Five 9 shares fell more than 25% today on news that the CEO resigned. His resignation chopped $1.2b off the value of the company.

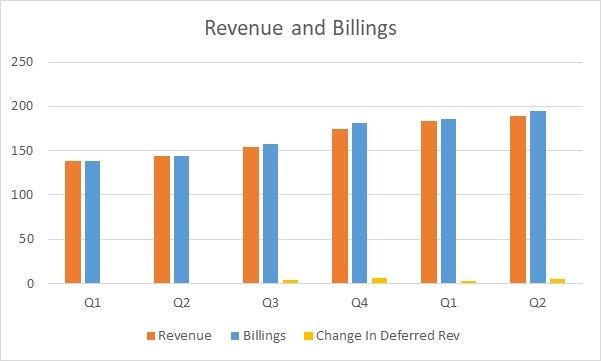

Revenue and Billings

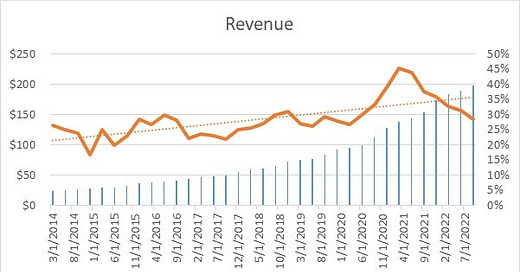

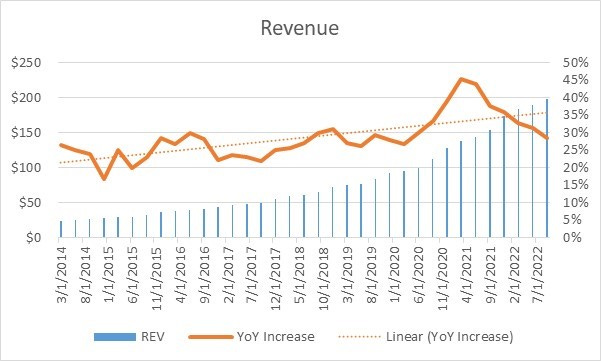

Also today, the company upped its revenue projection for the current quarter to $198m. That’s about 5% ahead of last quarter and 29% YoY Growth.

Growth has slowed. But 29% YoY is still pretty healthy.

Deferred revenue grew year over year from $43m to $51m in the quarter that ended June 30th. That’s about a 19% increase. Doing some quick math:

Billings (recognized revenue + change in deferred revenue) have increased from $144m in Q2 of 2021 to $194m in Q2 of 2022. That’s a 35% increase; Year over Year. And billings growing faster than GAAP revenue is another healthy signal in a SaaS business .

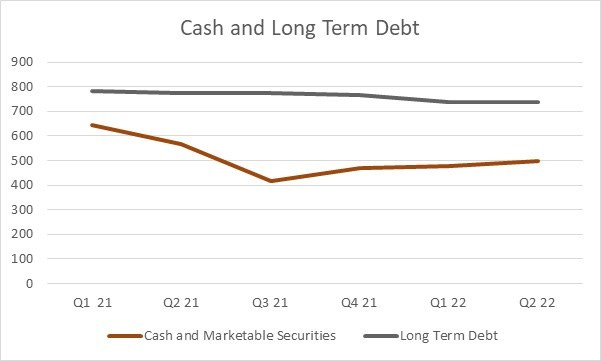

Cash and Debt

Cash from Operations for the 6-month period ending 6/31/22 was $25m. About the same as it was in the same period in 2021. Not great – but not news either.

Most of the long-term debt is in the form of convertible notes at what now looks like a favorable interest rate:

In May and June 2020, we issued $747.5 million in aggregate principal amount of the 2025 convertible senior notes in a private offering, all of which were outstanding as of December 31, 2021. The 2025 convertible senior notes mature on June 1, 2025, and the interest rate of the 2025 convertible senior notes is fixed at 0.500% per annum, payable semiannually in arrears on June 1 and December 1 of each year, beginning on December 1, 2020.1

The company has some mechanism in place to hedge against dilution if the notes convert

In connection with the issuance of the 2023 convertible senior notes and the 2025 convertible senior notes, we entered into capped call transactions with certain financial institutions, or the Option Counterparties. The capped call transactions are expected generally to reduce the potential dilution to holders of our common stock upon any conversion or settlement of either series of convertible notes and/or offset any cash payments we are required to make in excess of the principal amount of such convertible senior notes, as the case may be, with such reduction and/or offset subject to a cap under the terms of the capped call transactions2

Dilution

While we’re on the subject of dilution; there’s a lot of it.

Net cash provided by operating activities was $28.5 million during the year ended December 31, 2021. Net cash provided by operating activities resulted from our net loss of $53.0 million adjusted for non-cash items of $192.6 million, primarily consisting of $108.8 million of stock-based compensation,

So, what do you want first? The good news or the bad news?

The good news is that although the company lost $53m in 2021, $108m of that was the cost of stock-based compensation. The bad news is that common shareholders have suffered roughly 11% dilution over the past two years; albeit not all from stock-based compensation. Neither is really new news.

Clients

The company has a 122% net retention rate3. That’s up from 117% the prior year. There are 2,500 clients and no client makes up more than 10% of revenue. Gartner’s Magic Quadrant identifies them as one of the top four players in the space4. Gartner identifies these strengths:

Service strategy: Five9 is building competencies in AI and NLU sales and deployments, with increased ability to provide customer references for these functionalities across a variety of vertical markets and use cases.

Service execution: Five9’s customers frequently praise the company for providing strong post-sale support, which helps them derive full value from their investment.

Market responsiveness: After historically selling primarily to midsize contact centers, Five9 is now increasingly deploying its platform in contact centers with hundreds or thousands of agents.

And these weaknesses:

Geographic strategy:

Non-U.S. organizations considering Five9 should ensure their multiregional contact center platform rollout aligns with Five9’s geographic strategy.

Service offering: Customers have indicated dissatisfaction with the functionality of its digital interactions and digital self-service.

Operations: Five9 has only recently invested in expanding regional support for customers outside North America.

End of the story

Five 9 now has a market cap of $4.2b. 5.7X sales for a company with no GAAP earnings per share. Maybe nothing changed today ~ maybe it’s just an ‘all news is bad news’ sort of market.

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001288847/000128884722000017/fivn-20211231.htm page 44

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001288847/000128884722000017/fivn-20211231.htm page 45