DOCU: can’t sign off yet.

Stock Based Compensation ... Bloomberg's Daily Downer ... Results: +3.3%; vs S&P - 5.5%

DocuSign and the Fear of Missing Out

Last weekend, I wrote about DocuSign (DOCU). I built a model; tweaked my assumptions this way and that and got to the result I wanted. On Sunday morning when I wrote the column, I was sure DocuSign was a good value at $76 a share.

Here’s the background. I use a model that attempts to forecast a ten-year return on an investment by extrapolating into the future historical PE ratios and historical rates of growth in earnings, revenue, and dividend payouts. With the model I identify stocks that are for sale at a price 40% below my estimate of their fair value and I buy them.

When I’m disciplined I stick to the model. And it seems to work.

Sometimes I break discipline. I convince myself to buy something that doesn’t have a solid history (see Trulieve Cannabis) or isn’t priced at 40% below present value (see Apple and Microsoft.) That hasn’t worked as well.

There’s an old saw that says (Wall Street) investors are driven by fear and greed. For individual investors the drivers are fear and fear. Fear of losing money and fear of missing out on a chance to make money.

I realize now, 25 months into this project, that when I break discipline, it’s often because I’m afraid of missing out on a good thing.

There are a lot of things I like about DocuSign. Last Sunday, I convinced myself to buy DocuSign – even though it didn’t quite fit the model.

By Monday morning I realized that although it’s a good company – the price isn’t right. I was giving in to fear of missing out. I didn’t buy the stock.

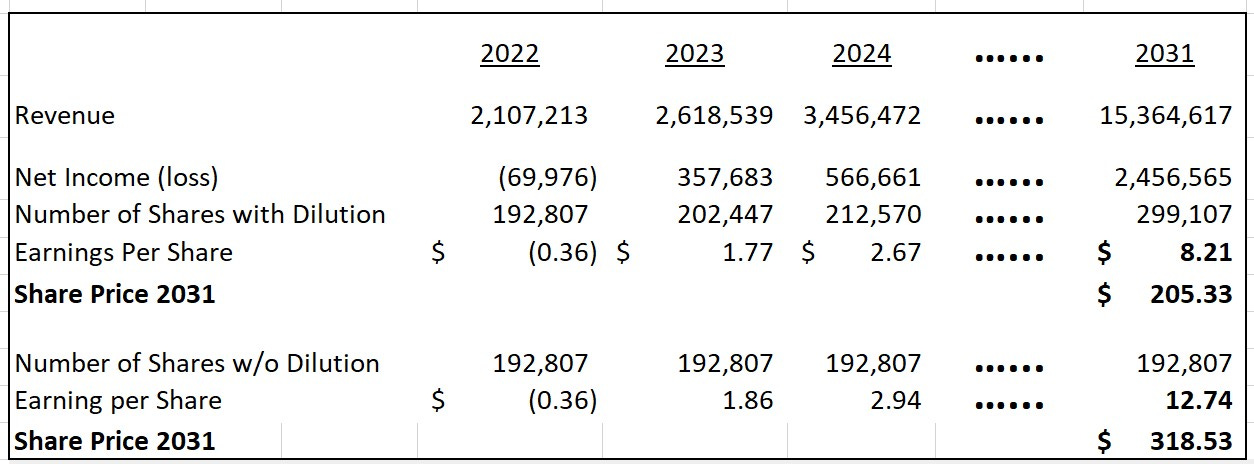

DocuSign: the model and present value

A very abridged version of my DocuSign model is above. Right or wrong, it forecasts a $205 a share price in 2031. Discounted back to today, and marked down 40% - I should pay no more than $61.

I’ll wait to see if it gets to $61. If it does, I’ll buy it. If it never gets that low, I missed out.

