Trulieve doesn’t fit the Weekly Stock Pick value model. It is not part of the WSP portfolio. You could say I bought it for recreational purposes.

Trulieve Cannabis Corporation

As befits someone who sells weed, Trulieve has a sketchy backstory.

“Trulieve Cannabis Corp. (formerly Schyan Exploration Inc.) was incorporated under the Business Corporations Act (Ontario) on September 17, 1940. It changed its name from “Bandolac Mining Corporation” to “Schyan Exploration Inc. On September 19, 2018 and effected the name change from “Schyan Exploration Inc. / Exploration Schyan Inc.” to “Trulieve Cannabis Corp.

So, Trulieve is 80+ years old and into marijuana. Like a lot of other 80-year-olds.

Trulieve describes itself as “a multi-state cannabis operator which … operates under licenses in six states… we are the market leader for quality medical cannabis products and services in Florida.”

The company was smart to focus on reaching profitability in one state before expanding. They picked Florida as their first base of operations. As someone who has spent a lot of time in Florida, I can tell you, that’s a great market in which to sell weed.

TRULIEVE ® CANNABIS CORPORATION IDEAL CUSTOMER PROFILE

It is very early days for the cannabis industry. There are myriad conflicting state and federal regulations to resolve. The banking system is not friendly to cannabis companies. Illegal marijuana dealers easily undercut the prices of the legal companies in the business. Cannabis companies cannot yet trade on the major US stock exchanges.

The industry is starting to consolidate

Trulieve has been doing its part by rolling up competitors. Expanding out from its base in Florida Trulieve has acquired:

11/2018 Leef Industries $4m CA

12/2018 Life Essence $4m MA

5/2019 The Healing Center $19m CT

11/2020 Keystone Relief $37m cash and stock PA

11/2020 Pure Penn/Pioneer $95m cash and stock PA

5/2021 Mountaineer Holdin $5.5m cash and stock WV

6/2021 Solevo Wellness $ .8m cash and stock WV

6/2021 Natures Remedy $16m cash and stock MA

7/2021 Patient Centric $10m stock MA

7/2021 Keystone Shops $55m cash and stock PA

10/2021 Harvest Health $2.1b stock AZ, CA, CO, MD, NV, UT

Trulieve claims its acquisition of Harvest makes it the leading provider in Arizona, one of the leaders in the Pennsylvania market and brings market share in Florida to north of 50%.

I like that the company is using acquisitions to build dominant market share in large states.

Federal law still prohibits interstate commerce in cannabis. The operation of these cannabis businesses is therefore very state specific. By building large market share within a state, Trulieve can create terrific economies of scale growing, processing and selling its products within that state.

Why I like Marijuana better than Beer or Gambling

If you want to invest in vice there’s no lack of choices. Let’s compare three.

During the period 2018 – 2020 Trulieve revenues grew 400%. While there was some compression of gross margin ((78% to 74%) other expenses were well controlled. G&A expense as a % of revenue declined. And sales and marketing expenses held steady around 23% of revenue.

If you think the Cannabis industry is in its early days this sort of financial performance bodes well for the future of Trulieve.

