I Rolled the Dice with ICE: (NYSE: ICE)

Newsflash: Results are Truly Awful; & Wait for it........

During Friday’s market route, I bought Intercontinental Exchange, Inc. (ICE) for $92.10 a share. ICE owns, among other assets, the New York Stock Exchange. It operates global financial exchanges, option exchanges, clearing houses and OTC energy, credit and equity markets.

ICE provides mortgage technology, data and listing services. I suspect that the ‘mortgage’ exposure accounts for some of the meltdown of share price from a 52 week high of $139 to the low nineties now.

The company ranks #384 in the Fortune 500, has more than 8,000 employees [1] and has a market cap greater than $74 billion dollars.

Here’s some things I like about the company

The Moat

Alphabet, Amazon, and Apple have all built sustainable value achieving the network effect. For that, they have been richly rewarded, over decades of time, in the stock market.

The markets and exchanges that ICE owns are exemplars of the network effect. Once a market is established, and becomes successful, sellers (listing companies) and buyers (you, me, and everyone else who trades stocks) will use that network. It is very difficult for a would-be competitor to establish a competing market. ICE owns the marquee network for trading large cap stocks (NYSE) and a plethora of other markets.

Data businesses enjoy a similar, though less studied, long-term advantage. It is hard to amass a monetizable set of data. But, once the data are collected, catalogued, and commercialized, it is difficult for a competitor to achieve commercial success replicating that data set. Once buyers understand that a particular business provides the data they need in an easy and affordable format – they go there. As long as the data purveyors price their data at reasonable levels would be competitors cannot justify the start up costs to enter the business and compete.

ICE operates in many heavily regulated industries.[2] Regulation creates a moat. In regulated industries, scaled up businesses can distribute the high expenses of regulatory compliance across a great number of clients or transactions. Smaller competitors simply cannot do that

ICE is an operator of marketplaces and a purveyor of data in highly regulated industries. It is well insulated in all its operations from competition. Its listing services and dataset subscription businesses both lend themselves well to a recurring revenue model.

Recurring Revenue

I like recuring revenue. Everybody does. Recurring revenue business models provide great visibility and provide insulation from cyclicality. Businesses with a recurring revenue model often command a premium from investors.

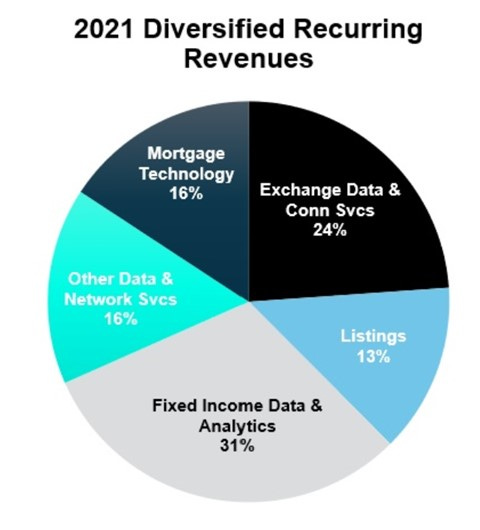

ICE has been increasing the percentage of revenue from recurring sources.[3]

We have diversified our business so that we are not dependent on volatility or transaction activity in any one asset class. In addition, we have increased our portion of recurring revenues from 34% in 2014 to 49% in 2021. These recurring revenues include data services, listings and various mortgage technology solutions.

Listings: The NYSE has been the venue of choice for innovators, visionaries and leaders for over 225 years… With over 70% of S&P 500 companies listed on the NYSE as of December 31, 2021, we are the leading listing venue … the NYSE is the global leader in ETF listings with 75%, or roughly $5.45 trillion, of ETF assets under management, or AUM, as of December 31, 2021. Revenues from listing fees are largely recurring in nature.

Fixed Income Data and Analytics: We are a leading provider of evaluated end-of-day and real-time pricing services on approximately three million fixed income securities spanning approximately 150 countries and 80 currencies …. Our reference data offering complements our evaluated pricing by providing our clients a broad range of descriptive information, covering millions of financial instruments … Our fixed income customers rely on our data, indices and analytics to inform pre-trade decision making, support post-trade regulatory and compliance needs and improve operational efficiency. In addition, our newer offerings in this area include a variety of ESG data and analytics offerings. Fixed Income Data and Analytics revenues are largely recurring in nature.

