HALF OF ALL MY SUBSCRIBERS WANT TO KNOW THESE TWO THINGS ABOUT MONEY………HERE’S NUMBER TWO

Real Estate Trust, following up on last week and a joke

I’m having fun with these click bait type headlines. Not sure if anyone else finds them funny for a serious, somewhat ponderous investment column. But I continue to amuse myself.

I wrote last week about answering my 21 year old daughter’s first question about money: how can she get some? I advise her to invest her money in inexpensive, passively managed, broadly diversified ETF’s which hold shares in the S&P 500 either in equal weight or market cap weight.

That led to a second question. “How can I explain what a share of stock is to a friend? Is it just some electronic thing on our apps that goes up or down?” I’ll answer that in just a few seconds – after the tip of the week.

I have a real bad feeling about the stock market right now. Inflation seems to be out of control and a prudent Federal Reserve should tighten the money supply soon. This is generally not good for stocks. So a big downturn in the market seems to be coming.

But – if you are young enough to sit out a downturn and a recession there’s still some stocks that seem to offer the prospect of an above average return.

GRPU – Granite Real Estate Investment Trust.

Inflation has me worried. So companies that own real property are attractive. Inflation is, inherently, the devaluation of the dollar. So companies that operate in countries with more stable currency, in this case Canada, are attractive.

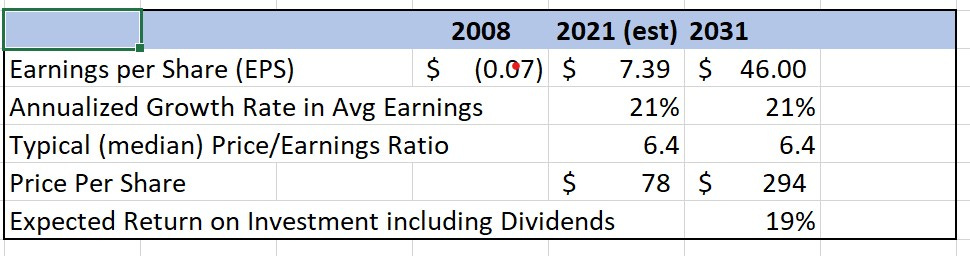

For those reasons, I looked at Granite a few weeks ago and bought some at $78.24 (USD). It’s trading around that still.

Granite is a Canadian-based company engaged in the acquisition, development, ownership and management of logistics, warehouse and industrial properties in North America and Europe. Even as COVID had battered demand for office space it has spared, or even accelerated, demand for warehousing and logistics.

I bought this on the assumption that the company could continue to grow earnings at the historical rate and would continue to distribute a dividend of about 3%.

But, full disclosure, there’s a lot of negatives. Zachs rates this as “sell” which is unusually harsh (although Refinitive says “buy’) It’s a Canadian company. It is very thinly traded. It is small. So, while I bought it, my only advice is take a look and, if you like it, buy it. Otherwise, don’t.

BACK TO THE TOP HALF OF THE NEWSLETTER.

How do you explain what a share of stock is? It’s an interesting question.

What a share of stock is is in the mind of the buyer. A share of Tesla, bought on Robinhood with the expectation of a quick gain is quite different than a share of Granite Real Estate Trust bought in the expectation that, over a long period of time, Granite will continue to execute well on its business plan.

The difference is this. The first buyer, of Tesla, is a speculator. The second buyer, of Granite, is an investor.

A speculator buys a share of stock because she believes that, for some reason, the price will increase in the short time. She can speculate on baseball cards, NFTs, or the stock market.

An investor buys a stock believing that, over a long period of time, the underlying business will increase in value.

So what really is a share of stock? Legally, it’s a fractional ownership in a business. So to make our comparison you need to know that Granite Real Estate Trust has 66,000,000 shares outstanding. And Tesla has 1,123,000,000 shares outstanding. One share of Granite owns 1/66m of Granite. One share of Tesla owns 1/1.123m of Tesla.

In the last 12 months, Tesla had $3 of earnings per share (total profit/number of shares outstanding). You could buy the $3 of earnings per share for $1,049 dollars a share today. In contrast, over the last twelve months, Granite Real Estate Trust had nearly $15 in earnings. You could buy those earnings for about $79 dollars.

One (Tesla) has an earnings yield (earnings per share/ price per share) of .2% - about what you get in a bank account. Or, you could buy the other, Granite with an earnings yield of ($15/79 =) 18%.

Of course, if it was that simple we’d all be rich. Tesla is in a much more interesting market than Granite. Tesla is growing much, much faster than Granite. Tesla has first mover advantage in the electric car market. And Tesla has an amazing founder (for example, see this https://babylonbee.com/podcast/basic/276 ) In contrast, there’s a lot of real estate investment trusts on the market. And among them, Granite doesn’t seem like anything special.

So you can speculate on Tesla. Or invest in Granite. Ten years from now you’ll know which was better.

Next week: My five biggest mistakes in 2021. You won’t believe number 4 (I am still loving the click bait headlines)

Joke:

Ariana DeBose on SNL

“Now, not many people know this, but West Side Story is actually based on another classic tale of star-crossed lovers,” the actress joked. “90 Day Fiancé.”:

It’s funnier when she says it: