The big news this week was the FedEx delivery on Friday

Broadridge Financial Solutions, Inc.

I came across Broadridge this summer while selling a software company that I ran (my day job.)

I wrote about it last week.[1]

The company, through its relationships with Depository Trust and Clearing Corporation[2] and CEDE & CO[3], controls the communications between public companies and their shareholders.

These exclusive relationships create a natural monopoly[4] for Broadridge

This position guards against competition, provides pricing power and delivers fairly predictable revenue growth.

Here’s some other things I like about the company:

The Moat

As discussed last week,[5] Broadridge occupies a central place in the machinery of the public markets. It will be very difficult, if not impossible, for a competitor to dislodge it.

Recurring Revenue

Most investors like recuring revenue. Broadridge, in a recent investor presentation, claims to have:[6]

$2.3b in recurring revenue, growing at 8% annually, from its Governance business.

“We provide a strong network through our governance platform that links broker-dealers, public companies, mutual funds, shareholders, and regulators. We continue to grow our governance solutions by continuing to transform content and delivery and improve product capabilities to drive higher investor engagement. We aim to be an integral partner to asset managers and retirement service providers by offering data-driven solutions that help them grow revenue, reduce costs and maintain compliance. We are also expanding our capabilities to better serve the needs of issuers and we are driving the next generation of digital communications while optimizing print and mail services through advanced technology.[7]

$921m in recurring revenue, growing at 14% annually, from its Capital Markets business

“Global institutions have a strong need to simplify their complex technology environment, and our SaaS-based, global, multi-asset- class technology platform addresses this need. As a leader in global trade management, we are driving next-generation solutions that simplify our clients’ operations, improve performance and resiliency, evolve to global operating models, adapt to new technologies, and enable our clients to better manage their data. We plan to continue building on our global platform capabilities, enabling our clients to simplify and improve their global operations across cash securities and other asset classes. Our 2021 acquisition of Itiviti, for example, allows us to expand our services across the trade lifecycle for equities and exchange-traded derivatives and grow our international reach. We continue to develop component solutions that meet the regulatory, risk, data, and analytics needs of our clients, while also helping to drive more efficient liquidity, price discovery, and improved execution for the firms we serve.

And $554m in recurring revenue, growing at 11% annually, from its Wealth and Investment Management Business

“Wealth and investment management clients, including full-service, regional and independent broker-dealers, investment advisors, insurance companies and retirement solutions providers are all undergoing unprecedented change. These firms are in need of partners to help them navigate the demographic shift of advisors and investors and the aging of the client experience and operational technologies that are essential to their business. These market dynamics are driving the need to more seamlessly integrate technology and processes and the need to access data-centric digital wealth solutions to better service advisors and investors. This can be achieved by simplifying and modernizing their complicated and interwoven legacy systems. We believe these needs have only accelerated during the Covid-19 pandemic. To address these demands, we have developed a holistic wealth management platform solution that provides seamless systems and data integration capabilities and enables firms to improve advisor productivity, investor experience and operational process efficiencies.

