Microsoft, Apple, Zoom. Wait for It.

Can raising interest rates increase inflation? Smells Like a Bad Investment, and Results: DOWN -1%; vs S&P DOWN - 6%

It is an awfully nice weekend at the beach. So, I’m going to keep this short.

Microsoft, Apple, Zoom

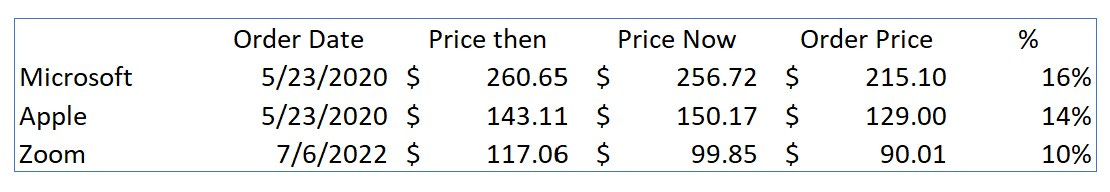

Here are three companies that I’ve written about and now have on back order at Fidelity:

I bought Microsoft twice in May: once at $268 and once at $255. My Limit Order at $215 is my estimate of a 40% discount from its present value. I’ll buy more at that price if it goes on sale.

I bought Apple for $159 in early May. That was 26% off my estimate of present value. If it drops to $129 (40% off) I’ll add more.

Zoom was $117 when I started writing about it a few weeks back. It has dropped to $99. That company has some serious risk. I won’t buy it unless I get it for $90 a share (my estimated 40% discount to present value).

I may be waiting quite a while - but I’m okay with that.

Can raising interest rates increase inflation?

Do Jerome Powell and his team of inflation fighting Feds really know what is causing the 2022 strain of inflation? Or, are they just dusting off Paul Volcker’s 42-year-old playbook?

Starting from the old college text book premise that inflation is caused by “too much money chasing too few goods” here’s a quick take from someone who writes like he’s thought about things:

Peccatiellio’s theory is that real, circulating money is created in two ways.

First through bank lending.

“Commercial banks create money by making new loans. When a bank makes a loan, for instance to somebody interested in taking a loan to buy a new car, it credits their bank account with a bank deposit of the size of the value of the new car. This new amount sitting on the car buyer’s bank account (and later on the car seller’s bank account) is literally new money.

The propensity of banks to lend, Peccatiellio observes, is influenced more by the likelihood of getting repaid and earning a profit than it is by the federal funds rate. That’s an important point as it relates to inflation.

The second way new, circulating money is created is through the federal government’s deficit spending.

If you are the US government, you can create new ‘‘real economy’’ form of money by spending more money than the taxes you intend to collect: budget deficits. When you want to balance your budgets, you will do the opposite: you will increase taxes by draining money from the private sector and run budget surpluses.

Think of the massive 2020-2021 US stimulus checks. The US government ran large budget deficits and literally created new ‘‘real economy’’ money by transferring checks directly to Americans.

