BUYER’S REMORSE

Docusign was in the news Friday morning.[1] The stock lost 24% overnight when the company dropped its guidance. For the full year 2023, the company is now forecasting 7% growth in billings.

I wrote about Docusign on May 22nd. I like the business. I didn’t like the price; at that time about $76/share.

I decided to put a limit order in at $67/share (my calculation of a discount to its present value) and wait. The stock climbed to $90/share by June 8th. I stopped paying attention.

On Friday morning I saw the headline on Barrons.

I checked my Fidelity account and, thanks to my limit order, I was the proud owner of Docusign.

EXECUTION PROBLEMS

From Barron’s on Friday

“DocuSign’s e-signature software did well during the pandemic. It thrived along with other companies that focused on a stay-at-home lifestyle such as Peloton Interactive , Chewy “

Peloton sells stationary bicycles. Chewy sells dog food (on the internet, like Pets.com, only better and without the sock puppet). The bounce in sales those two got during the pandemic was, plausibly, a one-time thing.

But they are not similar to Docusign nor is Docusign a stay-at-home lifestyle business.

Docusign was growing revenue quite nicely, around 37% year over year, in the three years before the pandemic. Increased vaccination rates and the gradual return to work are not causing the decline in growth at Docusign

The decline has two causes. The first is execution related. Specifically, sales execution.

The CEO was asked this question during the Q1 earnings call on June 9th[2]

Pat Walravens -- JMP Securities – Analyst

“Dan, why are so many of the [sales] reps quitting?

The CEO gave a roundabout answer. He referenced the falling value of stock-based compensation, recruiting by start-ups, fatigue among ‘Docusigners’ and the great resignation.

Here’s a different take from a Docusign Sales Rep writing on Glass Door [3]

“Now is not the time to work in sales. Quotas are rising, territories are getting split in two… and attainment is at an all-time low… Stock options are worth 40%... due to management's inability to forecast our numbers… The commercial org is really struggling… OTEs are already incredibly low … and no one is hitting quota... 1/26 reps… hit quota in Q4 …

“There is no training program for sales. If this is your first sales job, it's sink or swim.

“Our CEO told the company all-hands everyone would be getting raises. In the next call, our CRO specified - "everyone but sales".

“[My]Advice to Management: Don't promise raises and back-peddle. You just upset half the org, People are leaving and a lot of that is because wages are below market value, adjust for this or pay the price.

A problem with sales execution can be fixed if the CEO knows how. We’ll see about that over the next few years.

And that’s why I have Buyer’s Remorse. Docusign will take a while to fix. I could have paid less later.

INFLATION > RECESSION PROBLEM

The other problem cited by Docusign management on the earnings call was this:[4]

Generally [we] see across the board from all regions, a sense that companies are thinking about inflation, they're thinking about potential looming recession and maybe being more cautious on their buying behavior.

The coming recession has more advanced advertising than a Barnum and Bailey Circus.

INFLATION

A tremendous amount of money (4.6 trillion dollars) was created, and spent, on Covid Relief programs over the past two years.

A lot of that went directly into people’s pockets: enhanced unemployment, paycheck protection, stimulus checks. Most of the increase in the supply of money (5.8 trillion dollars) over that time was related to COVID.

What’s being counted in the money supply shown above (M2) is important:

(1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks… and (3) other liquid deposits, consisting of OCDs and savings deposits (including money market deposit accounts).

(2) plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs.[5]

The point is, this is real money. It’s been created by the Federal Reserve and it is in circulation.

When the supply of money increases faster than the production of goods and services the result is always inflation.

If you stare at this chart long enough you might see the correlation that I see between the growth in the money supply (the light blue line) and the consumer price index (the dark blue line).

If you see that, you would expect that the current inflationary wave is just beginning. The expansion of the money supply in 2020 and 2021 was unprecedented. The inflation of 2022 + will be as well.

RECESSION

The talk is that the next recession will be caused by the Federal Reserve raising interest rates to combat inflation. This will cause the economy to contract (the Recession) and inflation will be tamed. That’s the current wisdom anyway.

I’m having trouble connecting the dots.

Will a recession soak up all of the excess money that has already been created? I don’t see how. This money already exists. People have it.

Inflation is too much money chasing after too few goods and services. A recession will not take this money out of circulation. And it will decrease, not increase, the already limited amount of goods and services being produced. That won’t help.

Seems to me like it’s just going to take time, a long time, and a long expansion of GDP for the economy to grow into the current money supply.

The increase in consumer prices we are seeing now is a symptom, not the cause, of inflation. Inflation was created in 2020 – 2021 when the United States chose to inflate the amount of dollars in circulation in response to the pandemic. Like COVID itself, we’re going to have to live with this for a long time.