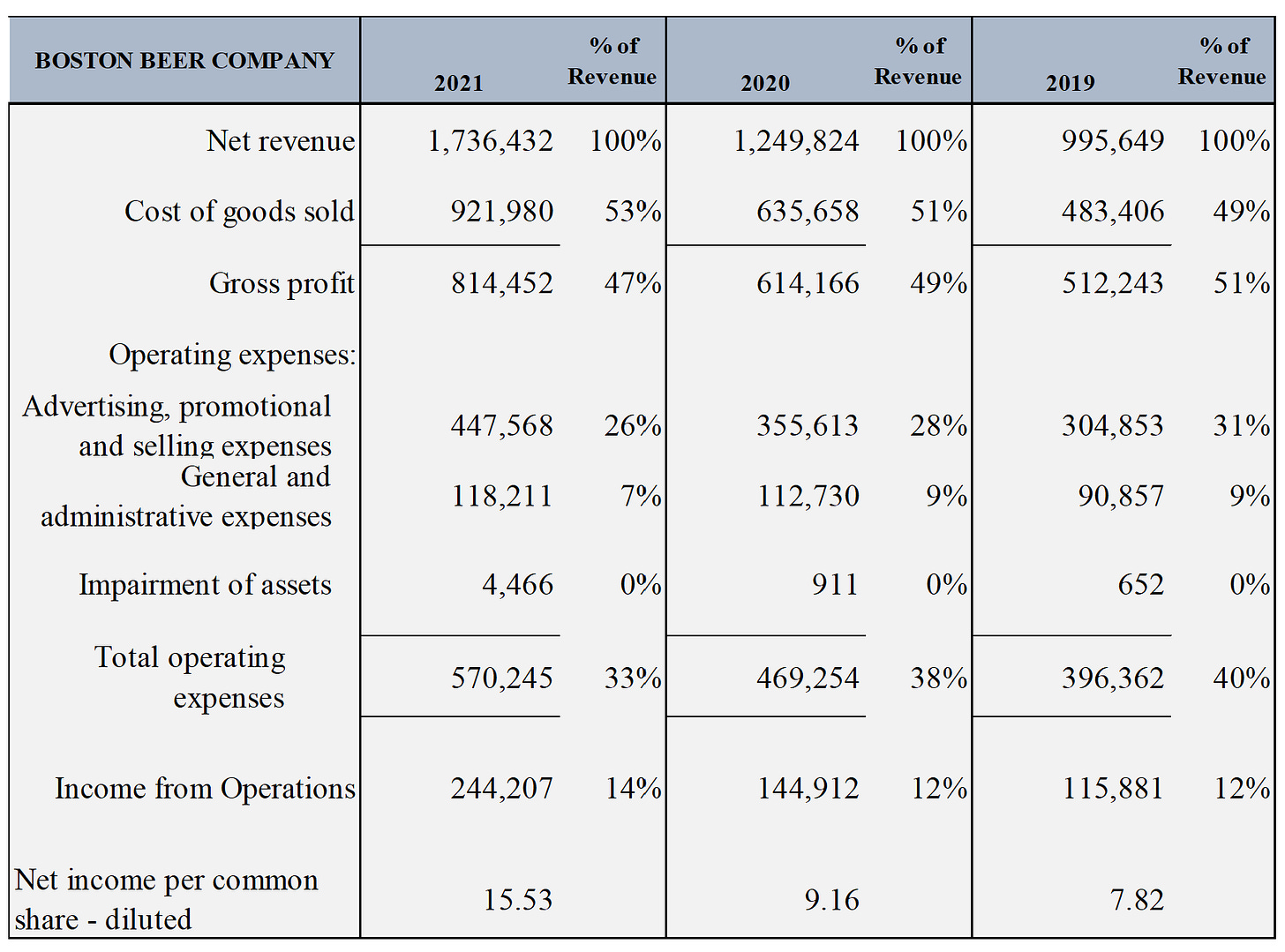

Beer

Beer is good. Boston Beer Company has done a nice job growing revenue despite a competitive market and changing consumer taste.

The company has grown revenue by 57% over three years and earnings per share have increased at nearly the same rate.

But gross margins are much higher in Cannabis than in Beer. With similar overhead expenses (about 35% of revenue) the bottom line in the Pot business is higher (34% income from operations) than in the beer trade (14% income from operations) Beer is good but Pot is better.