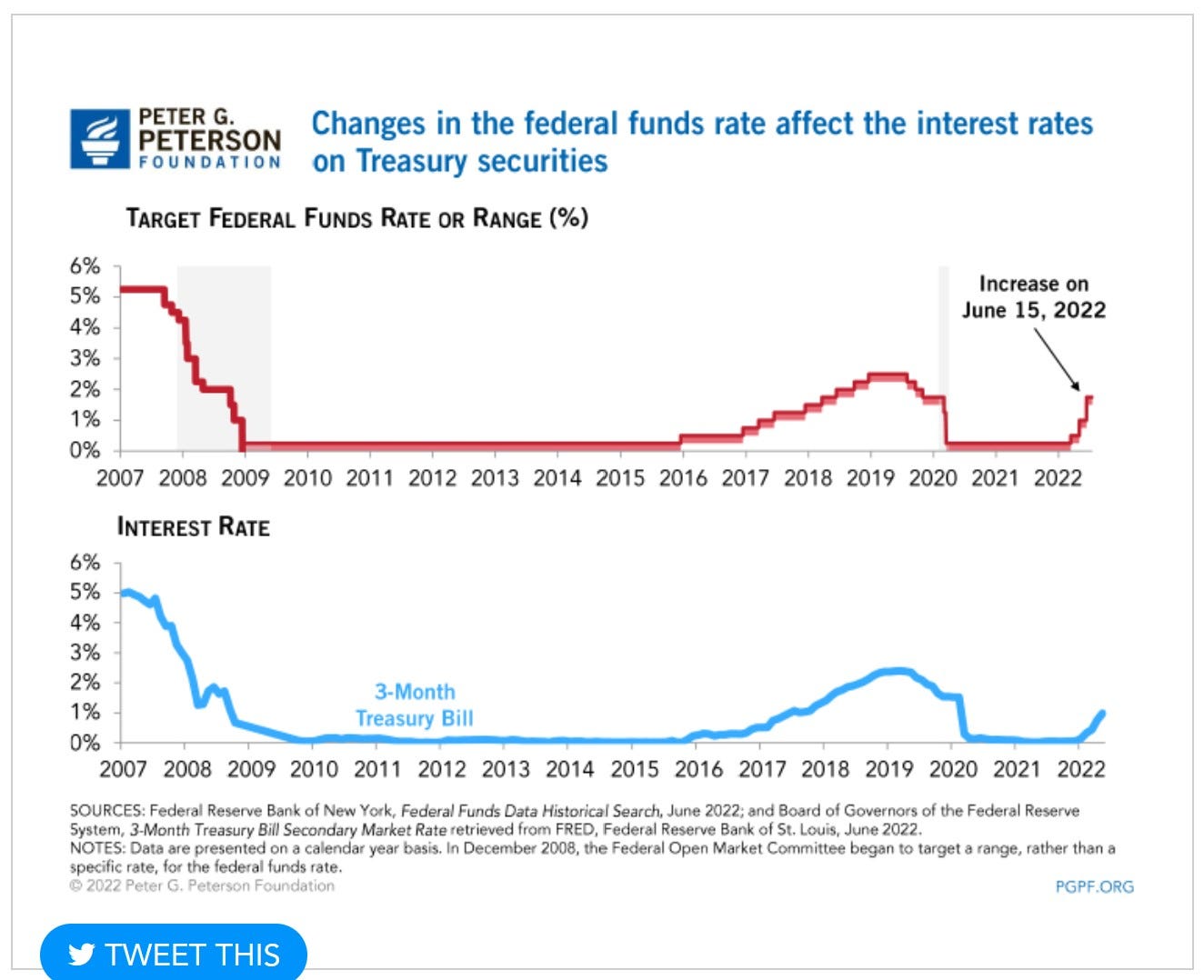

Leave that there and think about Jerome Powell’s interest rate increases and deficit spending.

Not surprisingly, as the Fed increases interest rates, the Treasury’s cost of borrowing increases.[1]

The amount of money created to make interest payments increases significantly.

So how might raising interest rates create, rather than tame the COVID 19 strain of inflation?

1) Banks may make more loans, and create more money supply, as the spread between the cost of deposits and the return from high interest loans widen.

2) Increased interest rate payments will put more money into circulation to the extent that those payments are made to households, investors and state and local governments.

If this inflation is being caused by “too much money” chasing a constrained supply of goods then the Fed’s actions may increase the supply of money and exacerbate inflation.

Kenneth Pringle alludes to something similar in Barron’s this weekend. “Jeremy Siegel on Why Today’s Inflation Is Different From the 1970s”[2]

The Fed might know how to create a recession. I’m not convinced they know how to lower inflation.

There are no do-overs in investing.

If there were, I’d take back Trulieve.

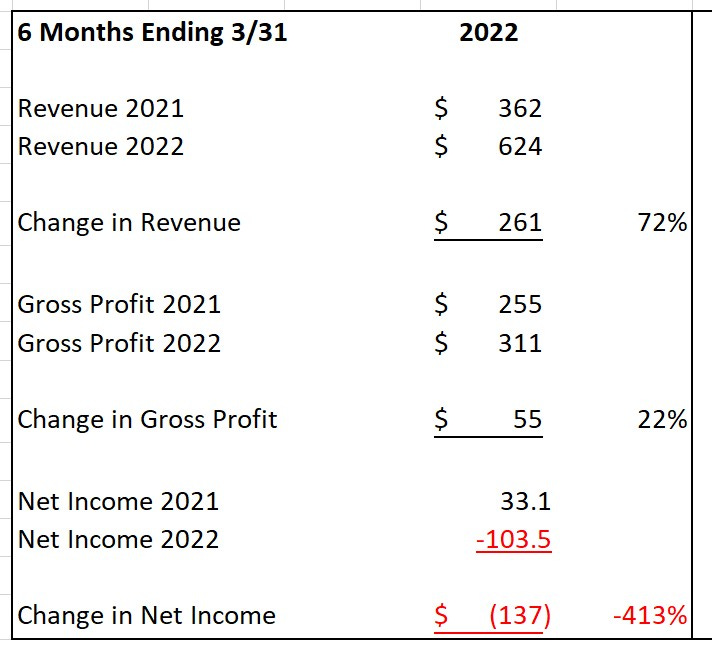

Trulieve is still growing like weed. But it has abandoned its focus on financial fundamentals and profitability[3].

A recent investor presentation High[4]-lights the damage.

To boil that down:

Over the 6-month period ending 3/31/22 a $261 million dollar increase in revenue (a 72% increase) brought only a 22% increase in gross profits. That implies the company is getting less efficient at producing its product even as it grows its business.

None of the $55 million in gross profits dropped through to the bottom line. Instead, the company burned $137m more than it had in the same period the prior year. That implies the company is getting less efficient at selling and marketing and administering its business.

Unprofitable growth is not a good strategy for companies that lack access to conventional sources of capital.

