How I Spent My Summer Vacation: DocuSign (DOCU), Zoom (ZM), & Broadridge (BR).

PLUS - NOT FEELING THE LUV

This is the first time I’ve written since July.

I took the month of August off. Not because I was feeling European, but because I was busy with my day job. I sold the software company that I run.

During that process, I learned a few things about two companies in my portfolio: DocuSign and Zoom. And I came across a company that was new to me: Broadridge.

DOCUSIGN

I wrote about DocuSign quite a bit in the winter and early summer.[1] I bought it on June 10th @ $66.50 a share.

DocuSign’s Investor Presentations[2] describe a $50 billion Total Addressable Market in a new space they define as the “Agreement Cloud”.

The “Agreement Cloud” seems real to me now. The sale I worked through in August was small by M&A standards. But closing even this little deal required nearly fifty different parties (buyers, sellers, option holders, banks, subordinated debt providers, etc.) to review and sign documents. Drafts of those documents circulated to all parties (via DocuSign) for months. The final, enormous and complex document packages were all organized, distributed, executed and saved in the DocuSign Cloud.

This was all managed quickly and efficiently by one junior associate at each of the buyer and seller’s law firms. That’s no small thing when two teams of lawyers are billing both buyers and sellers thousands and thousands of dollars an hour.

I liked using DocuSign. I bought more of it on September 1st at $54.34. The stock closed at $64.04 on Friday

ZOOM

I wrote about Zoom in July[3]. The stock was trading around $117 when I started following it. I liked the business but not the price. And I didn’t (and still don’t) like the company’s heavy reliance on software development in China nor the security risks that come with that.

I noticed something while working through my deal in August. Everyone used either Zoom or Microsoft Teams.

There appears to be a class difference between users of Zoom and users of Microsoft Teams.

The white shoe law firms and large commercial banks used Teams. Smaller accounting firms, third party diligence providers, investment bankers and the like used Zoom.

I suspect buyers of on-line meeting software make a trade-off between low security/low price Zoom and the costlier but more secure Microsoft Teams. This software is a must have for these firms and there’s plenty of business for both Teams and Zoom.

By August 23rd the price of Zoom had dropped to $84.28 a share. I bought it.

BROADRIDGE

I also came across Broadridge during my deal this summer.

Broadridge reminded me of some writing I had done in the Spring [4] about natural monopolies[5]. I liked Alphabet’s monopoly of search and bought that. Twitter’s monopoly on tweets is a monopoly on noise. I passed on that. I bought Verisk, [6] which has a near monopoly on the information used to run property and casualty insurance companies.

Broadridge Financial Solutions Inc. (NYSE: BR) is another natural monopoly.

Here’s what I learned about Broadridge and its unique place in the functioning of the public markets.

First, a little background.

The Owner of Record for nearly all publicly traded stock is a private partnership: CEDE & CO[7] (you, my friend, are merely the Beneficial Owner of the shares in your portfolio).

The partners of CEDE & CO are employees of Depository Trust and Clearing Corporation (DTC)[8] DTC, in turn, is owned by banks and brokerage houses. DTC:

“provide clearing and settlement efficiencies by immobilizing securities and making "book-entry" changes to ownership of the securities…DTC brings efficiency to the securities industry by retaining custody of more than 1.4 million active securities issues valued at US$87.1 trillion, including securities issued in the US and more than 131 countries and territories…DTC's core services include: Settlement Services, Corporate Actions Processing, Securities Processing, Issuer Services, Underwriting Services…..”[9]

DTC is the settlement agent for all publicly trades stocks. When a publicly traded company sends proxies, conducts votes, and disseminates other information – that company does so through DTC. Which gets us now to Broadridge (NTSE: BR).

Broadridge has an exclusive relationship with DTC. DTC contracts with Broadridge to serve the central role in the communication between publicly traded companies, the owner of record (CEDE &CO), the settlement agency (DTC) and the beneficial owners (you people commonly known as ‘shareholders.)

Barron’s recently described Broadridge’s position in the market like this:

The company has a near monopoly in the business of managing and distributing investor communications for practically every public company in the U.S., plus mutual funds, exchange-traded funds, and more. That includes proxies, regulatory disclosures, and other reports and filings required of all U.S. securities issuers. Those are non-discretionary communications that companies and funds need to distribute no matter what the world is doing. That segment tends to grow at the pace of overall stockholdings in the U.S., with Broadridge able to eke out higher profit margins thanks to a continuing shift from printed documents delivered by mail to digital investor communications.[10]

For the last thirteen years, Broadridge has grown revenue at a compound annual rate of 8%. It has grown earnings per share over that same period at a CAGR of 8%.

Over the more recent five years Broadridge has grown earnings at a rate of 12%.

About 2/3 of Broadridge’s revenue is recurring

The median price/earnings ratio over the last 13 years has been 21.9X.

The stock is selling for $171 now, about 37X last fiscal year’s earnings of $4.55 a share[11]. That seems a little pricey.

Broadridge is an interesting company with a nearly unassailable position deep inside the machinery of the stock market. Worth taking a long look and stay tuned for more about BR in the next newsletter.

Southwest Air

I was big fan of Southwest Air. The no change fee policy, the simple fare structure, the point-to-point[12] (as opposed to hub-and-spoke) routing system and the generous rewards program made it the perfect airline for no-frills business travel.

I’ve started traveling again for business… and Southwest isn’t what it used to be.