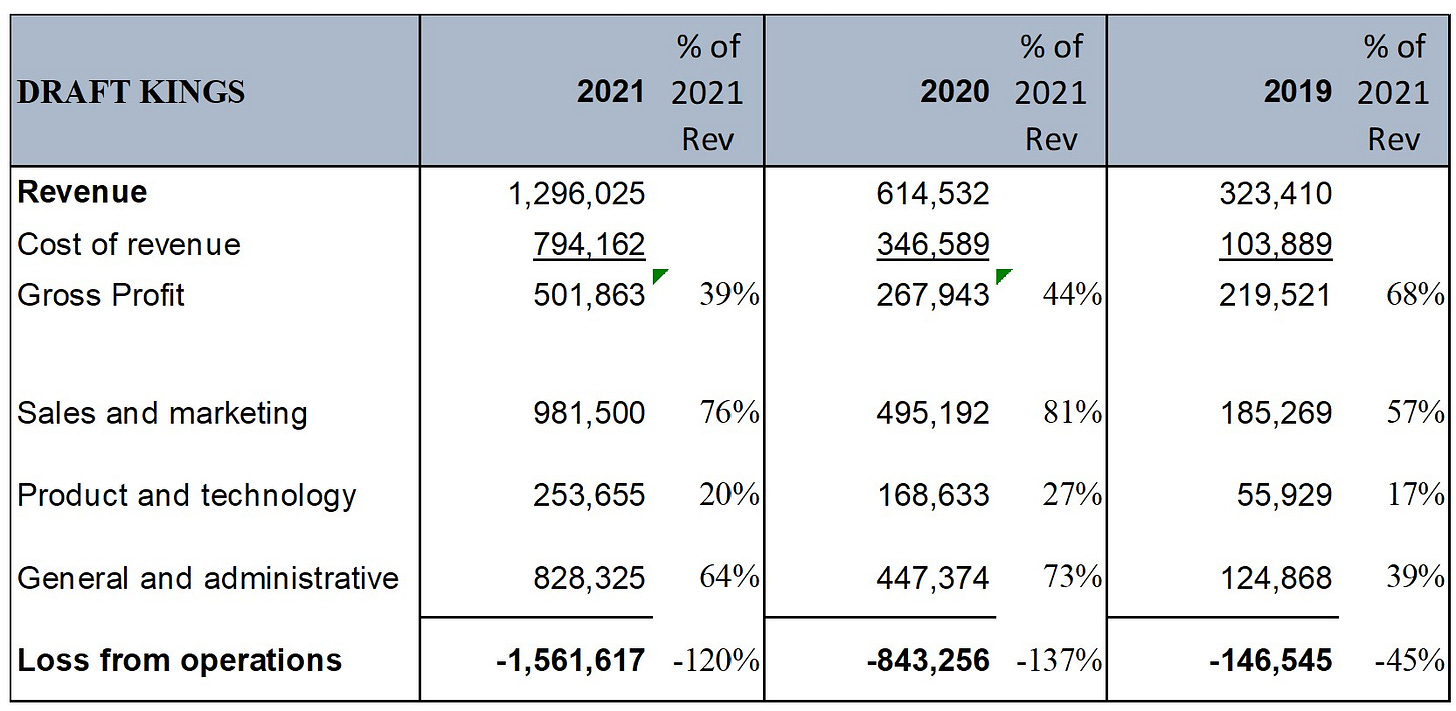

Gambling

Legalized sports betting is a little bit like the cannabis business. It’s a new industry with a lot of room to grow. Half of the states do not yet permit on-line gambling. Where it is permitted it is subject to state-by-state regulation.

Draft Kings is a publicly traded on-line gambling company.

Gross margins are low.

Sales and Marketing expenses are high. To add roughly $234m in gross profit in 2021 the company spent an additional $486m in sales and marketing – about $2 in sales cost for every $1 in gross profit.

Product and technology expense have grown from 17% of revenue in 2019 to 20% in 2021. And G&A expenses grew from 39% of revenue to 64% in the same time period. There are no obvious economies of scale in this business.

I wouldn’t bet on this one.

And – this week in financial journalism.

HEADLINE: BLOOMBERG NEWS

Wednesday morning:

“Rally Falters as Russia, Inflation Concerns Return

Thursday morning:

“Futures Fall, Havens Rise on Ukraine Risk

Friday Morning:

“U.S. Futures Advance on Planned Ukraine Talks

Every morning I drink my coffee and I look at the headlines on Bloomberg.

Some mornings the markets are up. Sometimes down.

What really amazes me is how, by 7:59 am Eastern Time each morning, the journalists at Bloomberg have discovered exactly why the markets are up or down.

How do they know?

I think it works like this:

SCENE: the 23rd floor of Bloomberg Tower at 731 Lexington Avenue. At 7:01 am the rising sun causes sunbeams to rake nearly horizontally through the floor to ceiling glass windows and across a sea of open, sustainable workspaces. All the spaces, but one, are empty. In the center of the room, with three 27-inch-high-definition monitors arrayed in front of him sits John Jones. His second Frappuccino of the morning rests by his left hand. His right hand deftly touches the buttons on the sleek black telephone magically connected to his headset. John is a man on a deadline.

“Hello, Mrs. Moskowitz? This is Johnny Jones at Bloomberg. Working on this morning’s headline? Hey, saw you sold some shares in ATT last night. Would you say you were more concerned about the situation in Ukraine or about inflation? Oh, I see. Cash for the daughter’s wedding. Well, all the best with that. Not even a little concerned with Ukraine? OK. No, no, I’m sure it will be lovely. Yes, I certainly hope the ex doesn’t show up either. Yes, thanks for taking my call. I’m sure it will be fine. No really...it’ll be lovely… Hey, I have to run….

“Hello, Mr. Browning-Smythe? John Jones Bloomberg News here. Saw on the terminal you sold your Unilever position last night. Were you more concerned with inflation or the Ukraine? Oh wow, “inflation in the Ukraine”. Say, that’s great. Do you mind if I use that?

“U.S. Futures Decline on Fears of Inflation in Ukraine

Subscriptions to the Weekly Stock Pick are free. Subscribe and the newsletter will be delivered to your inbox every Sunday morning.

If you like the newsletter please subscribe:

Or share:

Weekly Stock Pick Portfolio as of 2/18/2022

I’m not a financial advisor. The Weekly Stock Pick is a personal project. I try to write something entertaining while testing a theory that, over a ten-year period that began in April of 2020, a portfolio of individual stocks that I buy at a discount to their estimated present value will outperform the S&P 500 index. I print the results each week. 23 months into the project here’s how it looks.

(Returns include dividends received through 2/1/2022)

Thanks for reading. If you liked this week’s edition please share it with a friend.