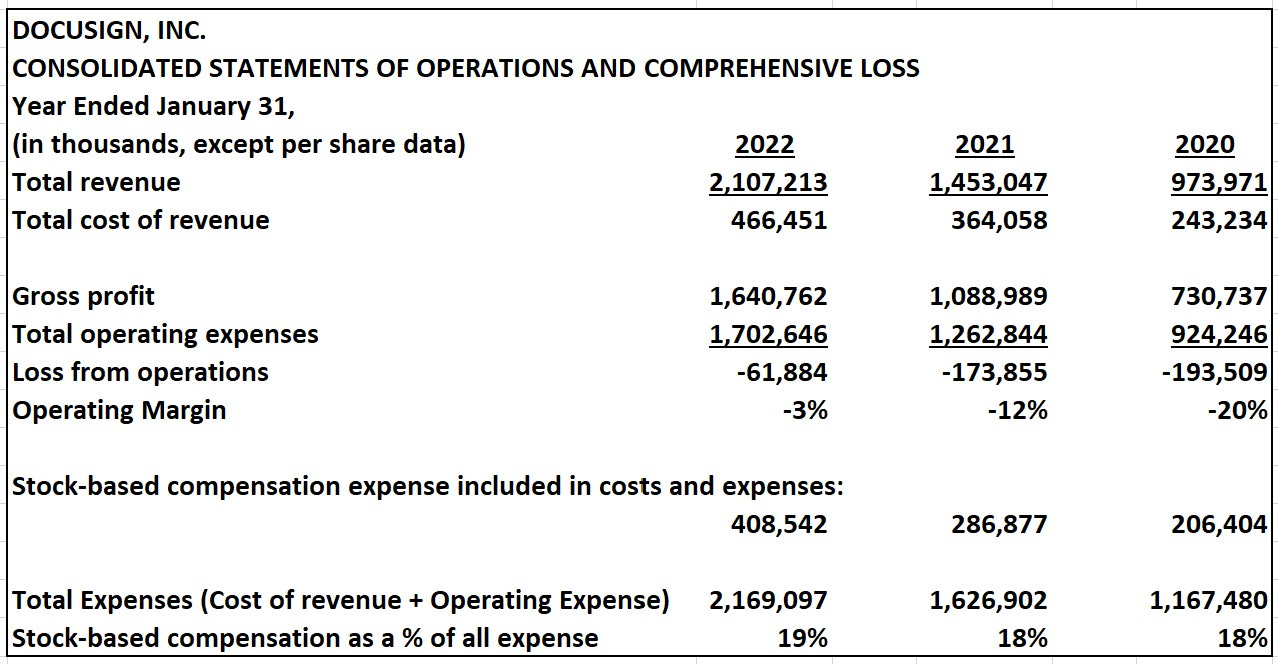

Stock Based Compensation – the DocuSign example.

At my day job, our investors guard equity jealously. The more equity private investors give to management and employees the lower the investors’ eventual return will be. Simple math.

Public company boards treat equity differently. They give away a lot of it.

DocuSign uses a lot of stock-based compensation[1].

Between 18% and 19% of the company’s total expenses are the expense of stock-based compensation.

Like a lot of tech companies, DocuSign’s presentations often back out stock-based compensation, along with other non-cash expenses, and present ‘non-GAAP’ adjusted earnings. I call BS on that.

Stock awards to management and employees dilute investors. Over the past three years DocuSign issued 24m[2] shares to settle stock options and restricted stock units – dilution of about 5% each year.

I built that dilution into my model. Here’s what the model (the same one shown above) looks like both with and without this 5% annual dilution from stock-based compensation

The compounding impact of that dilution on earnings per share is significant. Significantly bad for investors in DocuSign.

A Matter of (Bloomberg’s) Perspective

Every morning I open Bloomberg.com and see this graphic view of the markets.

The default view, the one that pops up at you automatically, has looked down like this most of the year. How much better I would feel if Bloomberg served up this perspective of the same market every morning:

Results: Bleh!

Portfolio: + 3.3 %

S&P 500: - 5.3 %

This is the 25th month of a 120-month project.

The project tests a theory that, over ten years’ time, a “buy low, sell never” portfolio of stocks bought at a discount to their estimated present value will both make money on an absolute basis and outperform the S&P 500. 25 months in it seems to be working – barely.

The portfolio is outperforming the S&P 500. It’s making money – albeit not nearly enough to keep up with inflation.

This is the portfolio when the market closed on Friday.

Thanks for reading. If you like this please share. Subscriptions are free.

Or email me at: weekendstockpick@gmail.com

Check the Archives for:

Allison Schraeger, Bloomberg February 13, 2022

Alphabet April 17, 2022

Billpay.com May 15, 2022

Biogen February 6, 2022

Blackrock February 27, 2022

Blackstone February 27, 2022

Bloomberg News February 20, 2022

Boston Beer February 20, 2022

Bunge April 10, 2022

Callidus March 29, 2022

Carbon Black March 29, 2022

Coca Cola January 30, 2022

CuraLeaf April 24, 2022

DocuSign May 15, 2022

Draft Kings February 20, 2022

Draft Kings April 3, 2022

Ella Nilsen, CNN March 13, 2022

Elon Musk April 17, 2022

Eric Savitz, Barrons February 13, 2022

Expeditors March 13, 2022

FEDEX March 13, 2022

Fidelity National February 13, 2022

First American February 6, 2022

First American February 13, 2022

Goldman Sachs February 27, 2022

Google April 17, 2022

Granite Real Estate Trust January 18, 2022

Green Thumb April 24, 2022

Henry Grabar, Slate April 17, 2022

IBM January 30, 2022

Inflation January 2, 2022

Inflation January 23, 2022

Inflation January 30, 2022

Intel January 30, 2022

Jen Psaki, MSNBC April 10, 2022

Jen Psaki, MSNBC April 17, 2022

Keith Romer, Bloomberg April 3, 2022

Kinder Morgan January 8, 2022

Nutanix March 29, 2022

Phillips 66 January 2, 2022

Prudential February 6, 2022

Sangfor Technologies March 29, 2022

Silicon Valley Bank March 20, 2022

SUSE March 29, 2022

TerrAscend April 24, 2022

Trulieve February 20, 2022

Trulieve April 24, 2022

Tweedy Brown April 17, 2022

Twitter April 17, 2022

Tyson April 10, 1011

UPS March 13, 2022

Verisk April 17, 2022

Verizon January 23, 2022

Virtuozzo March 29, 2022

VMWARE March 29, 2022

Wall Street Journal April 10, 2022

Wells Fargo March 20, 2022

Western Alliance Bank March 20, 2022

Will Yakowicz, Forbes April 24, 2022

[1] https://www.sec.gov/ix?doc=/Archives/edgar/data/1261333/000126133322000049/docu-20220131.htm Page 64

[2] https://www.sec.gov/ix?doc=/Archives/edgar/data/1261333/000126133322000049/docu-20220131.htm Page 66 “Consolidated Statement of Stockholders Equity”