Silicon Valley Bank

The Federal Reserve’s actions this week certainly piqued my interest in some bank stocks.[1]

Business to business banks have captive deposits. The terms of most commercial loans require the borrower to keep all cash on deposit at the lending bank.

As interest rates rise, commercial lenders can raise the rate of interest charged on loans much faster than they raise the rate of interest they pay their clients on deposits. Barring a recession – that should be good for some banks.

There are two banks I like a lot. Silicon Valley Bank (“SVB” for short) and Western Alliance Bank. Both focus on niche markets.

Silicon Valley Bank (SVB) is the go-to bank for venture capital backed start-ups and technology focused growth firms. SVB banks what they call “the innovation economy.” For more than forty years Silicon Valley Bank served entrepreneurs and businesses throughout their life cycles, first in the technology, private equity and the venture capital sectors. More recently they have built a presence in life science and healthcare.

They also serve the premium wine industry. Why? Because they are in California and that’s cool.

Most of the bank’s earnings come from interest income: the interest rate spread between interest charged on loans (and the interest SVB earns by investing clients’ deposits) and the interest rates the bank pays to clients on deposits.

As interest rates rise the spread between what SVB charges clients and what it pays clients will widen. Good for SVB!

Silicon Valley Bank also earns noninterest income from fee-based services like foreign exchange fees, credit card fees, deposit service charges, and lots of lending related fees. SVB has pricing power in all of these services. Clients don’t shop around. They are often required by their loan agreements to use the bank for these services.

But wait! There’s more! In addition to earning interest on loans to private companies the bank often takes low-cost warrants[2] to buy the client’s stock.

On the most recent earnings call Dan Beck, SVB’s Chief Financial Officer, said that the company has warrants to purchase stock in approximately 3,000 companies.[3] When those companies go public or are sold SVB will earn significant profits.

Western Alliance Bank

Western Alliance Bank (WAL) is a regional bank headquartered in Phoenix. In 2015 it acquired Bridge Bank, a small technology focused bank in San Jose, California. That put WAL into direct competition with Silicon Valley Bank in the tech sector.

Western Alliance claims a focus on niche banking. In recent earnings call they declared a “national commercial business strategy… to develop niche specialty banking business(es) and to … scale new business lines with superior risk adjusted returns.”[4]

The Annual Report[5] describes three segments:

Commercial segment: commercial banking and treasury management products and services to small and middle-market businesses, specialized banking services to sophisticated commercial institutions and investors within niche industries, as well as financial services to the real estate industry.

Consumer Related segment: offers consumer banking services, such as residential mortgage banking, and commercial banking services to enterprises in consumer-related sectors.

Corporate & Other segment: consists of the Company's investment portfolio, corporate borrowings and other related items, income and expense items not allocated to our other reportable segments, and inter-segment eliminations.

It’s a bit of a Hodge Podge.

How good are these two banks? Just for fun, let’s compare Silicon Valley Bank and Western Alliance Bank with a well known, Too Big to Fail, generic bank: Wells Fargo.

As you’ve heard a thousand times “Past performance is not indicative of future results…”

Also true, to quote the Bard, is that “what’s past is prologue”. The prologue to this banking story is that from 12/31/09 to 12/31/21 Wells Fargo, aka Big Generic Bank, increased its stock price from $27 a share to $30. In the same period of time Western Alliance stock price has grown from $4 to $108 while SVB’s share price has increased from $42 to $570.

Price to Book Value[6] is sometimes used as a measure of value. “Value investors…look for a company where the market value is less than its book value hoping that the market is wrong in its valuation.”

The market has this one right. Wells Fargo’s price/book ratio of 1 seems generous. And Western Alliance and SVB are worth 2X book value because they have performed well.

One measure of this is return on assets. Banks have a lot of assets. The rate of return on assets[7] is an important indicator of bank performance. On average, over the past five years, both SVB and Western Alliance have had nearly double the return on assets of the much larger Wells Fargo. Return on equity[8] over the past five years tells a similar story. On average, SVB and Western Alliance have posted double the return on equity of the 90+ year old Wells Fargo.

There’s another metric important in banking. On the income statement banks break out non-interest expense.

Non-interest expense is all the overhead. It’s compensation, rents, advertising, travel.

Keeping overhead low is important for banks. Calculating that non-interest expense as a % of revenue gives you a good idea of how efficient the bank’s management is.

By this measure, Western Alliance is the best of three. It spends 41% of revenue on overhead. SVB is second. And, of course, Wells Fargo brings up the rear spending a bloated 65% of revenue on overhead.

So where does all that take us?

Annual revenue growth since 2009 was 15% at Western Alliance and 23% at SVB.

Earnings grew annually at 30% at WAL and 27% at SVB during that same time period. Wells Fargo somehow managed to engineer[9] 6% growth from its flat revenue.

Sadly, none of the three has much of a dividend story. SVB pays none. WAL has only recently started paying a dividend. And Wells Fargo’s dividend growth is a paltry 5%.

I like both Western Alliance and SVB. Both are very attractive at the current price. I’ll go with the larger and more focused SVB Financial Group (Nasdaq: SIVB) for my Weekly Stock Pick.

