Risk On, Risk Off: Verisk (Nasdaq: VRSK)

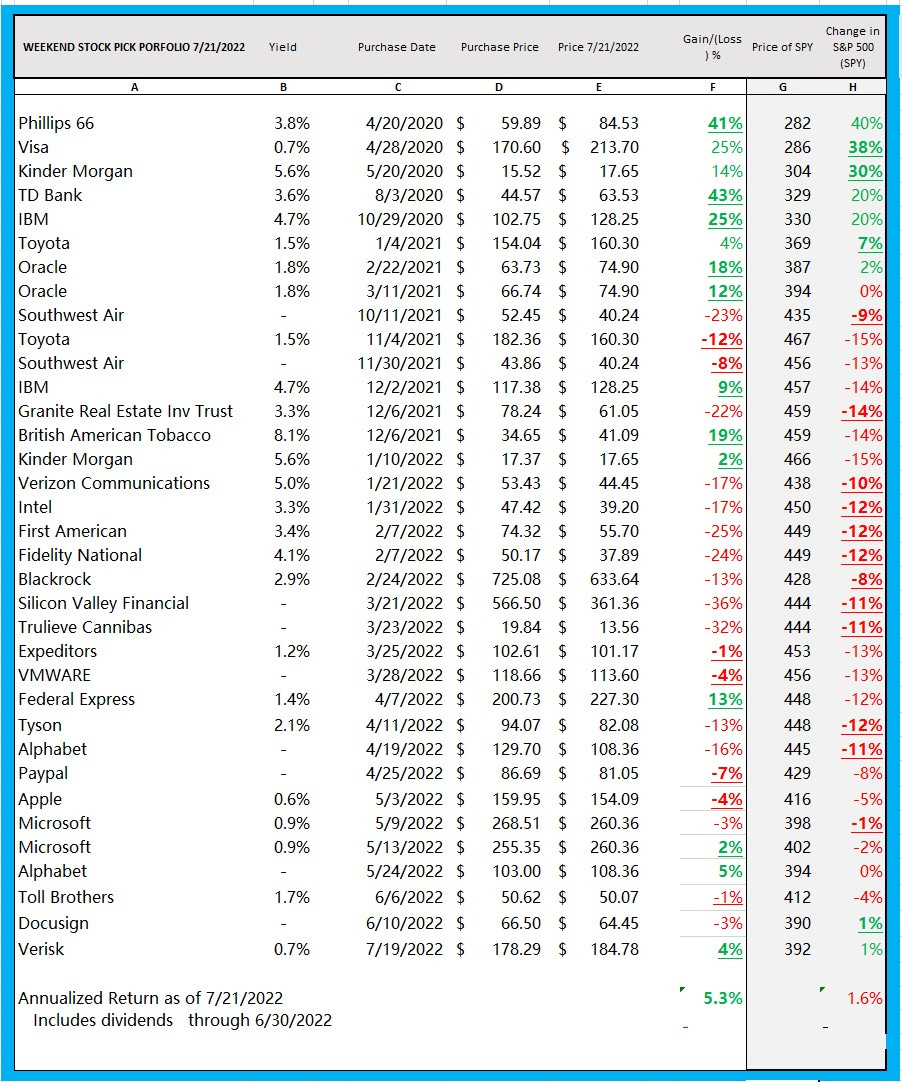

An Amazon ecosystem? Psychology of an individual investor. Results 4/20/2020 to 7/21/22 - UP +5.3%;

72 miles from New York City, when driving west on the Pennsylvania Turnpike in the morning, if the sky is clear and the sun is still low, a decent car radio can pick up WBBR 1130 AM Bloomberg News Radio.

I listen on those mornings. I want to hear the co-host of Bloomberg Surveillance, Tom Keene[1], wax eloquent before the opening bell.

And, as surely as the sun is rising behind me, somewhere before Exit 339 he will describe the day as “Risk On” or “Risk Off.”

I don’t recall if last Monday was a Risk On or a Risk Off day.

Either way, Tom Keene got me thinking again about Verisk.

NASDAQ: VRSK

I was writing about monopolies back on April 17th. I liked Alphabet’s functional monopoly of the search space. I bought GOOG.

I wrote about Twitter’s monopoly on Tweets. That seemed akin to having a monopoly on noise. I passed on that one.

