VERIZON UNDERVALUED AND 2021 Review

The stock pick of the week, inflation and a lesson learned in 2021

VERIZON IS UNDERVALUED AND 2021 REVIEW

2021 is in the rearview mirror and today’s newsletter will take a look backwards. In this edition, we’ll look at our usual weekly stock pick, revisit inflation and then discuss a lesson learned in 2021.

1 – THE WEEKLY STOCK PICK – VERIZON

I had trouble finding stocks to get excited about last week until I reread the January 3rd Barron’s. Andrew Bary had a column on the “Dogs of the Dow.”

https://www.barrons.com/articles/intel-dogs-of-the-dow-high-yield-strategy-51641227415

The “Dogs of the Dow” are ten stocks on the Dow Jones Industrial Average that are, for one reason or another, in the doghouse. If you’re not familiar with the “Dogs of the Dow” strategy – look at the link here:

https://en.wikipedia.org/wiki/Dogs_of_the_Dow

One of the ten “Dogs” is Verizon (VZ). VZ is down 7.5% in 2021. You could say it got a participation trophy while the rest of the market won best in show.

Verizon is priced now at 10X earnings. That looks inexpensive compared to the average of 25X earnings for the S&P 500

The S&P, on average, is paying about 1.2% in dividends. Verizon pays four times that: 4.8%.

Sticking with the dog metaphor, I think Verizon is this year’s pick of the litter and I’m buying it now. Here’s why.

Since 2005 Verizon has grown earnings, on average, 11% per year.

Typically, since 2006, Verizon sells for 12X earnings.

Zacks expects Verizon to earn $5.36 a share in 2022. Project growth of earnings at 11% per year for 10 years and assume a sale of the stock at 12X those 2031 earnings.

You’d collect $205 when you sell in 2031. That, together with the $46 in dividends you will have collected along the way get you an annualized return of 16%.[1]

2 – AND A QUICK UPDATE ON INFLATION

At the beginning of the year, in the newsletter “phillips-66” , we looked at inflation using the macro-economic formula of:

(Money supply × velocity of money) = (price level × real GDP)

Calculated inflation was 7.8% and trending higher. Last week’s report of 7% inflation supports that trend.

