Fear of Missing Out?

Plus: Docusign and Bill.com – The Digital Transformation of the Back Office... And Results: S&P 500 Down 0.5%; Portfolio Up 6.6%

Fear of Missing Out?

I bought Microsoft and Apple recently [1] They didn’t quite fit my model, which is to buy stocks that are selling at a forty percent discount to what I calculate as their present value.

I bought them anyway. I thought they would go lower. But I was afraid they would go higher. I convinced myself to buy. Ultimately, I believe in both companies. But still. They did go lower and I should have stuck to my discipline and picked up the greater discount. Fear of Missing Out.

Another mistake I’ve made, and am determined not to make with this project, is selling into downturns. I wrote of that in an earlier newsletter. Oak Tree Capital’s Howard Marks, a much better writer than I am, explores that thoroughly in his piece “Selling Out.” One of my subscribers sent me this and it’s worth a read. Or, of course, you can listen to the podcast.

https://www.oaktreecapital.com/docs/default-source/memos/selling-out.pdf?sfvrsn=5a4f7166_11

https://www.oaktreecapital.com/insights/memo-podcast/selling-out

Moving on to investing:

Docusign, Bill.com and the Digital Transformation of the Back Office

Trung Phan’s piece in Bloomberg on May 12th caught my eye:

“Digital transformation is still in an early phase, which means many hard-hit cloud and “software-as-a-service” stocks could bounce back in years to come.[2]

…this phase of digital transformation is still in its early days, which means that some beaten-down tech names could have healthy prospects for long-term growth.

Phan cites a year ago interview with Stanley Druckenmiller, the former chairman and president of Duquesne Capital.

“At the time, Druckenmiller said that “price” — not the underlying fundamentals — was the main concern with popular cloud and SAAS names. Valuations in this segment of the tech sector have indeed reset: The median forward revenue multiple for the Bessemer Venture Partners Cloud index has contracted from ~15x to ~7x in the past year.

Docusign and Bill.com are two cloud providers who are replacing quotidian, fundamental, largely manual business processes with software. Docusign lets the user sign something: Online!. Bill.com lets the user pay bills: Online! This is truly digital transformation.

Both have great products and are rapidly becoming the category killers in their respective spaces. Are the stocks priced right?

Both companies are young and have a history of losses. The value of the stock depends on their future growth and profitability. Seeing that through the clouds is difficult.

I have three threshold questions: 1) is there a path to profitability; and 2) do they have sufficient cash on hand to get there; and, finally 3) what value would they have once profitable?

The Businesses

Docusign defines it’s market as “the agreement cloud.” With Docusign, parties can prepare, sign, track and store documents in the cloud. Docusign claims this is a $50b market[3]. The company operates across all verticals and offers industry specific solutions tailored for life sciences, government, financial services and real estate.

Bill.com’s product is used to pay bills. Invoices are sent by vendors to a Bill.com address. The software routes the invoice through the approval chain. Once approved the invoices are queued for payment. The accounts payable department approves the payments and Bill.com manages the mailing of checks or creation of electronic payments.

Both companies have a ‘land and expand’ go to market strategy. Once installed in a client’s business they increase fees or add additional services. Both are successful with this. New customers spend about 110% to 130% more in their second year of service than they did when they signed up.

Both companies use the network effect to their advantage. If a vendor wants to get paid by a customer who uses Bill.com the vendor signs up for Bill.com. The vendor often becomes a customer of Bill.com and uses Bill.com to manage payments to its own vendors. Docusign spreads in a similar fashion. If one party to a contract uses Docusign, the other party finds it easy to sign up and use Docusign for its own contracts.

This is working well. Bill.com has grown revenue 85% annually and Docusign 41% annually over the past five year.[4]

Both businesses seem recession proof – within their installed base. Clients incorporate this software into their business processes. Ripping software out would often require adding additional headcount in back office functions.

“It’s tough to make predictions, especially about the future.”[5] My guess is that in a recession new client acquisition will slow somewhat, but not flatline, for both companies. Both make back-office processes more efficient which can allow for reductions in headcount. That’s attractive in good times and bad.

Path to Profitability

Cash from Operations: For most tech companies generating positive cash from operations is a prequel to profitability.