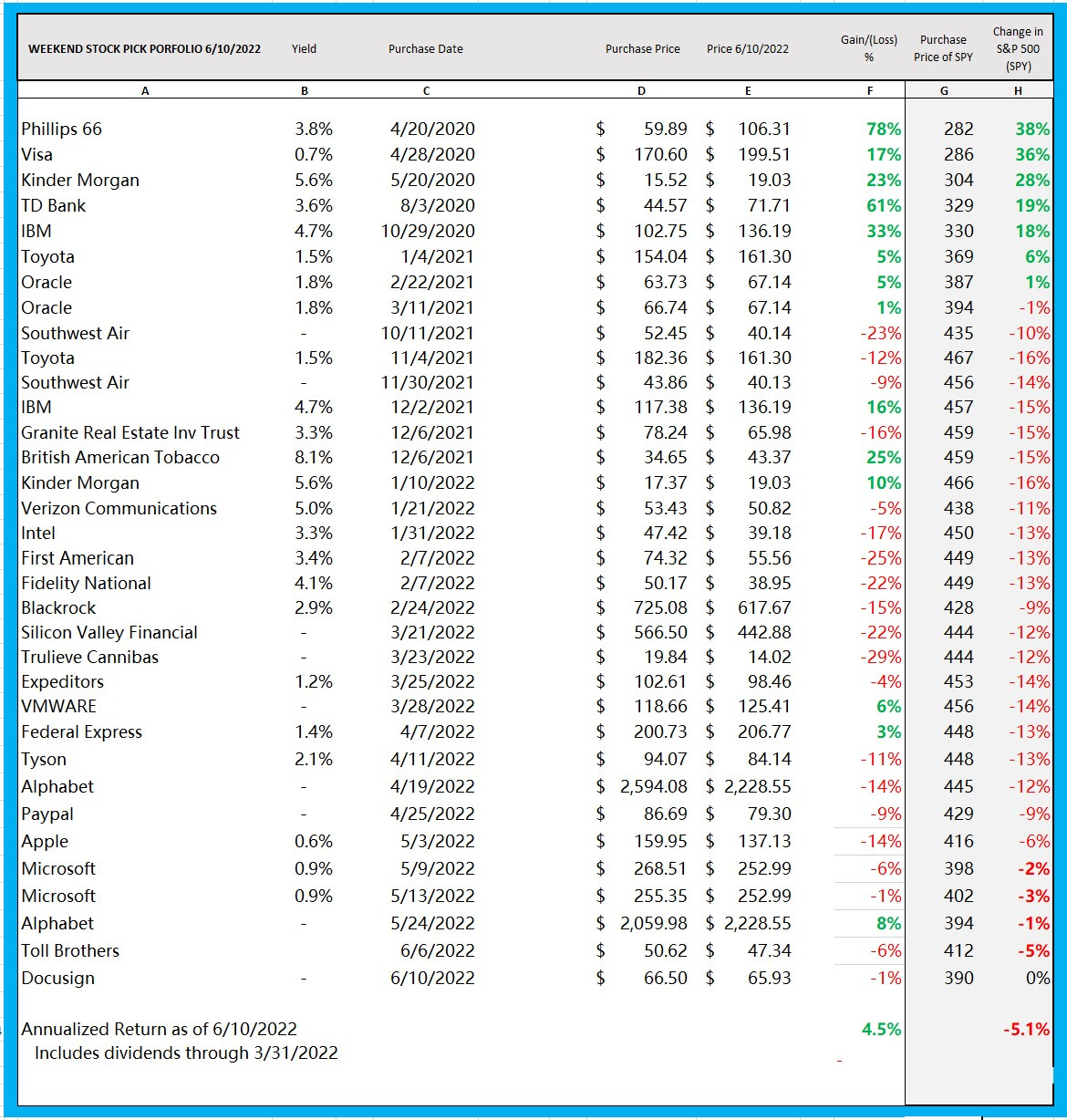

RESULTS APRIL 20, 2020 THROUGH JUNE 10, 2022

The Weekend Stock Pick project tests a theory that, over a ten-year period of time, a basket of stocks purchased at a steep (approximately 40%) discount to their present value will a) make money, and; b) outperform equal investments in the S&P 500 as represented by the SPDR ETF: SPY.

Well, the portfolio is outperforming the S&P by about 9 ½ %. But it sure isn’t making much money.

Check back next week –

[1] https://www.barrons.com/articles/docusign-stock-price-earnings-growth-51654862783?mod=hp_DAY_4

[2] https://www.fool.com/earnings/call-transcripts/2022/06/09/docusign-docu-q1-2023-earnings-call-transcript/

[3] https://www.glassdoor.com/Reviews/DocuSign-Account-Executive-Reviews-EI_IE307604.0,8_KO9,26.htm

[4] https://www.fool.com/earnings/call-transcripts/2022/06/09/docusign-docu-q1-2023-earnings-call-transcript/

[5] https://fred.stlouisfed.org/series/M2SL