I wrote about Verisk, which has a near monopoly on the information used to run property and casualty insurance companies in the US.

I liked the business but thought the price, $213 a share in April, was rich. The stock had dropped to a more reasonable $176 a share on Monday.

RECAP of Verisk

Property and Casualty Insurance is nearly a commodity. Companies compete around the margins through service and pricing. They spend heavily on advertising and agents to attract customers. Switching costs are low as customers can change companies easily to save a few dollars a month on premiums.

To make any money in the business an insurance company needs to be very good at predicting and controlling the cost of claims.

Getting that right requires a lot of data. Far more data than any one insurance company can collect on its own.

Verisk is the company that collects data from all the property and casualty insurance companies, sorts and indexes it, and sells it back to them.

Verisk started as a non-profit association owned by the insurance industry. It went public in 2009. It’s expanded into the energy data business but 74% of revenue still comes from the insurance segment in which it has limited competition.

For more read here:

Verisk owns most of the data needed to operate a property and casualty insurance company in the United States. Each of the top 100 Property and Casualty Insurance Companies in the United States is a customer of Verisk.

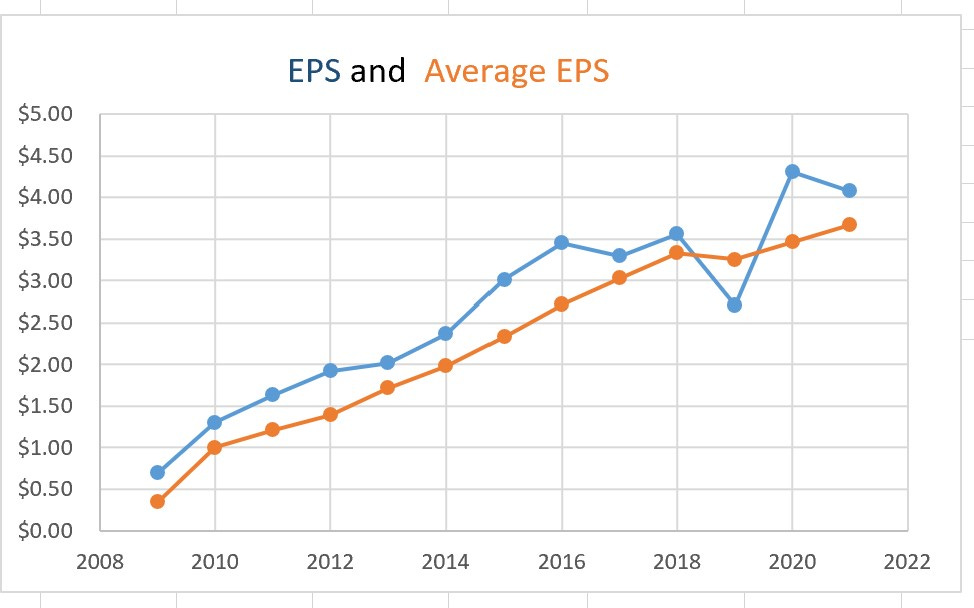

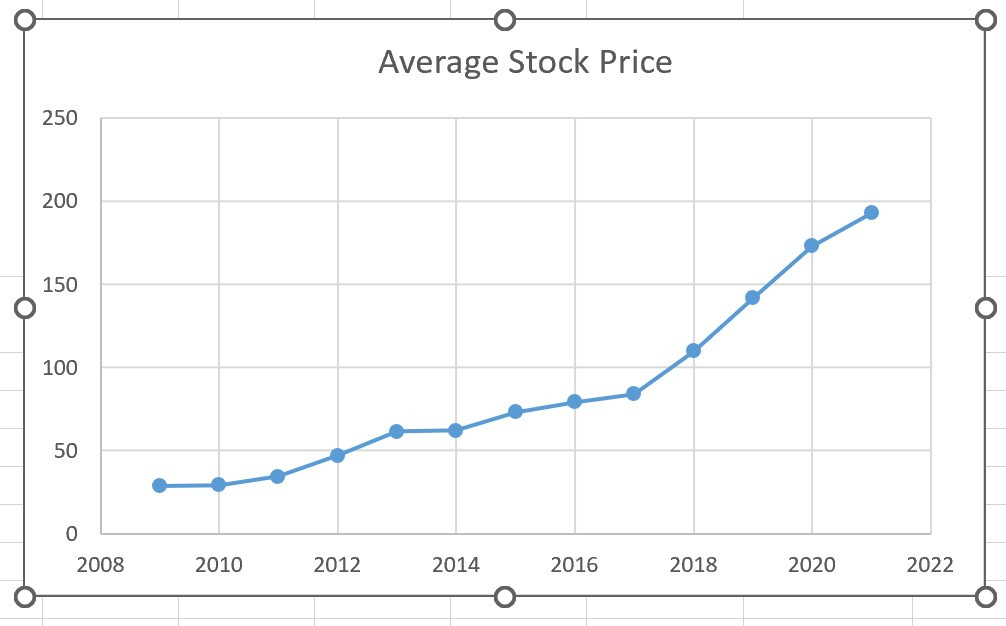

It’s a nice business. Take data from your customers and sell it back to them. Since going public in 2009 Verisk has grown revenue at an average annual rate of 9%. In that same time, it has grown earnings per share from $.70 a share to $4.48 a share. Verisk has had only one unprofitable quarter, that in 2009, the year it went public.

The stock was down 3% in 2014. In every other year since 2009 it has gained no less than 6%. The share price grew from $27 a share in 2009 to $221 at the beginning of this year before dropping to $185 today.

BALANCE SHEET

The company spends heavily on acquisitions, capital improvements, dividends and stock buy backs.

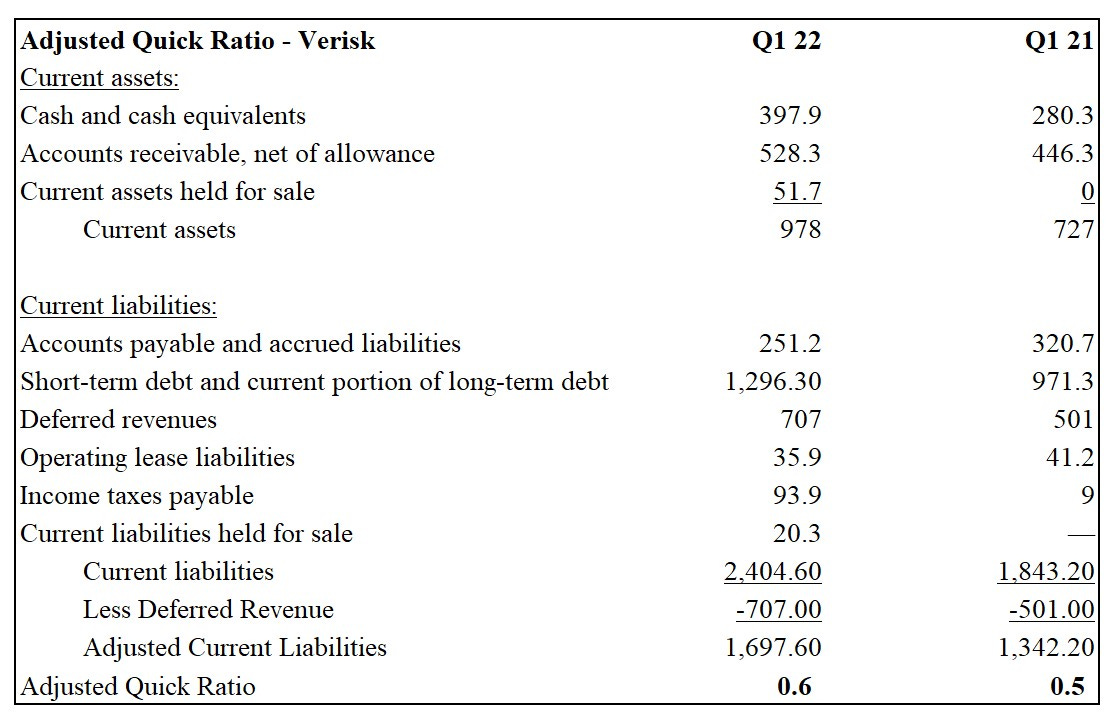

When I wrote about Verisk in April I didn’t like the Balance Sheet. Verisk had $280m in cash and a combined $971m in short term and current debt.