Docusign is comfortably there. Over the last three years it has generated cash from operations equal to, on average, 18% of revenue. In the most recent year cash from operations was 24% of revenue.

Bill.com’s not even close. Cash from operations over three years averaged a -2%.

Efficient SG&A: Profitable businesses will spend a declining percentage of revenue on sale, general and administrative expenses.

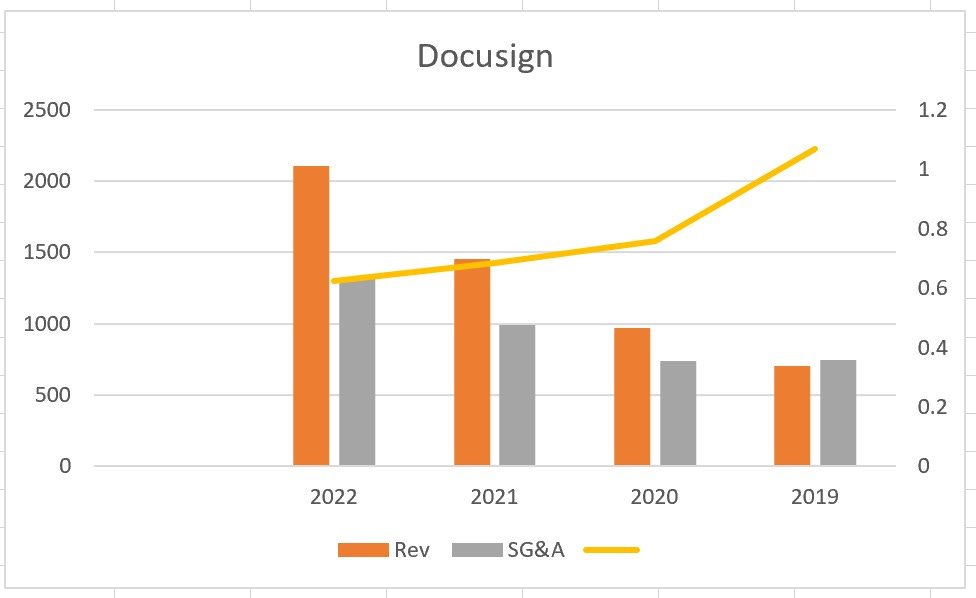

Docusign is showing this characteristic. SG&A as a % of revenue (the yellow line in my very homemade excel chart above) has declined from 107% of revenue in 2019 to 62% in the most recent period.

Docusign management illustration above (from thethe 2021 investor presentation [6]) shows they are focused on increasing the return on the ‘sales’ portion of Sales, General &Administrative spending. Good for them.

Things are not so good over at Bill.com

SG&A as a percent of revenue has increased from 54% of revenue to 84% of revenue as the company has grown. WTF?

Research and Development Expense: Technology companies at scale should show consistent levels of R&D expense. The theory is that they’ve built their product and can become profitable simply by selling more of it. Here, Docusign looks like what you’d expect. R&D spending as a % of revenue bounces around between 13% to 19% of revenue during the last four years.

Bill.com, again, doesn’t look like a mature company. R&D spending has increased each year, growing from 28% of revenue four years ago to 38% of revenue in the most recent year.

Let’s put paid to Bill.com. Docusign’s management has a path to profitability. Do they have enough cash to get there?

Cash on Hand

Docusign’s fiscal year ended January 31, 2022. At that time they had $802m of cash and marketable investments. Debt was $718m. Most of this is in the form of a convertible note which matures on January 15, 2024 and is convertible at what now seems like a sky-high price of $420 a share. These notes have an effective interest rate of 3.8%.[7]

Free cash flow (cash from operations minus capital spending) was $214m in fiscal year 2021 and $445m in the fiscal year that ended January 2022. Seems unlikely they need to borrow any more cash. They will likely need to refinance. Interest expense was $6.4m in 2022. Maybe it doubles? $12.8m when they refinance? That wouldn’t put much of a dent in free cash flow.

What’s it Worth?

Anybody can guess. I built my own 10 year forecast that assumed 30% YoY revenue growth in the near term slowing to 20% in the outer years. I assumed improvements in efficiency continue for the near term then flatten out and assumed an 18% tax rate in later years. I assumed shareholders will continue to be diluted 5% per year by the issuance of shares related to share based compensation programs. What did I end up with?

