tighten up operations.

The company recently hired Ziad Ghanem as President and Chief Operating Officer.

Ghanem was President of Parallel, a large venture backed multi-state cannabis business

https://www.liveparallel.com/about

Ghanem has a lot of experience in retail. Prior to Parallel, he spent 16 years at Walgreens where he ultimately became the Senior Director of Global Pharmacy Development.

Presumably, TerrAscend have hired an operator.

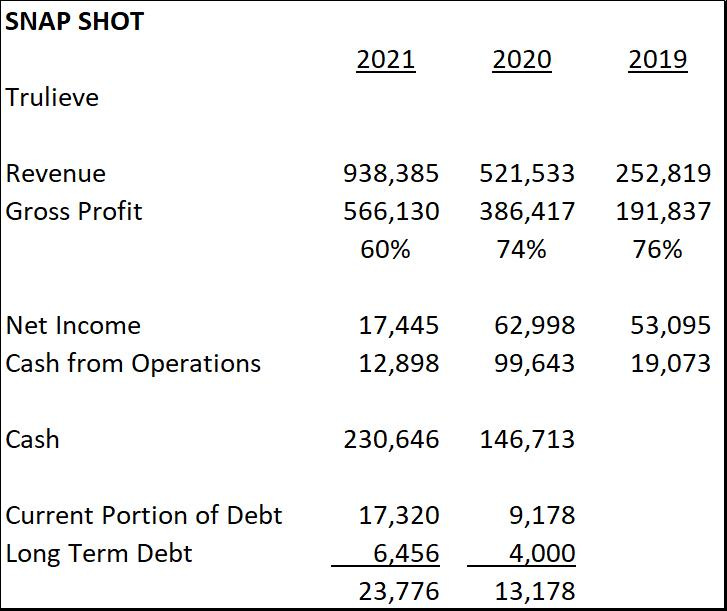

Trulieve (TCNNF)

I wrote favorably about and bought Trulieve in February.

Trulieve has maintained decent margins, generates cash from operations and has a low level of debt.

113 of its 162 stores are in Florida. It built scale in a single large state and is expanding from there outward.

I like all that.

The last annual report hinted at some routine growing pains[10]:

“Management concluded that our internal controls…were not effective… the Company did not maintain a sufficient complement of personnel with the appropriate level of knowledge… in certain areas important to financial reporting… it was determined <also> that the… controls over information technology systems were not effectively designed or implemented.

There’s a lot of grumbling from the stores:[11]

“9/20/21 Patient Consultant: They are more focused on opening more stores than they are on keeping their stores stocked… I'm surprised the business is doing so well given their practices.

“2/13/2022 Delivery Manager: Little to no training… training degrades more through every hiring cycle. Huge breakdown of communication…They have expanded faster than they could keep up with, spreading themselves too thin to keep up with patient demand and employee needs. Multiple HR issues, and the CEO and her husband are under investigation.

This is never good. The CEO’s husband was tried[12] and convicted[13] following an FBI bribery investigation.

And reporting on the trial includes this nugget:

“Burnette <the husband> was recorded as saying that neither he nor Rivers <the CEO> knew much about the medical cannabis business

It is likely that the company has reached a size where it needs to bring in professional management.

The stock is down 15% since I bought it. I’m not ‘buying the dip’ on this one.

My Take

Cannabis is a fast-growing business in the United States. A very fast growing, very difficult business being consolidated by very immature, highly leveraged companies with inexperienced management teams.

The consolidation will take some time. Winners will emerge. Losers will flame out.

I can’t smoke out the winner. So, I’ll sit back, chill, read Weedweek, and watch to see what happens next.

Weekend Stock Pick Results So Far

For the period April 20, 2020 through April 21, 2022 the annualized rate of return for the stocks I recommended and bought for this newsletter is 14.3%.

This compares favorably to a return of 9.8% on the S&P 500 over the same time period.