And, to be blunt 😊, the distraction of the CEO’s political activities and her husband’s criminal tribulations continue in the Florida press:

This is smelling like a bad investment.

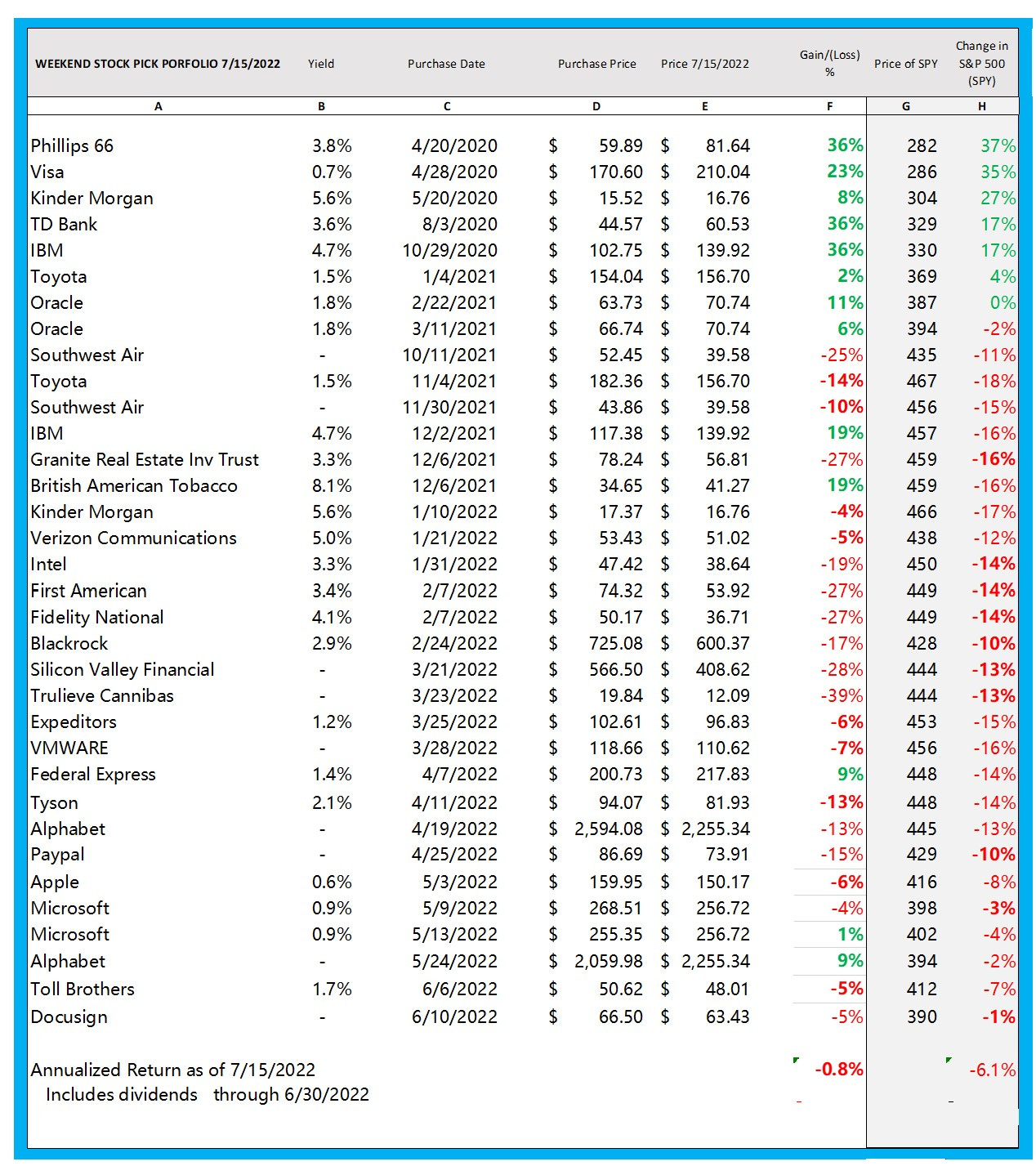

Results:

Portfolio: Down -1 %

S&P 500: Down - 6 %

This is the 28th month of a 120-month project.

The project tests a theory that, over ten years’ time, a “buy low, sell never” portfolio of stocks bought at a discount to their estimated present value will both make money on an absolute basis and outperform the S&P 500

Not much to see here. This is what it looked like when the market closed on Friday.

Thanks for reading.

email me at: weekendstockpick@gmail.com

Check out my website https://www.weekend.financial/

[1] https://www.pgpf.org/analysis/2022/06/higher-interest-rates-will-raise-interest-costs-on-the-national-debt

[2] https://www.barrons.com/articles/jeremy-siegel-on-why-todays-inflation-is-different-from-the-1970s-51657931619?mod=hp_DAY_7?mod=article_signInButton

[3] https://investors.trulieve.com/static-files/864de50f-e718-4392-8d77-504364f202bf

[4] Since my kids are all grown and out of the house you few readers will suffer through the Dad Jokes, bad puns and word play.