Fear of Missing Out

I really like Docusign. I want to buy it. I can tweak the assumptions in my forecast to prove to myself that the stock is under valued. Or, I can use slightly different assumptions and prove that $118 a share is too much to pay.

At this price, the stock price has to increase “just” 14% annually for 10 years to fit my discount model. That seems pretty plausible given the revenue growth and efficient business model. So; am I buying this because of the fundamentals? Or is it because I’m afraid of missing out?

Results: So Far, So Good

Portfolio > Up 6.6%

S&P 500 > Down 0.5%

This column started in April of 2020 as a COVID project.

The project tests a theory that, over a ten-year period, a “buy low, sell never” portfolio of stocks bought at a discount to their estimated present value will both make money on an absolute basis and outperform the S&P 500. 25 months in it seems to be working.

This is what it looked like when the market closed on Friday.

15 of 31 investments are higher (by an average of 14%) than the S&P index bought on the same date. 15 are lower (by an average of 8%). Dividends collected through 3/31 are about 2% of the total return vs slightly less than 1% for the index.

Thanks for reading. If you like this please share. Subscriptions are free.

Or email me at: weekendstockpick@gmail.com

Check the Archives for:

Allison Schraeger, Bloomberg February 13, 2022

Alphabet April 17, 2022

Biogen February 6, 2022

Blackrock February 27, 2022

Blackstone February 27, 2022

Bloomberg News February 20, 2022

Boston Beer February 20, 2022

Bunge April 10, 2022

Callidus March 29, 2022

Carbon Black March 29, 2022

Coca Cola January 30, 2022

CuraLeaf April 24, 2022

Draft Kings February 20, 2022

Draft Kings April 3, 2022

Ella Nilsen, CNN March 13, 2022

Elon Musk April 17, 2022

Eric Savitz, Barrons February 13, 2022

Expeditors March 13, 2022

FEDEX March 13, 2022

Fidelity National February 13, 2022

First American February 6, 2022

First American February 13, 2022

Goldman Sachs February 27, 2022

Google April 17, 2022

Granite Real Estate Trust January 18, 2022

Green Thumb April 24, 2022

Henry Grabar, Slate April 17, 2022

IBM January 30, 2022

Inflation January 2, 2022

Inflation January 23, 2022

Inflation January 30, 2022

Intel January 30, 2022

Jen Psaki, MSNBC April 10, 2022

Jen Psaki, MSNBC April 17, 2022

Keith Romer, Bloomberg April 3, 2022

Kinder Morgan January 8, 2022

Nutanix March 29, 2022

Phillips 66 January 2, 2022

Prudential February 6, 2022

Sangfor Technologies March 29, 2022

Silicon Valley Bank March 20, 2022

SUSE March 29, 2022

TerrAscend April 24, 2022

Trulieve February 20, 2022

Trulieve April 24, 2022

Tweedy Brown April 17, 2022

Twitter April 17, 2022

Tyson April 10, 1011

UPS March 13, 2022

Verisk April 17, 2022

Verizon January 23, 2022

Virtuozzo March 29, 2022

VMWARE March 29, 2022

Wall Street Journal April 10, 2022

Wells Fargo March 20, 2022

Western Alliance Bank March 20, 2022

Will Yakowicz, Forbes April 24, 2022

[1] See the May 8th newsletter “Why I Finally Bought Apple” for details on both.

[2] https://www.bloomberg.com/opinion/articles/2022-05-12/if-tech-crash-is-another-dot-com-bubble-the-cloud-has-a-silver-lining?re_source=postr_story_0

[3] https://s22.q4cdn.com/408980645/files/doc_presentations/2021/06/DOCU-Analyst-Day-2021-Presentation-FINAL.pdf

[4] Including, however, revenue from acquisitions.

[5] Attributed to Yogi Berra. If he really said all the things he’s supposed to have said it’s a wonder he had time to shut up and play ball.

[6] https://s22.q4cdn.com/408980645/files/doc_presentations/2021/06/DOCU-Analyst-Day-2021-Presentation-FINAL.pdf

[7] https://www.sec.gov/ix?doc=/Archives/edgar/data/1261333/000126133322000049/docu-20220131.htm#ic5423d11c1ed44e2adc6efa8b94774ca_115