Blackstone

Other people's money

Blackstone

Goldman Sachs, Blackstone and Blackrock are three financial services firms. They are all in the business of making money by managing other people’s money.

There is more money than ever in the world. A lot of that money is held in institutions. Institutions hire firms like these to manage their holdings.

Money management should be a good business for a long time. The Weekly Stock Pick portfolio has a ten-year horizon. That’s a long time for these companies to make money with other people’s money.

All three of these are good businesses. All three are selling for a discount to a calculated net present value.

Revenue and earnings growth at Blackrock has been stronger, and more consistent, than at Blackstone or Goldman. And the discount to present value is greater.

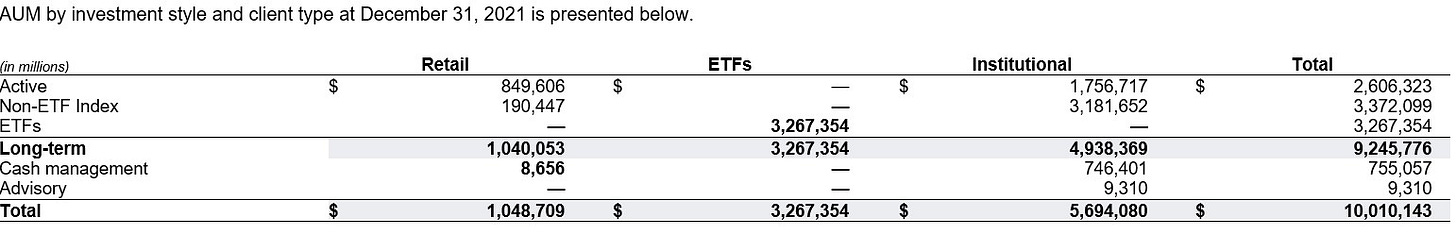

Blackstone’s revenue is derived from assets under management and Blackstone’s assets under management look like this.

I like the focus on Index Funds and ETFs (Blackstone bought iShares from Barclay’s in 2009.) And I like the (relatively) small % of revenue that comes from active management and advisory services.

I bought Blackrock on Thursday.