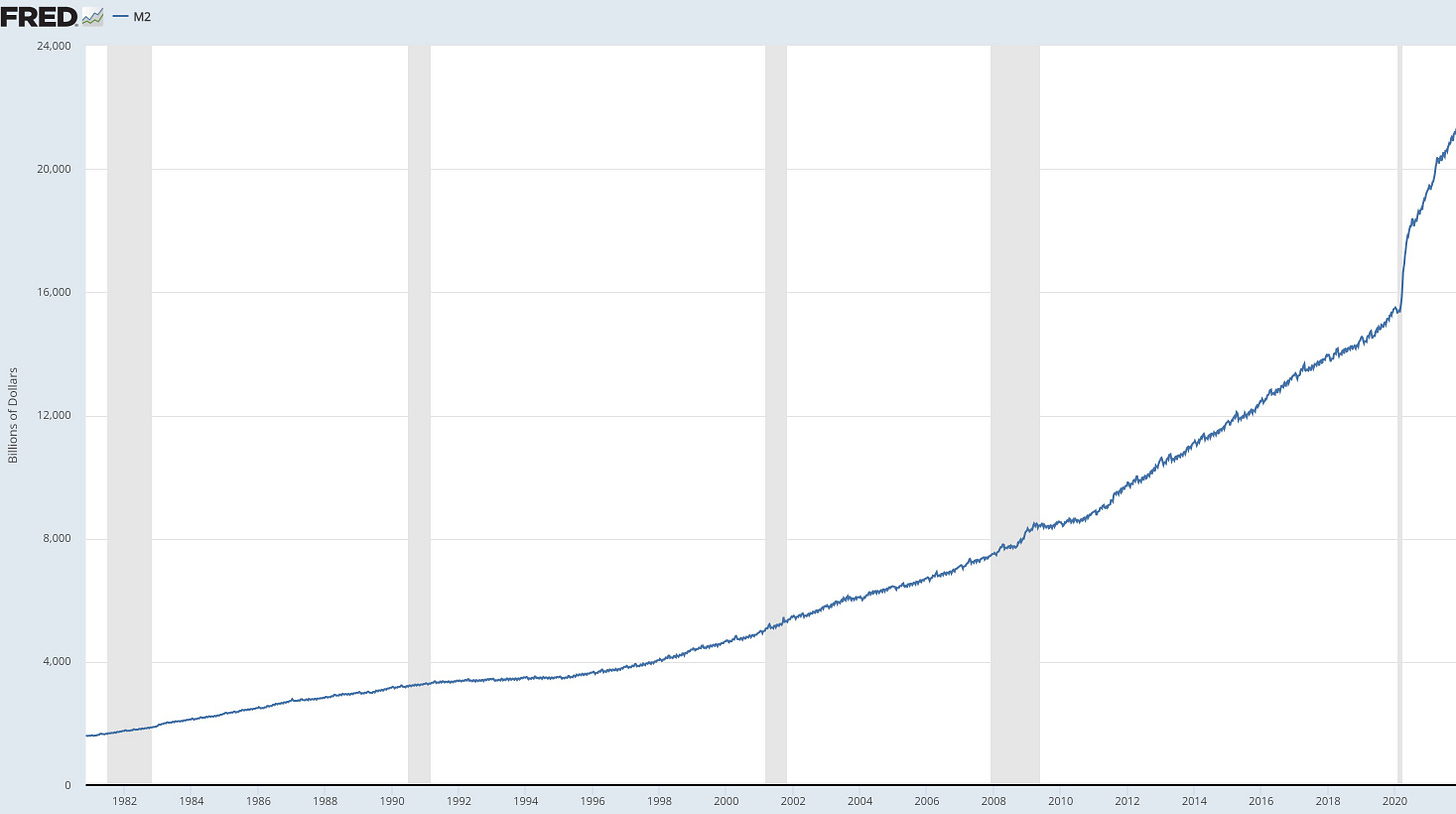

The rise in inflation continues to lag behind the sharp increase in the amount of money in circulation, an increase that began in 2020 (see below).

https://fred.stlouisfed.org/series/WM2NS#0

The Federal Reserve Bank’s target inflation rate is 2%.

A quick aside: 2% sounds reasonable. But it’s not. You can think about it this way: Grandma gave you a $100 bill on your 1st birthday. Excited, you stuck that Benjamin under your mattress. Fast forward, you jump up on the morning of your 21st birthday, look under the mattress, and find $66.67. “Happy Fuckin Birthday to you too Federal Reserve!”

What can the Federal Reserve do to get back on target? 1) reduce the money supply; 2) slow the rate of growth of the money supply; 3) ignore reality and do nothing. None of these are necessarily good for the market.

If anyone can think of other, more optimistic scenarios – please leave a comment below.

3 – FINALY, MISTAKES[2]

Everyone has heard of ‘buy and hold’. Buy good, growing businesses at a reasonable price. Plan to keep them for a long time, and hope to enjoy the wealth accumulation from compounded growth.

Everyone also knows that you learn from your mistakes. If you make a lot of mistakes, you become quite learned. In 2021 I learned a lot.

One thing I learned in 2021 is that it is a lot easier to buy than to hold.

I missed out on quite a bit of money by selling too soon.

Here’s a chart of my bigger mistakes.

This shows what I paid, my profit when I sold, and what I would have now if I had not sold.

These were all companies I bought in late 2020 or early 2021. I bought them after doing my research.

When I bought them, I planned to keep them for a long time. But instead, I sold quick after I made a little bit of money.

Most of these profits were taxable – so I sent the government a good chunk of whatever I did make.

I would be wealthier today, and would have a smaller tax bill, if I had resisted the impulse to sell.

Lesson learned: there are two powerful forces in investing: patience and time. To make the best use of time you must exercise patience.

Next week we’ll look at another type of mistake: impulse buying.

Thanks for taking the time to read this. Please subscribe to this free newsletter and share with friends.

[1] If you’d like to see the math behind this leave me a comment or DM me and I’ll e mail it to you

[2] Well, not finally. I’m sure I’ll make a lot more.