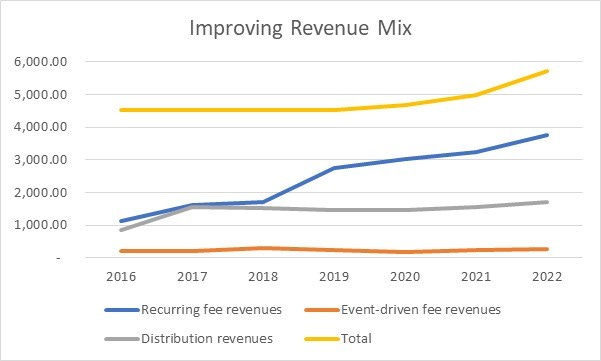

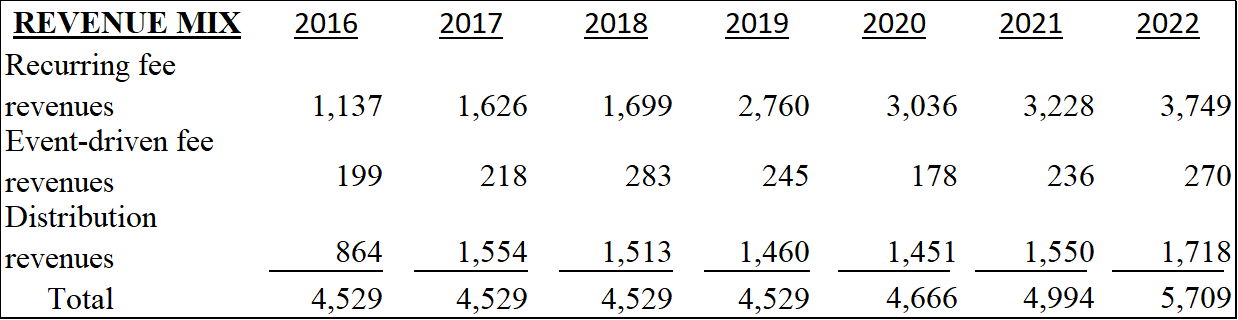

Most of the revenue growth since 2016 has come from increases in recurring revenue.

Since 2016 Recurring Revenue is growing at a 22% CAGR. Recurring revenue has grown from 25% of all revenue in 2016 to 65% of total revenue in 2022.

Dividend

Over the past 14 years, the dividend has grown at a compound annual rate of 21%. The current yield is 1.7%. In the past (2010, 2013) the yield has climbed as high at 3%. The company is committed to increasing the dividend.

“Broadridge has increased its dividend every year since becoming an independent company, with double-digit increases in nine of the last 10 years. As a testament to our execution, the strength and resilience of our business model, and, of course, the long-term trends driving our growth.[8]

Risks

There are some risks.

BR is subject to the growth or contraction of the number of public companies trading in the US:

“Since peaking at around 8,000 sometime in the mid-to-late 1990s, depending on your data source, the number of companies publicly listed on U.S. exchanges has steadily declined. In 2016, according to Credit Suisse, that number got down to around 3,600. Today, closer to 6,000 companies trade on the NYSE and Nasdaq. [9]

The Company effectively dominates its addressable market. It looks for growth through acquisitions in adjacent markets. The risk of growth through acquisition is well known.[10]

Adding to that risk, Broadridge uses debt to fund many of its acquisitions. The business is highly leveraged.

“As of June 30, 2022, we had $3,793.0 million in aggregate principal amount of total debt. Additionally, our revolving credit facility has a remaining borrowing capacity of $1,475.0 million as of June 30, 2022.[11]

However, in the most recent earnings call, the company has expressed its commitment to lowering its leverage ratios[12]

“Finally, we repaid $95 million of debt as we continue to prioritize debt repayment over share repurchases until we reach a leverage ratio that is in line with our objective to maintain an investment-grade credit rating.

And, despite the high level of debt, the Company believes that the float on the cash moving through the trading platforms offsets rising interest rates[13]

“Keep in mind that while higher interest rates are impacting our interest expense line, the impact on Broadridge as a whole is largely neutral as our $1.6 billion in variable debt outstanding is essentially matched by cash balances held in our mutual fund trade processing and stock transfer businesses. So, any increase in interest expense is offset by an equivalent increase in float revenue in ICS.

Conclusion:

The stock was selling for $171 when I wrote about it last week. That seemed pricey. Like everything else on the market it closed lower on Friday: $163.

That’s about 34X last fiscal year’s earnings of $4.55 a share[14].

The present value of the shares is around $205[15]. If it falls into the $145 to $125 range (giving a 30% to 40% margin for error below present value) I’ll buy it.