This newsletter and the Weekend Portfolio is a personal project.

The project tests a theory that, over the ten-year period that began in April of 2020, a “buy low, sell never” portfolio of individual stocks bought at a steep discount to their estimated present value will outperform the S&P 500 ETF SPY.

I’m two years in and so far so good.

Stay tuned for another eight years if you want to see how this all turns out.

If you like the newsletter please share it. Feel free to comment.

Thanks!

In the Archive

Allison Schraeger, Bloomberg February 13, 2022

Alphabet April 17, 2022

Biogen February 6, 2022

Blackrock February 27, 2022

Blackstone February 27, 2022

Bloomberg News February 20, 2022

Boston Beer February 20, 2022

Bunge April 10, 2022

Callidus March 29, 2022

Carbon Black March 29, 2022

Coca Cola January 30, 2022

Draft Kings February 20, 2022

Draft Kings April 3, 2022

Ella Nilsen, CNN March 13, 2022

Elon Musk April 17, 2022

Eric Savitz, Barrons February 13, 2022

Expeditors March 13, 2022

FEDEX March 13, 2022

Fidelity National February 13, 2022

First American February 6, 2022

First American February 13, 2022

Goldman Sachs February 27, 2022

Google April 17, 2022

Granite Real Estate Trust January 18, 2022

Henry Grabar, Slate April 17, 2022

IBM January 30, 2022

Inflation January 2, 2022

Inflation January 23, 2022

Inflation January 30, 2022

Intel January 30, 2022

Jen Psaki, MSNBC April 10, 2022

Jen Psaki, MSNBC April 17, 2022

Keith Romer, Bloomberg April 3, 2022

Kinder Morgan January 8, 2022

Nutanix March 29, 2022

Phillips 66 January 2, 2022

Prudential February 6, 2022

Sangfor Technologies March 29, 2022

Silicon Valley Bank March 20, 2022

SUSE March 29, 2022

Trulieve February 20, 2022

Tweedy Brown April 17, 2022

Twitter April 17, 2022

Tyson April 10, 1011

UPS March 13, 2022

Verisk April 17, 2022

Verizon January 23, 2022

Virtuozzo March 29, 2022

VMWARE March 29, 2022

Wall Street Journal April 10, 2022

Wells Fargo March 20, 2022

Western Alliance Bank March 20, 2022

[1] https://www.nbcnews.com/video/san-francisco-4-20-celebration-draws-thousands-138194501722

[2] https://www.wikileaf.com/strain/og-kush/

[3] https://www.forbes.com/sites/willyakowicz/2021/03/03/us-cannabis-sales-hit-record-175-billion-as-americans-consume-more-marijuana-than-ever-before/?sh=75e61b2d2bcf

[4] https://www.forbes.com/sites/willyakowicz/2021/03/03/us-cannabis-sales-hit-record-175-billion-as-americans-consume-more-marijuana-than-ever-before/?sh=75e61b2d2bcf

[5] https://weedmaps.com/dispensaries/

[6] https://www.sec.gov/ix?doc=/Archives/edgar/data/1795139/000095017022002469/gtbif-20211231.htm

[7] https://www.weedweek.com/stories/curaleaf-reaches-new-heights-in-debt-financing/

[8] https://mjbizdaily.com/how-curaleaf-deal-could-shape-marijuana-debt-financing/?utm_source=pocket_mylist

[9] https://www.sec.gov/Archives/edgar/data/1778129/000110465922037574/tm2210360d1_10ka.htm

[10] https://www.sec.gov/ix?doc=/Archives/edgar/data/1754195/000095017022004989/tcnnf-20211231.htm

[11] https://www.glassdoor.com/Reviews/Trulieve-Reviews-E1833236.htm

[12] https://mjbizdaily.com/bribery-trial-husband-of-trulieve-ceo-bragged-about-medical-cannabis-influence/

[13] https://www.weedweek.com/stories/trulieve-ceos-husband-convicted/