1 – INTEL GETS A GREEN LIGHT

Last week I wrote about Andrew Bary’s column the “Dogs of the Dow.”

https://www.barrons.com/articles/intel-dogs-of-the-dow-high-yield-strategy-51641227415

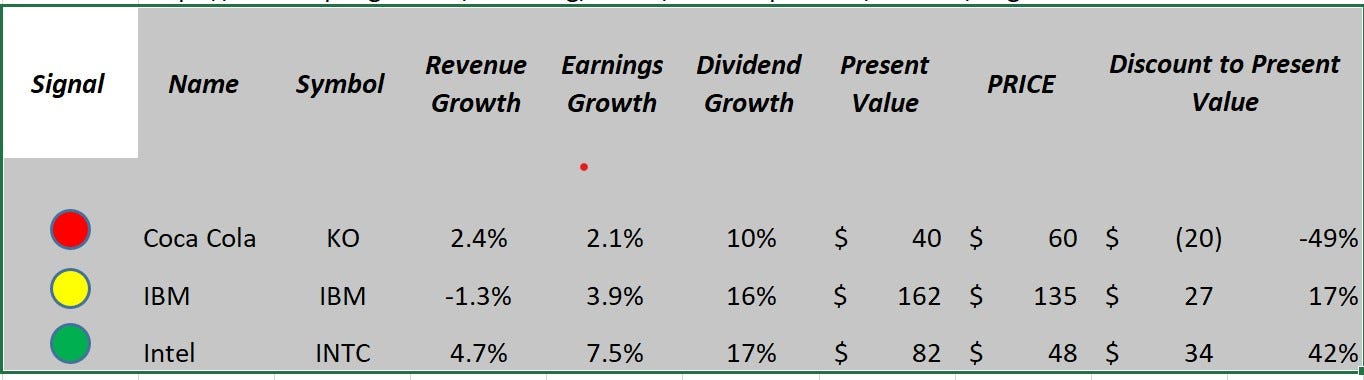

I looked at three of the other ‘Dogs’ this week. One’s a mutt. Two deserve a closer look.

Coca Cola (KO) looks like it’s gone flat. Annual revenue, since 2005, has been growing at just 2.4%. Earnings are growing at a similar pace. The dividend yield has increased – but how long before that fizzles out? I like Coke. I bought a can yesterday. But I’m staying away from the stock.

IBM in interesting. Annual revenue has declined slightly over the last 20+ years while earnings have grown at nearly 4% per year.

The company spun out the low margin managed services business at the end of last year. The company bought Red Hat (think Linux) in 2019. IBM has more than 9,000 technology patents and is one of the leaders in block chain technology. And IBM owns Watson. And Watson won Jeopardy. So how cool is that?

The company is priced at a discount to what appears to be the present value. I’m going to keep an eye on it and buy it if it drops closer to $100 a share.

Intel (INTC) looks like the pick of this litter

Annual revenue has grown 4.7% over the last 20+ years while earnings have grown at nearly 7.5% per year.

Intel was, at one time, the leader in the chip fabrication business. That industry has matured into a brutally competitive space that requires constant innovation and enormous amounts of capital investment. The new CEO at Intel faces challenges to restore the company to the leadership position. Among other things, to keep growing earnings faster than revenue, the company will need to improve its shrinking margins.

Bloomberg’s Ian King has a nice article about the headwinds and tailwinds facing Intel:

And Eric Savitz covers the most recent Intel earnings news here:

If the company can continue to grow sales and earnings at its historical pace Intel’s $48 a share price has a 40% + discount to value. That’s a comfortable margin for error that computes quite nicely.

I’ll place some chips on this one tomorrow if I can get it for $48.

2 – A short economics lesson from the global pandemic of 1957.

Last week’s reported GDP growth number was 6.8% - higher than expected. That might be good news for inflation. Here’s an interesting take on inflation and pandemics, written way back in April of 2021, from The University of California’s undergraduate economics journal the USC Economics Review back in April:

https://usceconreview.com/2021/04/15/the-u-s-decline-in-money-velocity/

“The International Monetary Fund (IMF) forecasts GDP to grow 5.4 percent in 2021, which would help counteract the negative 3.5 percent loss in real GDP in 2020. A rise in 2021 GDP growth of this stature would lead to excess demand, thus causing high inflation, however with continual re-opening of the economy, the paralleled surge in spending to further stimulate the economy would put inflationary pressures at ease. A quick glance back into the 1957 influenza pandemic can reflect a certain level of correlation to the COVID-19 pandemic. Influenza took the world by storm and affected not only individual livelihoods but also the U.S. economy in a large way. A nine-month recession took place shortly after and inflation actually began to weaken, causing no large surge in long-term inflation levels.