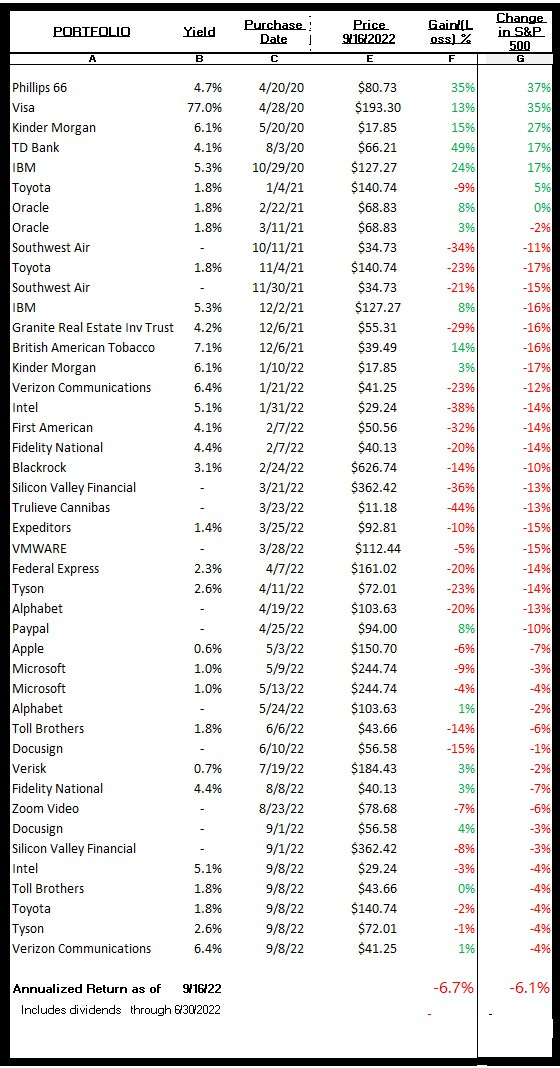

My Results – Down 6.7%

For the first week since I began writing this in April of 2020 my portfolio results are trailing a hypothetical portfolio invested in the S&P 500 index.

I purchase shares in the companies that I write about with my own money. And, to keep things honest, I publish the portfolio results each week. This week they’re bad.

This newsletter is meant to test a theory that, over a ten-year period of time, a diversified portfolio of US equities purchased at a discount to their present value will outperform the S&P 500. I started purchasing stocks for this portfolio in April of 2020. I’ve purchased shares in 31 different companies.

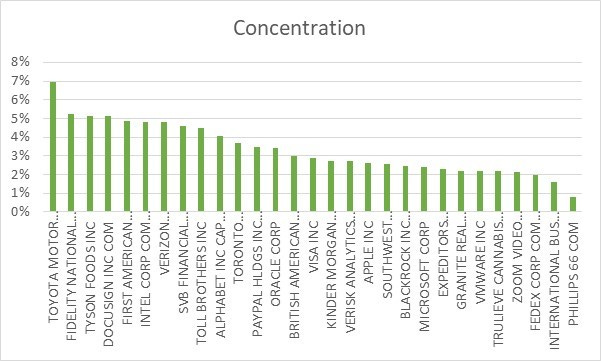

When complete, the portfolio will hold positions in 70 to 100 companies. Currently there is some concentration:

About 45% of the portfolio is invested. 55% is still in cash.

Next week: NYSE and CME Group and M2

If you know anyone who would think this experiment interesting, please share the newsletter.

If you would like a copy of my Broadridge model Email me at: weekendstockpick@gmail.com

THANKS,

Sept 11 2022 “how-i-spent-my-summer-vacation”

[2] https://en.wikipedia.org/wiki/Depository_Trust_%26_Clearing_Corporation

[3] https://en.wikipedia.org/wiki/Cede_and_Company

[4] https://en.wikipedia.org/wiki/Natural_monopoly

Sept 11 2022 “how-i-spent-my-summer-vacation”

[6] https://s1.q4cdn.com/204858996/files/doc_presentation/2022/09/Broadridge-Fiscal-Q1'23-Investor-Presentation.pdf

[7] https://www.sec.gov/ix?doc=/Archives/edgar/data/1383312/000138331222000037/br-20220630.htm

[8] https://www.marketbeat.com/earnings/transcripts/78976/

[9] https://www.benzinga.com/news/20/10/18026067/the-number-of-companies-publicly-traded-in-the-us-is-shrinking-or-is-it

[10] https://hbr.org/2020/03/dont-make-this-common-ma-mistake

[11] https://www.sec.gov/ix?doc=/Archives/edgar/data/1383312/000138331222000037/br-20220630.htm

[12] https://seekingalpha.com/article/4533600-broadridge-financial-solutions-inc-br-ceo-tim-gokey-on-q4-2022-results-earnings-call

[13] ibid

[14] https://www.sec.gov/ix?doc=/Archives/edgar/data/1383312/000138331222000037/br-20220630.htm

[15] If you’d like a copy of my model just e mail me at weekendstockpick@gmail.com and I’ll send it to you.