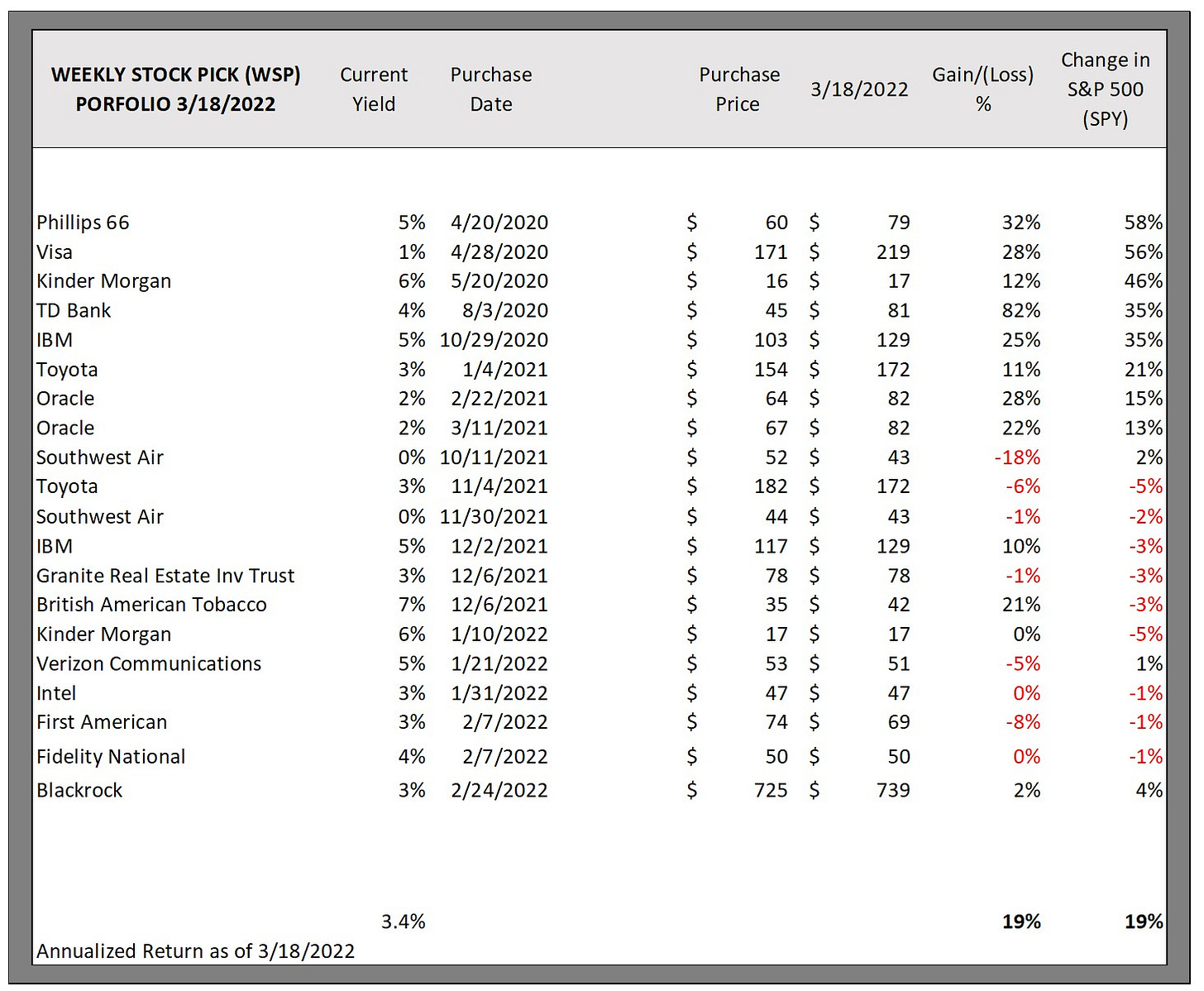

2) Weekly Stock Pick Portfolio as of 3/18/2022

The Weekly Stock Pick newsletter is a personal project.

The project tests a theory that, over the ten-year period that began in April of 2020, a “buy low - sell never” portfolio of individual stocks bought at a steep discount to their estimated present value will outperform the S&P 500 index. I use the Spider ETF SPY as a convenient proxy for the S&P 500.

I’m not a professional advisor – I buy these stocks with my own money. To keep things honest, I print the portfolio each week. 100 weeks into this 520-week project the portfolio looks like this vs the ETF SPY:

Annualized return includes dividends received through 12/31/2021.

If you like the newsletter please share. Subscriptions are free.

Thanks!

[1] If I take the right things into account, I can find a stock that lets me vault to the to top. With the right pick I can make bank. Cheque back in a few years to see how this worked out.

[2] https://flowcap.com/warrants-in-venture-debt/

[3] https://www.fool.com/earnings/call-transcripts/2022/01/21/svb-financial-group-sivb-q4-2021-earnings-call-tra/

[4] https://www.fool.com/earnings/call-transcripts/2022/01/29/western-alliance-bancorp-wal-q4-2021-earnings-call/

[5] https://www.sec.gov/ix?doc=/Archives/edgar/data/1212545/000121254522000090/wal-20211231.htm#i211f0c186cde486282a846cb5b55a381_76

[6] https://www.investopedia.com/ask/answers/how-are-book-value-and-market-value-different/

[7] https://www.investopedia.com/ask/answers/031215/what-formula-calculating-return-assets-roa.asp

[8] https://www.investopedia.com/terms/r/returnonequity.asp

[9] Here’s one way to do that: https://www.nbcnews.com/news/all/wells-fargo-pay-3-billion-over-fake-account-scandal-n1140541