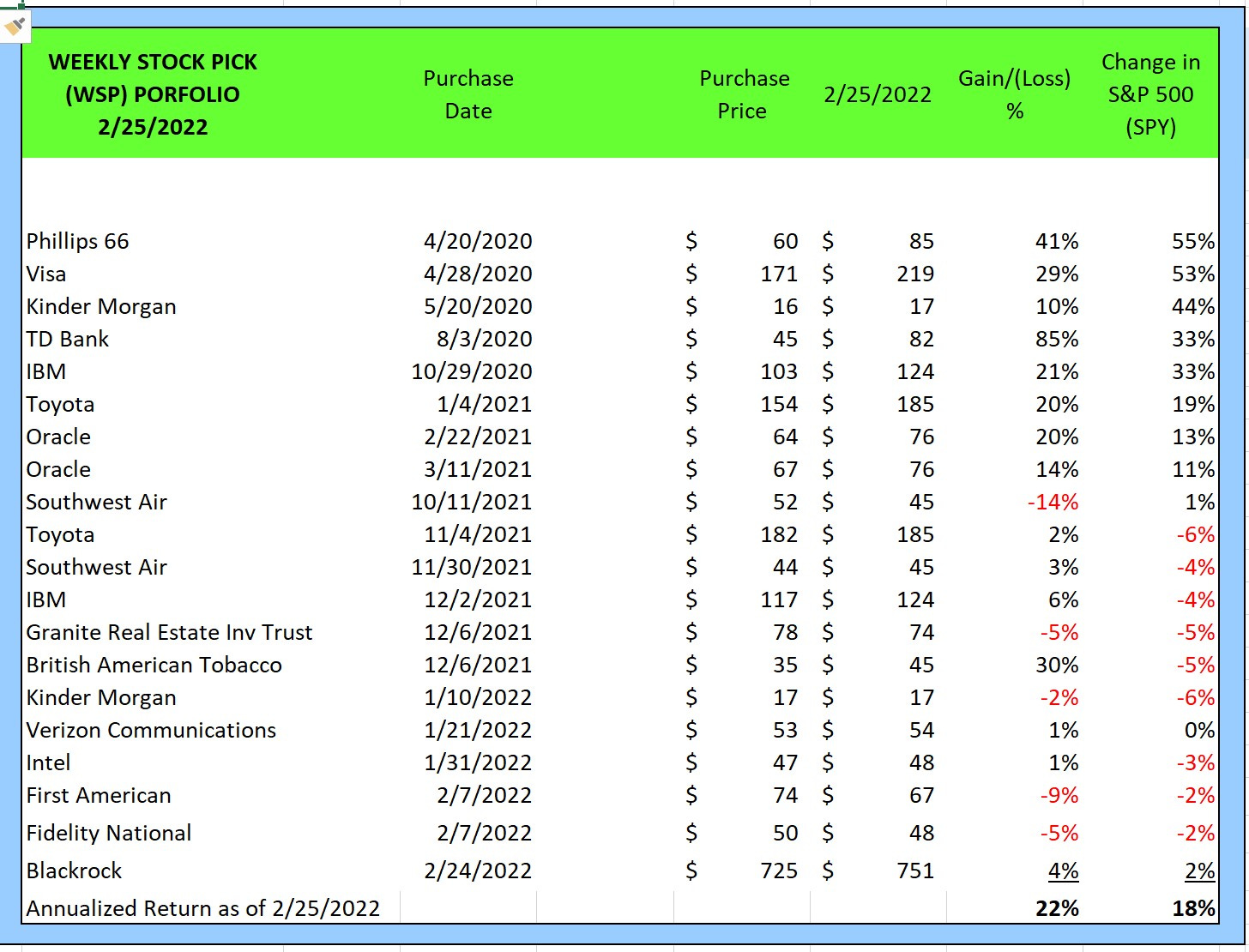

Weekly Stock Pick Portfolio as of 2/25 /2022

The Weekly Stock Pick newsletter is not financial advice. It’s a personal project.

When I get it right, the newsletter is brief and entertaining.

The WSP project tests a theory that, over the ten-year period that began in April of 2020, a portfolio of individual stocks bought at a steep discount to their estimated present value will outperform the S&P 500 index.

I print the portfolio each week. 97 weeks into this 520-week project the portfolio looks like this vs the index ETF SPY:

Can anyone beat the market?

Here’s a nice summary of why trying to beat the market doesn’t work.

https://www.investopedia.com/ask/answers/12/beating-the-market.asp

“Investment fees are one major barrier to beating the market. If you take the popular advice to invest in an S&P 500 index fund rather than on individual stocks, your fund's performance should be identical to the performance of the S&P 500, for better or worse. But investment fees will be subtracted from those returns, so you won't quite match it, never mind beat it. Look for index funds with ultra-low fees of 0.05% to 0.2% a year, and you'll get close to equaling the market, though you won't beat it.

Fidelity’s zero commission trade option helps keep trading expenses low. The WSP portfolio is benchmarked against an index fund (SPY) which has a .09% expense ratio.

Taxes are another major barrier to beating the market. When you pay tax on your investment returns, you lose a significant percentage of your profit. The capital gains tax rate is 15% to 20%, unless your income is very low. And that's the tax on investments held for at least one year. Stocks held for a shorter-term are taxed as ordinary income

For the WSP portfolio I try to identify businesses I want to own for ten years. I hope to avoid transferring money from the portfolio to the government by not selling anything for ten years. We’ll see how that works out.

Investor psychology presents a third barrier to beating the market. Perversely, most people have a tendency to buy high and sell low because they're inclined to buy when the market is performing well and sell out of fear when the market starts to drop. This one at least is within your control.

I’ll put this one on the list of things to work on with my therapist.

This past week….

I try to find something humorous or entertaining to include each week. There just wasn’t any of that this past week. God bless and protect the people of Ukraine.