Since then, Verisk received $575m in cash from the sale of 3E, a non-core energy information business, to New Mountain Capital. However, Verisk also spent $445m in cash on acquisitions in Q1.

The sale of its financial services business to Transunion for $515m in cash has been announced and was expected to close in April of this year. Maybe that will improve the balance sheet. It still looks a little weak to me.

3/31 Balance Sheet Items[3]

Debt aside, there’s some things to like. Deferred revenue is up $206m (41%) from the same period last year. To the extent that this shows up later in the year in increased subscription revenue it bodes well.

Verisk at $178.29

I bought Verisk last Tuesday for $178.29. That’s a still rich 31X the 2022 estimated EPS ($5.70)[4] and above the median multiple (29X) at which the stock has traded since 2010.

It’s about a 28% discount from my estimate of the present value.

Like everything else in this portfolio – we’ll see how smart this looks in about ten years.

An Amazon Ecosystem?

One of my many, many[5] investing regrets is missing the transformation of Apple from personal computer manufacturer to Lord Master of the Apple Ecosystem.

I was reminded of that when I saw that Amazon bought One Medical last week. Is Amazon trying for a brick and mortar ‘ecosystem’ play? If it is, I think it made two big, bad choices. One was Whole Foods. Now it’s One Medical.

Amazon is an operationally excellent enterprise. It’s sort of the FedEx of retail. It’s not obvious how that culture of operational excellence can be applied to selling groceries or providing health care.

It sure is an interesting story to follow though.

Psychology of Investing:

This is the 28th month of a 120-month project.

The project tests a theory that, over ten years’ time, I can build a “buy low, sell never” portfolio of stocks bought at a discount to their estimated present value and 1) make money and 2) outperform the S&P 500.

I buy stocks with my personal money and plan to hold them for ten years. I’m about two years into the project.

As this goes on, and it will for another eight years, the impact of psychology on my investing decisions is starting to become clear.

Confirmation Bias is a real thing and is very hard to overcome. I’ll spend hours and hours researching a company because I think it might be a good buy. Then, I find out….I shouldn’t buy it …..and it feels like a defeat.

I’m aware now that much of the research I start is to confirm something that I think I already know.

This leads to bad results (see Trulieve). Confirmation bias is likely a problem for all individual investors.