Origination Technology: Our proprietary and comprehensive mortgage origination platform, Encompass, acts as a system of record for the mortgage origination…. and enabling automated enforcement of rules and business practices designed to help ensure that each completed loan transaction is of high quality and adheres to secondary market standards. These revenues are based on recurring Software as a Service, or SaaS, subscription fees,

Data and Analytics: ICE Mortgage Technology’s Automation, Intelligence, Quality, or AIQ, offering applies machine learning and artificial intelligence, or AI, to the entire loan origination process…AIQ revenues can be both recurring and transaction-based in nature.

In addition, our Mortgage Technology’s data offerings include real-time industry and peer benchmarking tools, which provide originators a granular view into the real-time trends of nearly half the U.S. residential mortgage market. We also provide a Data as a Service, or DaaS, offering through private data clouds for lenders to access their own data and origination information. Revenues related to our data products are largely subscription based and recurring in nature.

The Numbers

Revenue growth: ICE has grown revenue from $995m in 2009 to $7,146m in 2021. Over that period, the compound annual growth rate for revenue was 18%. Over the last five years revenue has grown at with a CAGR of 10%.

EPS Growth: Since 2009, earnings per share has grown from $.85 to a trailing five year average of $4.00/share – a CAGR of 14%. Over the most recent five year period earnings per share have grown at 19%. Zacks expects earnings per share for 2022 to be around $5.36 a share.[4]

Stock Price Growth: Share price has grown at a rate of 20% annually over the last fifteen years. My model assumes a 10% growth rate over the next ten years.

PE Ratio: On Friday, ICE was selling for 15.7 time earnings. That’s a few points less than the median PE (20.9X) where it has traded during the 2009 – 2022 period.

Dividend: The yield (1.7%) is no reason to buy the stock. But the company has grown the dividend at an 18% annual rate since 2015. My model assumes 16% annual dividend growth, terminating at $6.25 a share, yielding about 2%, ten years from now.

Risk / Reward

Risk: Everything, everywhere is at risk today. I bought the shares Friday despite a feeling of near certainty that they would be cheaper on Monday. C'est le marché.

Reward: If my modeling is correct (and readers of this column know that, lately, the model hasn’t looked very solid) the shares are worth about $169.[5]

Buying the shares on Friday @ $92.10 gave me a 45% discount to present value and an anticipated ten-year annualized return of 14.5% throgh 2033.

Watching and Waiting.

Broadridge (BR) I wrote about this one last week and the week before. The shares have declined from $171 two weeks ago to $163 a week ago. It was $154 at the end of the day on Friday. It’s getting close to the $145 - $125 range where I’d like to buy it.

CSX (CSX) Was at $34 a share in early 2022. I like the profile of the business and what appear to be strong operating cash flows. It closed at $27 on Friday. When I looked at it in February, I liked it around $21 a share. I’ll try to dig deeper into that this week.