The customer experience boarding, flying and getting off the plane is still top of the class. I have more than a million points.

But the company has eliminated many direct flights on very popular routes: think Philadelphia to Orlando. To get where I need to go without changing planes, I’m flying American, United and Delta. Southwest’s point-to-point routing system has eroded. And with that, the competitive advantage of offering more of the direct flights necessary for business travel is eroded as well.

LUV is down 27% from where I bought it in October of 2021. I thought about getting more and lowering my average price per share.

But if I can’t fly it, I won’t buy it. I hope the company builds back and returns to its business travel roots.

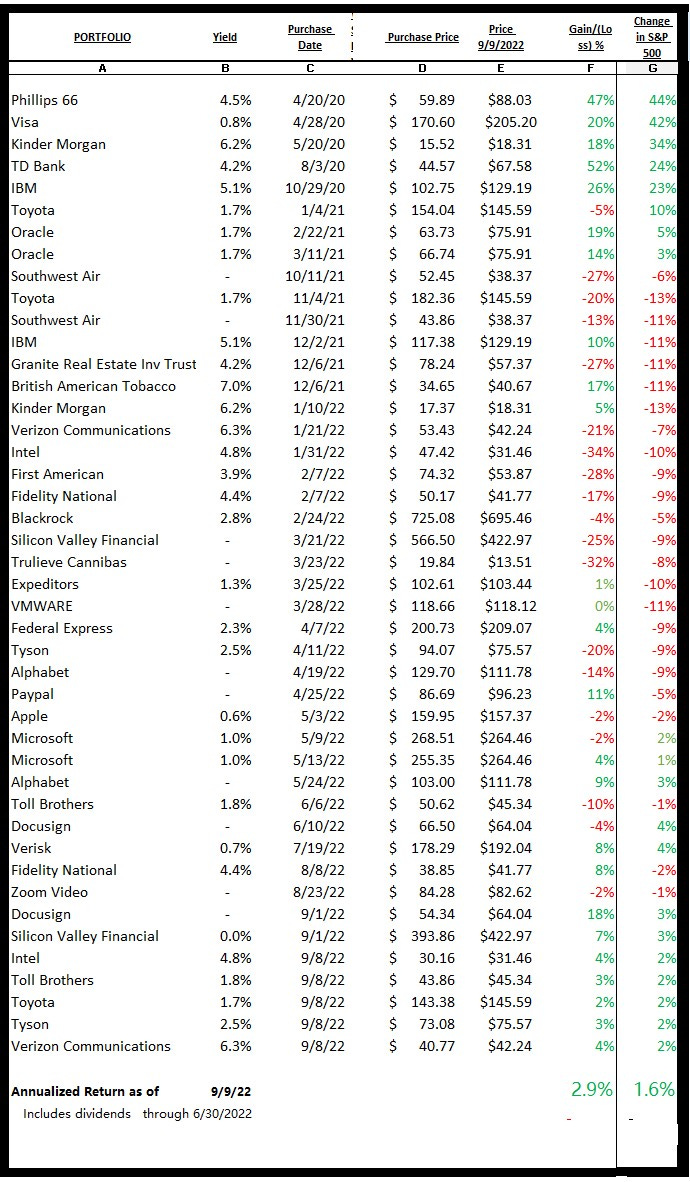

Results

Portfolio: UP + 2.9 %

S&P 500: UP + 1.6 %

This is a ten-year project that began in April of 2020 and will continue through March of 2030. 2 1/3 years into it is too early to say if I can outperform the index by any meaningful degree.

In the course of this experiment, I’ve learned this: picking stocks is easy. Making money is hard

Since the last newsletter I’ve doubled up on some of the stocks I had previously bought. On September 8th I bought more Intel at $30.15/share; more Toll Brothers at $43.85; more Toyota at $143.38; more Verizon at $47.46 and more Tyson at $73.08. Earlier in the month I bought more DocuSign at $54.35 and more Silicon Valley Bank at $393.86.

In August, in addition to Zoom (@ 84.28), I also added more Fidelity National Shares at $38.47 a share.

Results of all this are quite shy of spectacular. My newsletter’s portfolio has an annualized rate of return of 2.9% vs 1.6% for a hypothetical portfolio invested in the S&P 500 index on same dates.

If you like the newsletter, please support my writing by sharing or subscribing

.

If you don’t like it – send it to someone annoying:

Subscriptions are free.

Email me at: weekendstockpick@gmail.com

THANKS,

https://frankw.substack.com May 22, 2022

[2][2] https://s22.q4cdn.com/408980645/files/doc_presentations/2022/DocuSign-IR-Presentation-Fall_Final.pptx.pdf

https://frankw.substack.com July 3, July 11, 2022

[4] https://frankw.substack.com April 17, 2022

[5] https://www.investopedia.com/terms/n/natural_monopoly.asp

[6] https://frankw.substack.com July 24, 2022

[7][7] https://en.wikipedia.org/wiki/Cede_and_Company

[8] https://en.wikipedia.org/wiki/Depository_Trust_%26_Clearing_Corporation

[9] https://www.dtcc.com/about/businesses-and-subsidiaries/dtc

[10] https://www.barrons.com/articles/broadridge-earnings-stock-price-51660858577?mod=article_inline

[11] https://www.sec.gov/ix?doc=/Archives/edgar/data/1383312/000138331222000037/br-20220630.htm

[12] https://en.wikipedia.org/wiki/Point-to-point_transit