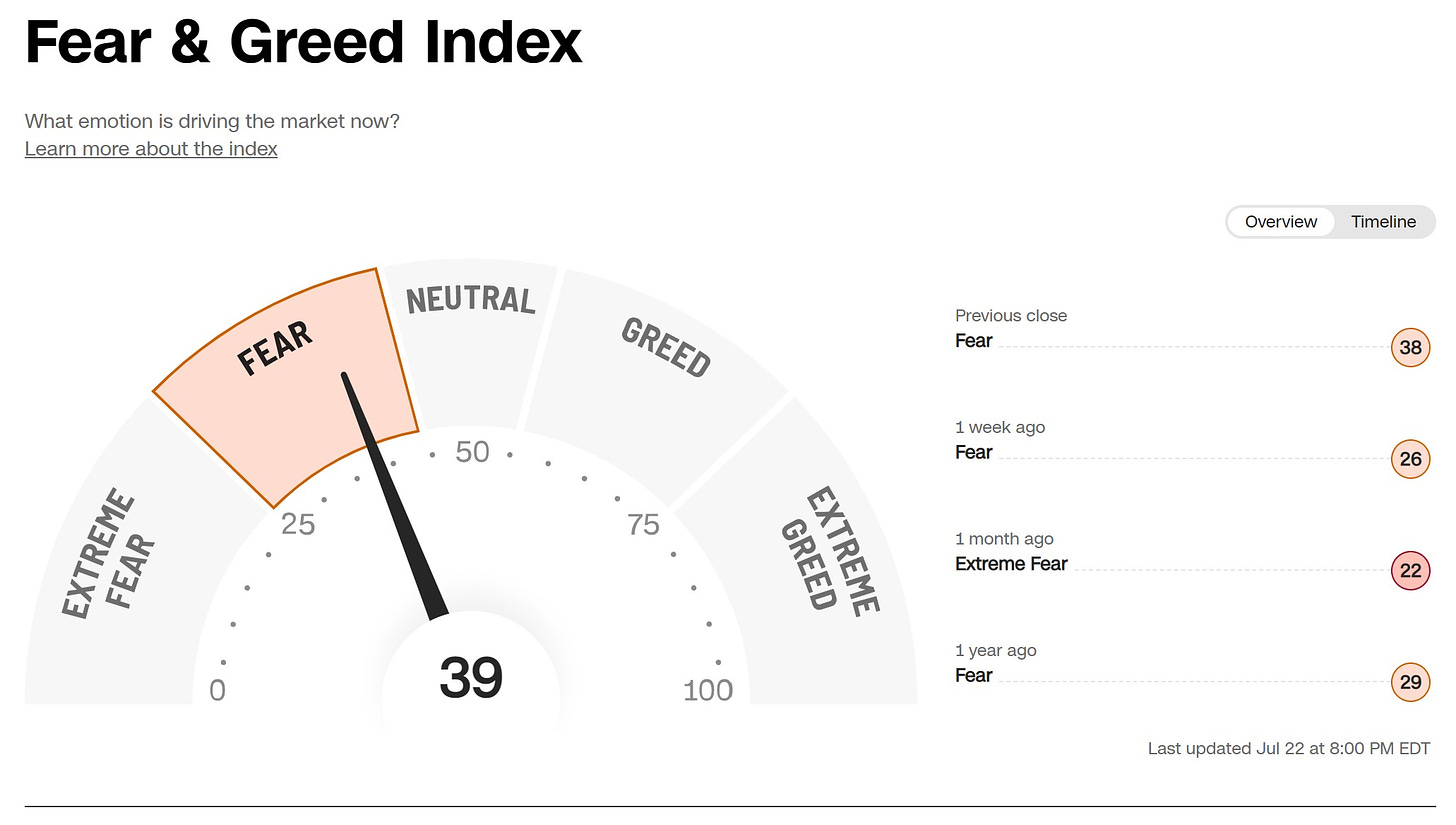

Fear and Greed and Fear of Missing Out: CNN produces a Fear and Greed Index.[6]

The index calculates a measure of fear and greed based on seven readily observable data points. This as an indicator of overall market sentiment.

My observation is that Fear of Missing Out is a more powerful influence on decisions about individual stocks. Here’s a slimmed down excerpt of Wikipedia’s description of this phenomenon [7]

Fear of missing out (FOMO) is the feeling of apprehension that one is either not in the know or missing out on information, events, experiences, or life decisions that could make one's life better. FOMO is also associated with a fear of regret … and can be described as the fear that deciding not to participate is the wrong choice…

FOMO is also present in … investing…{AND} is associated with… depression and anxiety… Hype and trends can lead business leaders to invest based on perceptions of what others are doing, rather than their own … strategy

For an individual investor (for example, me) Fear of Missing out is a powerful influence that can and does lead to bad decisions. See Southwest Air.

Results

Portfolio: UP + 5.3 %

S&P 500: Down - 1.6%

Overall, I’m outperforming the index by 6.9% and, at least as of today, am making money. Still, results are less than I expected - so far. I’ve made 35 purchases since April of 2020. 17 of them are ahead of the index (if I had bought the index fund on the same day). The others are behind.

If you like this, please support by sharing this with someone else.

If you don’t like it, just sign up someone you don’t care for here:

Subscriptions are free.

Email me at: weekendstockpick@gmail.com

check out my website https://www.weekend.financial/

THANKS,

[1] Not to slight Lisa Abramowicz or Jonathan Ferro who are every bit as entertaining as Tom Keene.

[2] Average earnings per share is simply the average of the trailing four years of EPS. I use average earnings per share, not EPS, to calculate the growth in earnings.

[3] https://www.sec.gov/ix?doc=/Archives/edgar/data/1442145/000143774922010671/vrsk20220331_10q.htm

[4] Zack’s 6/2/22 Research Note

[5] Many, many, many ad infinitum….

[6] https://www.cnn.com/markets/fear-and-greed#:~:text=The%20Fear%20%26%20Greed%20Index%20is%20a%20compilation%20of%20seven%20different,volatility%2C%20and%20safe%20haven%20demand.

[7] https://en.wikipedia.org/wiki/Fear_of_missing_out