Next week: CME Group, CSX and M2

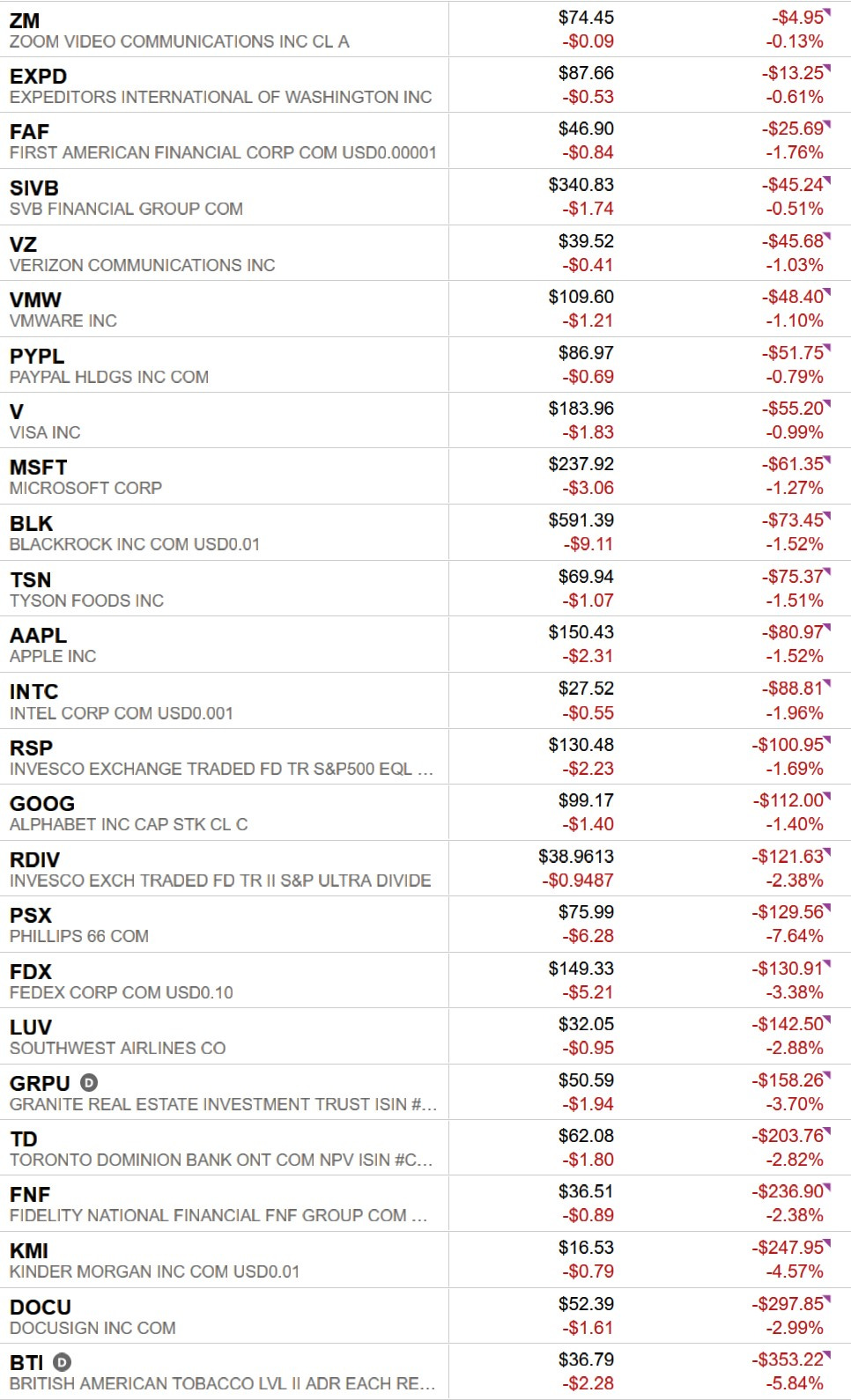

Results – Pretty F’n Awful

This newsletter is meant to test a theory that, over a ten-year period of time, a diversified portfolio of US equities purchased at a discount to their present value will outperform the S&P 500. I started purchasing stocks for this portfolio in April of 2020. I’ve purchased shares in 32 different companies.

To keep things honest, I publish the results of my stock purchases each week.

Not this week.

I’m heading to the airport in about an hour to catch a flight to Florida. In the interest of time, I’m skipping my typical position by position comparison of each purchase I’ve made.

Unless Hurricane Ian changes my plans, I’ll update my portfolio results poolside while sipping a few Mojitos and print it again next week.

In the meantime, take my word for it. When the market closed on Friday, there was red everywhere.

If you would like a copy of my ICE model send me an email at: weekendstockpick@gmail.com

Don’t forget to subscribe

THANKS,

[1] https://fortune.com/company/intercontinental-exchange/amp/

[2] https://www.sec.gov/ix?doc=/Archives/edgar/data/1571949/000157194922000006/ice-20211231.htm Page 17

[3] https://www.sec.gov/ix?doc=/Archives/edgar/data/1571949/000157194922000006/ice-20211231.htm

[4] https://www.zacks.com/stock/quote/ICE?q=ICE

[5] If you’d like a copy of my model just e mail me at weekendstockpick@gmail.com and I’ll send it to you.